The Brave New World of Beauty

It’s all about speed and freedom. To paraphrase Leonard Cohen, democracy has come to beauty. And how quickly.

Twenty years ago, Beauty Inc (fka Beauty Biz) was in its infancy and the digital age was dawning. The development of the internet was the engine for all the other breakthroughs, marking the advent of a new, digitally powered breed of indie brand, more influential than even the upstarts that rewrote the rules of the 1990s.

More from WWD

There was a shift in the balance of power, as technology enabled the traditional barriers to entry to come crashing down and gave consumers everywhere not just a voice but a vote in the types of products they want and the places where they want to shop.

“Years ago, the salesmen in the field were responsible for growing the business. That’s no longer true,” said Robert Mettler, the distinguished retail leader who held top roles at Macy’s West, May Department Store Co. and Sears Roebuck Co. before retiring.

“Today what you’ve got is very few barriers and the opportunities abound,” he said.

In the old days, high-ranking sales reps would stroll into Bloomingdale’s wielding boxes of pricey chocolates to delight the beauty advisers. Today, those sales pros have been replaced by the Kim Kardashians, the Kylie Jenners and the Lisa Rinnas holding court on social media.

Photo courtesy of Kylie Cosmetics

“In the beginning, brands were really dictating the trends,” said Larissa Jensen, vice president and industry adviser at NPD Group. “They decided what new product was going to come out, what that was going to look like and how they were going to put it [on display].”

The industry once promulgated the concept of one ideal beauty look, a notion that has since been thoroughly debunked by a generation that has embraced individuality. But there was a seed of malaise even as far back as 2005, in the consolidation of the retail system that culminated when Federated Department Stores acquired May Department Store Co. sparking speculation about the future of a chain of nearly 1,000 department stores. For some observers, the dream of efficiency of nationalization could turn into a nightmare of hunting for common dates to hold promotions.

“It became an issue of sameness and boredom,” said an executive who pointed to the monotony of blockbuster promotions. What was a delight in Minneapolis in January was not necessarily welcomed in Miami.

When asked if this led to the department store’s current troubles, one executive, Lynne Greene, former group president of the Estée Lauder Cos. Inc., said, “I don’t think it did it alone, but I think it was a significant contributing factor.”

What did come in the wake of the consolidation was the rise of specialty retail, namely Sephora and Ulta Beauty, accompanied by a generation of indie brands, tidal waves of digital technology and the ubiquitous influence of social media, starting about 10 years ago.

That changed everything, leading to the rise of a new generation of direct-to-consumer indie brands and giving the consumer a real voice instead of paying her lip service.

“It really dictates the trends,” Jensen said. “Any woman with a phone in her purse is a trend setter and the Avon Lady is being replaced by digital live streaming.”

“The consumer rules,” agreed Robin Burns-McNeill, chairman and cofounder of Batallure Beauty, who sees the industry as evolving, rather than slipping away. “It is pivoting in many different directions, and in many ways it is better.

“There are the same objectives of building awareness,” she continued. “The difference today is you have to be discovered. You have to do things that make sure [that happens]. It’s harder because there are so many brands out there.”

Jensen said that “when social media was beginning to rise you saw the rise of the Kardashians and the whole contour trend. Consumers wanted to create that look for their media postings.”

That helped give way to a boom in makeup, a long run that lasted from about 2011 to 2018, as color cosmetics became a tool of self-expression.

It went way beyond fashion looks inspired by influencers. Natural, clean, vegan — all have been borne out of the wave of change of the last decade.

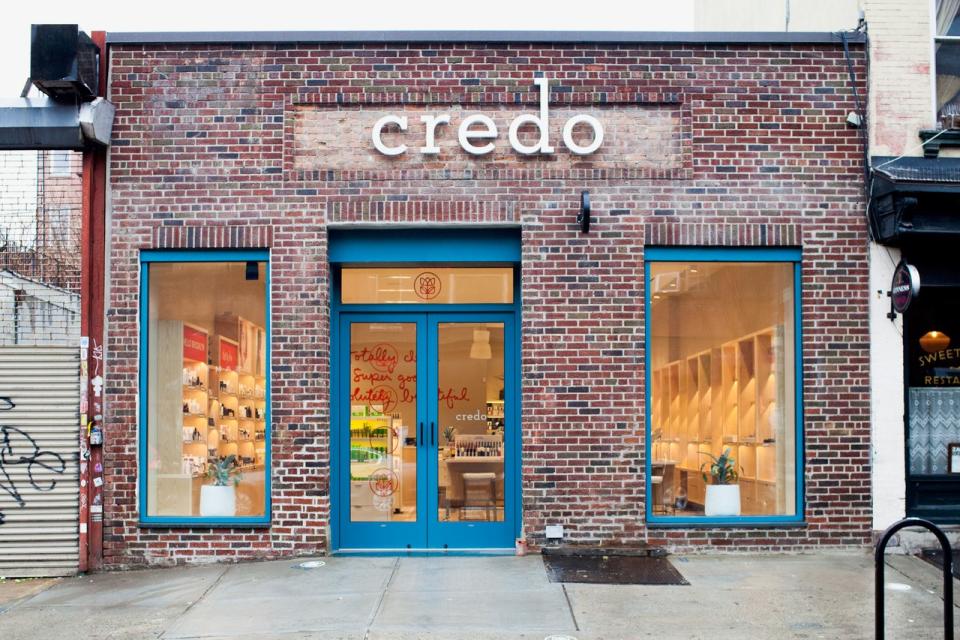

Courtesy of Credo Clean Beauty

As a result, the beauty industry exploded. Jensen estimated that sales in the U.S. of prestige products doubled in the last 20 years to a rate around $19 billion annually now. (That follows the disastrous plague year of 2020 when sales fell to $16 billion. In 2019, U.S. prestige beauty sales approached $20 billion, Jensen said.)

For an international viewpoint, global sales for the top 100 beauty companies were $93 billion in 2001, according to the Top 100 of WWD’s Beauty Report, a forerunner of Beauty Inc. In 2021, that number was $212.59 billion.

Along with the growth has come a new balance in categories in the prestige sector. In the ’70s and ’80s, entering the beauty business usually meant launching a fragrance when scent was king in the domineering department stores. Surprisingly, about 20 years ago, makeup and fragrance were both tied for 36 percent market share each. Today makeup is at 35 percent, skin care is 32 percent, fragrance is 25 percent and the nascent but growing hair category is 8 percent.

The power of social media over the last decade has also revived the once dormant celebrity market. The last craze of celebrity beauty marketing began at Coty with Jennifer Lopez and Glow shortly after the turn of the century as seemingly everyone with a Hollywood rating clamored to put their name on a fragrance.

Then the market “went off a cliff” but has now returned, said Pamela Baxter, cofounder of Bona Fide Beauty Lab and a long-standing veteran of Estée Lauder and LVMH. “Now every celebrity and their uncle wants to do beauty brands,” she said, adding “what is driving celebrities is social media. The number of people they can reach is endless. All sales lead back to social media.”

The immense power of social media is at least partly derived from its video sharing programs, like YouTube and, more recently, TikTok, according to Conor Begley, cofounder of Tribe Dynamics.

“The visual platforms were the ones that really unlocked the beauty category,” he said. “You can’t really communicate a beauty product through text; it has to be visual. It has to be a photo.”

True breakthroughs also came with L’Oréal’s acquisition of NYX in 2014 and Estée Lauder’s purchase of Too Faced in 2016, as the industry’s two biggest players placed large bets on digital-first brands. Begley described those moves as “big watershed moments.”

More recently, one of the more dramatic effects of the social media revolt has been to compel corporations to take an earlier role in the M&A acquisition hunt, according to Javier Escalante, analyst for Evercore. More and more companies are developing in-house incubators and accelerators to participate in the development of nascent companies at an earlier stage of life than ever before.

The more aggressive timeline is being pushed by the faster pace of revenue growth, fueled by social media. It used to take to take 10 years for a young company to hit the $100 million revenue mark to achieve proof of concept. Rihanna’s Fenty beauty start-up at LVMH recently hit 500 million euros in less than two years.

Rex Features / WWD

Whereas the big players like Lauder, L’Oréal, P&G, Natura and Unilever used to mainly be interested in taking a decent-sized brand and then scaling it exponentially, today they are increasingly looking at much smaller deals.

Part of the motivation also lies in attracting the next generation of talent, not only to spur innovation but to manage social media. More than one source pointed out that corporations, with their slick magazine advertising budgets, are no longer controlling the conversation. Customers are talking among themselves across the web about brands and their products.

The renewed sense of independence is reshaping the competitive landscape. Contract manufacturers are no longer just filling bottles. They are offering expertise in design and product formulation, said Roger Schmid, the coordinator of global innovation within the Brazil-based Natura & Co. group. It is easier than ever for anyone to make their own products as manufacturers lower their demands for minimum orders to 1,000 units, compared with 10,000 to 20,000 units in the past. “Now you can basically outsource nearly everything,“ Schmid asserted.

“For the big corporations — to attract talent is going to be more and more difficult,” he continued. ”If you have talent, you want to create your own brand. It’s part of the democratization of beauty.”

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.