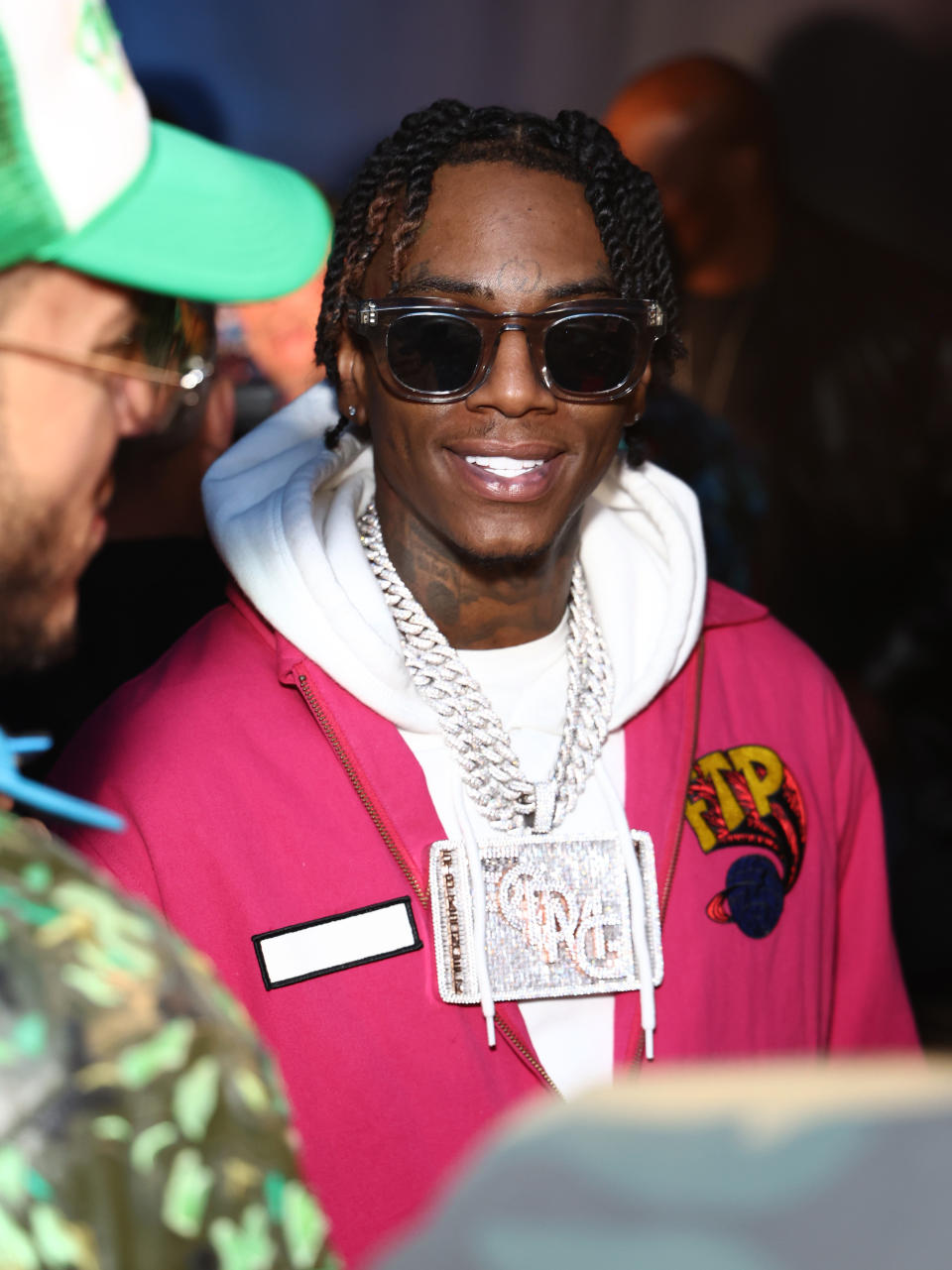

Ne-Yo, Akon, Lil Yachty, Soulja Boy Hit With SEC Charges In Crypto Case

On Wednesday (March 23), Ne-Yo, Akon, and other notable celebrities were charged by the SEC for illegally promoting cryptocurrency without disclosing they were being paid to advertise. The Securities and Exchange Commission revealed that Lindsay Lohan, Jake Paul, Austin Mahone, Kendra Lust, Soulja Boy, and Lil Yachty were also being charged in the complaint.

All of the listed public figures, except for Soulja Boy and Mahone, settled to pay more than $400,000 “in disgorgement, interest, and penalties to settle the charges, without admitting or denying the SEC’s findings.” The SEC alleges that crypto asset entrepreneur Justin Sun and his companies sold TRX and BTT as investments through unregistered “bounty programs.”

More from VIBE.com

Quinta Brunson To Make Hosting Debut On 'Saturday Night Live'

DJ Cassidy Aims To Make History With Pass The Mic Live! Tour

DJ Cassidy Kicks Off 'Pass The Mic' Tour With Ashanti, Fabolous, Lil Kim, Ma$e, 112 And More

Sun’s move directed interested partakers to advertise crypto across their social media accounts and recruit more figures to Tron-affiliated Telegram and Discord channels in exchange for BTT and TRX allocations.

According to the official press release, the complaint accuses the entrepreneur, BitTorrent Foundation, and Rainberry of offering and selling “BTT in unregistered monthly airdrops to investors, including in the United States, who purchased and held TRX in Tron wallets or on participating crypto asset trading platforms.” The party’s unregistered offers and sales were said to have violated Section 5 of the Securities Act.

SEC’s high-profile complaint detailed Sun’s alleged use of “wash trading” in this case, which involved the businessman potentially “orchestrating a scheme to artificially inflate the apparent trading volume of TRX in the secondary market.”

“This case demonstrates again the high-risk investors face when crypto asset securities are offered and sold without proper disclosure. As alleged, Sun and his companies not only targeted U.S. investors in their unregistered offers and sales, generating millions in illegal proceeds at the expense of investors,” said SEC Chair, Gary Gensler. “But they also coordinated wash trading on an unregistered trading platform to create the misleading appearance of active trading in TRX. Sun further induced investors to purchase TRX and BTT by orchestrating a promotional campaign in which he and his celebrity promoters hid the fact that the celebrities were paid for their tweets.”