Netflix Releases First Biannual Viewing Report With Massive Trove of Data, Including for Licensed Titles

Netflix is expanding its viewership data transparency with the release of its first biannual report covering six months of streaming habits on the platform, revealing for the first time how licensed content like USA Network drama “Suits” performs alongside the streamer’s originals.

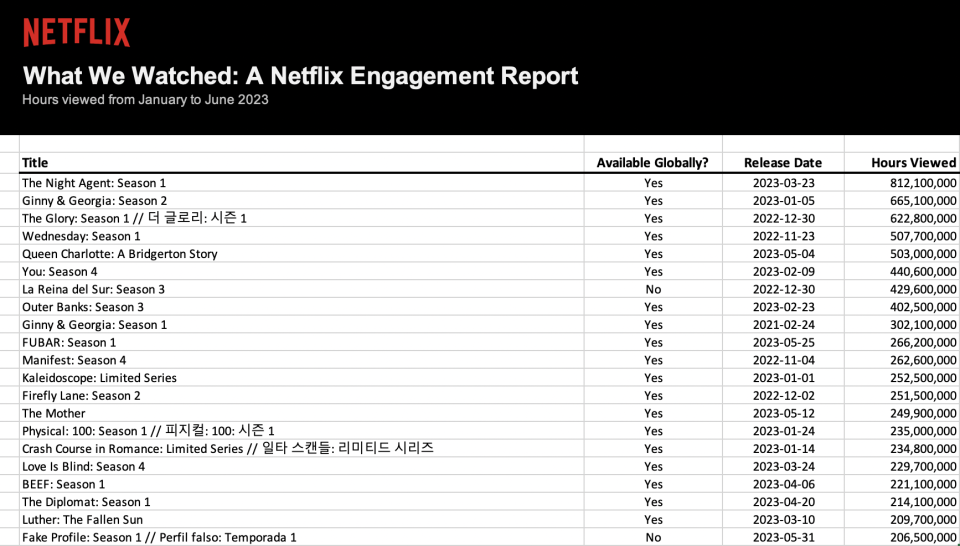

The new report, titled “What We Watched: A Netflix Engagement Report,” covers more than 18,000 titles and nearly 100 billion hours viewed between January-June 2023. It includes: 1) hours viewed for every title (both Netflix original and licensed TV shows and movies) watched for more than 50,000 hours during that period; 2) the premiere date for any Netflix original TV series or film; and 3) whether a title was available globally.

More from Variety

'Love Is Blind' Renewed for Seasons 6 and 7 at Netflix With New Episodes Coming Valentine's Day

Netflix Down? Users Report Network Connection Errors With Connected TV Devices

Each piece of that information is key here, because these findings aren’t as cut and dried as Netflix’s weekly Top 10 reports and “Most Popular” lists. For example, at the top of this report is “The Night Agent,” a series that debuted globally March 23 and racked up 812 million hours viewed by the end of June. And at No. 3 is “Wednesday,” Netflix’s top English-language series of all time — not because it was a less popular series, but because it came out in November 2022, and a good chunk of its massive audience had already completed the show by the Jan. 1 start date for this report.

Additionally, the report focuses on hours viewed versus Netflix’s new favored way of representing its weekly Top 10 lists, which is by estimated viewers. However, Netflix says that more than 60% of its titles released between January and June 2023 appeared on their weekly Top 10 lists, so there is a large amount of crossover between titles on the report and the standing week-to-week rankings.

Access Netflix’s full report for January-June 2023 at this link.

During a call with reporters Tuesday, Netflix co-CEO Ted Sarandos and VP of strategy and analysis Lauren Smith fielded questions about the findings, noting that they plan to release their next biannual report covering the June-December 2023 period in the new year. (So be on the lookout for “Suits” to really pop in that data, as its surge began over the summer.)

When asked by Variety why Netflix chose not to have the information audited by a third party or presenting it to the Media Ratings Council, Sarandos said: “I’m the co-CEO of a public company, so sharing bad information has consequences. So this is the actual data that we use to run the business. And in terms of the requirements for things like advertising, Nielsen does require third-party validation on those things. But this is our data, and it is our accurate data. It’s the data that we use to run the business that we’re sharing with you. Us compiling the data to provide to a third party to provide it to you seems like a lot of steps for something that’s already a pretty heavy lift.”

Sarandos said that, although streaming viewership data transparency was a key negotiation point in the recent WGA and SAG-AFTRA strikes, that was not the main factor that contributed to Netflix releasing this new report.

“This has been on a continuum for several years,” the co-CEO said. “So this is not driven by anything differently than that. I think it’s really important, that’s why I did say earlier, that lack of data, lack of transparency, the unintended consequence was this kind of mistrust, this environment of mistrust around the data. So this is probably more information than you need, but I think it creates a better environment for the guilds, for us, for the producers, for creators and for the press.”

When it comes to the power of licensed content on Netflix, Sarandos said that while he’s proud of how well the platform does boosting library titles like “Suits,” he doesn’t see a benefit in Netflix licensing its own content elsewhere.

“What’s interesting is a show like ‘Suits,’ which has been played on USA for a long time, has been available on Peacock and has been available on Amazon for a couple of years before it hit Netflix, and yet we were able to unlock this enormous global audience for it,” Sarandos said. “And that’s the combination of our large subscriber base and our recommendation system that knew to put ‘Suits’ in front of people who were going to love it the most.”

However, Sarandos said he’s “not positive that that’s reciprocal” with Netflix content going elsewhere.

See below for the findings from the “What We Watched: A Netflix Engagement Report” that were specifically highlighted by Netflix, each in the streamer’s own words:

The strength of returning favorites like “Ginny & Georgia,” “Alice in Borderland,” “The Marked Heart,” “Outer Banks,” “You,” “Queen Charlotte: A Bridgerton Story,” “XO Kitty” and film sequels “Murder Mystery 2” and “Extraction 2.”

The popularity of new series like “The Night Agent,” “The Diplomat,” “Beef,” “The Glory,” “Alpha Males,” “FUBAR” and “Fake Profile,” which generate huge audiences and fandoms.

The size of the audience of our films across every genre including “The Mother,” “Luther: The Fallen Sun,” “You People,” “AKA,” “?Que viva México!” and “Hunger.”

The enthusiasm for non-English stories, which generated 30% of all viewing.

The staying power of titles on Netflix, which extends well beyond their premieres. “All Quiet on the Western Front,” for example, debuted in October 2022 and generated 80M hours viewed between January and June.

The demand for older, licensed titles, which generates tremendous value for our members and for rights holders.

Best of Variety

Sign up for Variety’s Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.