What is the Investing Gap and How does it Affect Women?

Money is power, and women aren’t getting their share of it. In America, men earn 20% more than women, and that disparity is even greater for women of color. Now is the time to close that gap—and these are the women doing it.

You’ve probably heard of—and experienced—the wage gap: the reality that the average woman makes 80 cents on the dollar (even less for women of color) when compared to men.

Those numbers look particularly glaring in the light of movements like Time’s Up and #MeToo—and the issues are inextricably linked, as activist Ai-jen Poo pointed out in an essay for our Equal Pay package. Not only does the same sexism that underlies harassment and gender discrimination also fuel the wage gap, but financial stability is also key to being able to say goodbye to a job with hostile working conditions.

VIDEO: 10 Quotes From Famous Women About Money

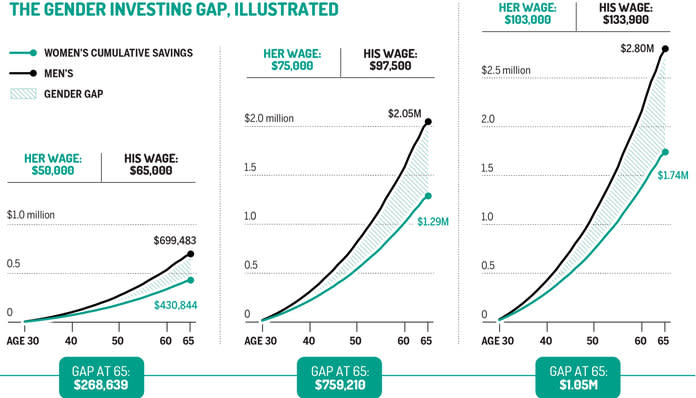

On top of gender wage disparity, though, there’s another phenomenon making men’s wallets heavier than women’s, and that’s the gender investing gap. While often overlooked, it’s a much bigger problem than most people think. How much bigger? According to a report that Money ran last year, the gender investing gap could be costing women more than $1 million over the course of their careers. It accounts for one of the biggest money-makers that women miss out on. (Topping that is still the 20 percent bonus that men get for just being men, naturally.)

RELATED: How Media Mogul Tina Brown Learned to Negotiate—and Got a Million-Dollar Bonus

The wage gap, of course, amplifies this problem. According to Money’s projections, a woman earning $50,000 could be losing $265,639 to the investing gap by the time she retires; a woman earing $103,000 could be losing $1.05 million. Women tend to keep 71 percent of their money in cash (men keep 60 percent), which is low risk but also low reward, and those who do invest tend to start later.

But don’t call women bad investors—in fact, the investing gap has nothing to do with investing acumen. The great irony is that when women do invest, they tend to outperform men by almost an entire percent each year. Yup, women are “better” investors. On average, they keep a cool head during market dips, don’t get caught with as many fees, and don’t get cocky (yes, that was proved by a study).

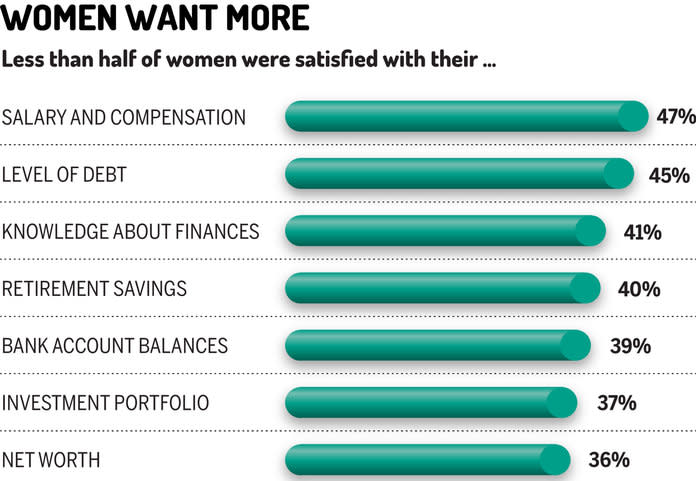

The more likely barrier? Fear—the same kind that makes women good investors in the first place. According to a survey of 2000 millennial women released today by SoFi and Levo League, 56 percent of participants named fear as the main reason they don't invest. "While women are more likely to do research to maximize their comfort buying and selling securities, men take the plunge. Men begin investing earlier on, unobstructed by a lack of confidence," Alison Norris, a certified financial planner at SoFi, tells InStyle of her observations. But, she adds, "Overconfidence can be a detrimental investment trait, and our discomfort may work in our favor." Studies show that women more aware of financial risk than men, Money highlights, which helps them make informed, rational investing decisions.

RELATED: Sexual Harassment Is Widening the Wage Gap

The good news: That means you can sidestep the investing gap by, well, investing. Millennials in particular are investing less than older generations overall. But 60 percent of millennial women polled find themselves with extra cash after paying their monthly expenses—and they want to invest it.

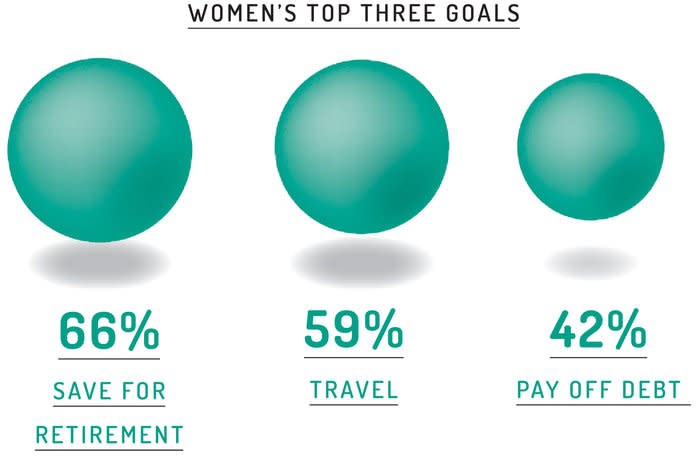

The best place to start? Investing in a 401(k) retirement account if your employer offers one. Many companies have matching programs (read: free money!), and your contributions will grow untaxed and therefore faster. Individual retirement accounts (IRAs) outside of work are also good options and provide tax incentives. "Industry best practices recommend saving 15% of your annual income for retirement. If 15% is too much right now, save what you can and commit to increasing the percentage you contribute at regular intervals, like when you get a bonus or a raise," says Norris.

If you're ready to make additional investments, first lay out your specific goals, which may include buying a home, taking a sabbatical, or a specific lifestyle upgrade. "Those goals will help you determine the right investment strategy," says Norris. "The time horizon you have for your goals—how long you have until you achieve them—is the main thing that should determine how you invest. If you have a long time to save and invest for a goal, you can be more aggressive. If your goal is right around the corner, you should be more conservative."

Investing will mean losing at some point, Norris warns—but it's about playing the long game. "The key is to expect that the market will fluctuate and stay the course, no matter what. You have to tell yourself—in good times, before you even see those dips—that they’re going to happen."

No matter the type of investment, the best way to close the gap and get your money's worth is to make it a routine habit. Investing a little bit of money from each paycheck gives your portfolio the opportunity to grow exponentially. It might seem like a risk or an inconvenience or just not a big deal, but the payoff is worth it.