Lower Prices, Higher Optimism: How the Pre-Owned Watch Market Will Fare in 2024

If you were searching for an adage to describe the current state of the pre-owned watch market, “what goes up must come down” has never been more accurate.

Nearly four years after the start of the biggest bull run in watch history (which kicked off, not coincidentally, during the early days of the Covid-19 pandemic), the industry is finally reckoning with a return to c. 2019 normalcy.

More from Robb Report

Taylor Swift's Watch Choker Turns Heads on the Grammy Awards Red Carpet

Gearheads vs Watch Guys: How to Tell the Luxury World's Nerdiest Collectors Apart

Victoria Beckham Just Launched Her First Watch Collection With Breitling

Prices on the secondary market peaked in May 2022 and have been declining ever since, with the fourth quarter of 2023 having marked the seventh down quarter in a row, according to a report released by Morgan Stanley and WatchCharts in mid-January.

To find out what all of this means for buyers, and the dealers who’ve supplied them, Robb Report spoke to a handful of pre-owned specialists. While there is some debate about the trajectory of prices—did the market hit bottom in the fall or is there still a ways to go?—there seems to be consensus on a handful of key points about the high-end watch business in 2024.

No. 1: It’s time to buy, buy, baby.

“We’re going to see a shift from a seller’s market to a buyer’s market,” Los Angeles-based dealer Steven Rostovsky says.

That’s true right now in the secondary space, but it’s also becoming increasingly true in primary channels, according to Rostovsky.

“Over the last few years, the brands were in control. If they didn’t sell to person A, they’d sell to person B. They flattened their channels, they took away distribution, and, in some cases, they went direct. The reversal has begun. The manufacturers are going to see that in 2024. And there will be more openness to consider other strategies for retail.”

No. 2: Prices are falling—and that’s a good thing.

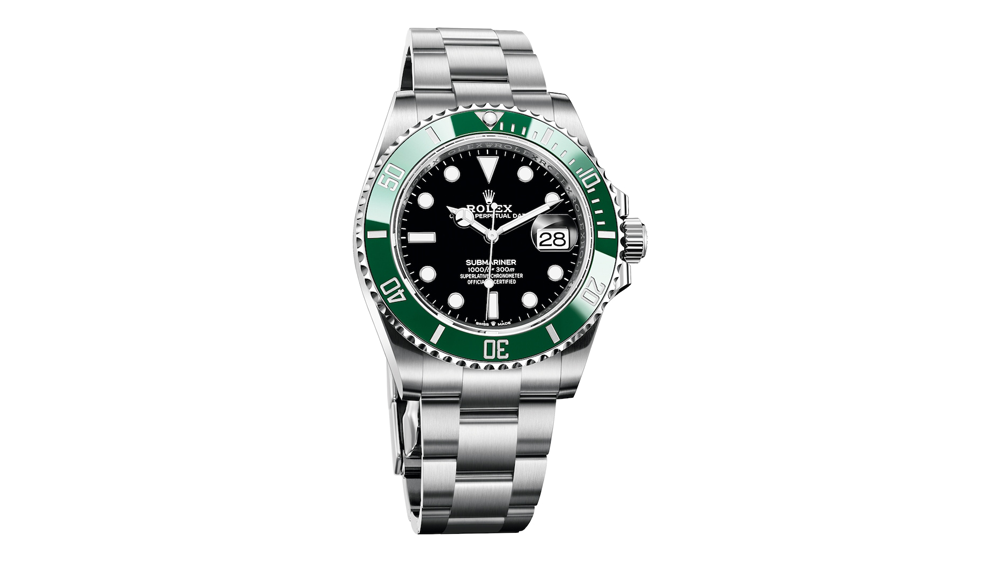

Industry insiders are relieved that the frenzy that drove secondhand prices on blue-chip models as high as five times their retail value is over. We’re talking primarily about steel sport watches from “the Big Three” brands—Rolex, Patek Philippe, and Audemars Piguet—as well as pieces by F.P. Journe and Richard Mille.

“It’s been over a year since things started cooling off,” says Eddie Goziker, co-founder of the pre-owned retailer Wrist Aficionado. “As soon as the government stopped printing money, crypto started a downturn, and interest rates started going up—that was a perfect storm for luxury to pull back.

“But we needed it,” Goziker adds. “The market went too high, too fast. And it wasn’t a healthy rise. A periodic, gradual rise in prices is good. But prices were going up 5 percent a month, and we couldn’t keep up. At some point, we were canceling sales because it didn’t make sense to sell because it would be more expensive to buy the next month.”

Just how far have prices fallen? According to Morgan Stanley, in 2023, prices on Rolex, Patek, and AP declined by 8 percent, 16 percent, and 18 percent, respectively. (But never fear: In the fourth quarter, secondhand prices on the Big Three still commanded a collective 24.7 percent premium compared with retail prices.)

No. 3: True watch lovers are coming back to the market.

Now that watches are once again “an interest class as opposed to an asset class,” as Geoff Hess, Sotheby’s head of watches for the Americas puts it, the speculators have left the building.

The corollary to that statement is that the passionate collectors who were priced out of the market at peak hype have returned.

“People didn’t want to pay five times retail for a watch, but they were okay paying maybe one-and-a-half to two times retail,” Goziker says. “When prices cut back 20, 30, 40 percent, all the buyers that were priced out came right back in. That’s why, as far as volume of sales, the numbers probably went up.”

No. 4: Independents are still having their day.

Despite across-the-board price declines, one category of watches has proven remarkably resilient.

“The independents are immune to the dramatic fluctuations of the market,” Rostovsky says. “The reason is because Covid, even though it brought a lot of speculators to the category, it also brought a lot of interest and new collectors to the marketplace. Think about some of the leading independents’ production: Gr?nefeld makes maybe 100 watches a year. Romain Gauthier about 200. De Bethune maybe 250 to 260. Vianney Halter can produce maybe 30 watches.

“Such small production with such a large base of new interest means they will maintain their value and hold fine,” he adds. “But will they sell over retail? That’s not healthy.”

No. 5: Against all odds, optimism reigns.

Instead of focusing on how much prices have fallen since the heady days of early 2022, watch insiders are pointing to the resiliency of the marketplace.

Take this note from the Morgan Stanley report: “Overall, we believe that underlying demand remains solid—albeit weakening sequentially—and we take comfort in the fact that despite the market downturn since 2Q22, which saw brands’ secondary market prices approach a three-year low, Patek Philippe and Audemars Piguet have exhibited prices around 30 percent higher than what they were three years ago.”

The prospects for this year are still a little cloudy—“2024 will be a complicated year where the secondary market will obviously suffer from a weakened demand for new watches due to obvious negative macro-economic parameters,” says Oliver R. Müller, founder of LuxeConsult, a watch consultancy based near Lausanne, Switzerland—but overall, plenty of dealers are buoyant about the category in the long-term.

“I’m very confident in 2024,” Goziker says. “The stock market is very high, so there’s still liquidity. And once interest rates come back down and crypto kind of turns… We don’t need quantitative easing and we don’t need government printing in order to stimulate another boost in the luxury market. I think that people are still making money. The rich are still getting richer, and we cater to that 1 percent.”

Best of Robb Report

Sign up for Robb Report's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.