Contemporary Sportswear Kicks Into High Gear for Fall

Contemporary sportswear firms, which relied heavily on their websites during the pandemic, are feeling more optimistic about their brick-and-mortar businesses, opening more freestanding stores and shoring up their wholesale sales in department and specialty stores for the fourth quarter. They’re also expanding internationally, launching various collaborations and improving their online capabilities.

Still, the supply chain remains a challenge, and companies are keeping a close eye on inventory.

More from WWD

“The concern now is how are we managing inventory. Everyone’s talking about what’s going on with inflation and recession. None of us has a crystal ball. We’re trying to make sure we are thoughtful about inventory we have going into the fourth quarter and going into the first quarter of 2023,” said Stephanie Unwin, chief executive officer of Veronica Beard. She said supply chain represents the “greatest challenge.”

WWD spoke to several leading contemporary firms about the biggest challenges and opportunities they see in the fourth quarter, and where they see the business heading. Here, a snapshot of what they had to say.

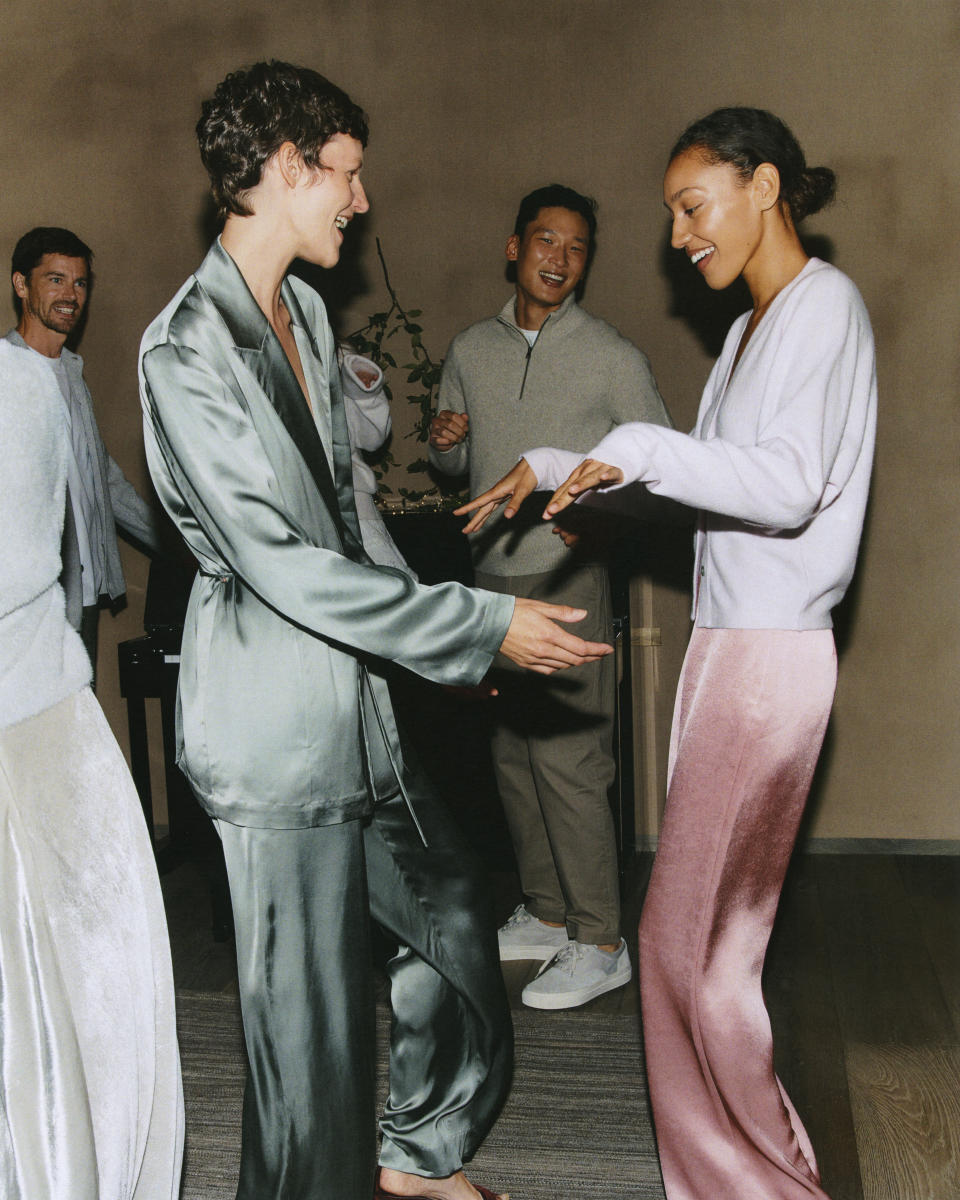

L’Agence

Jeff Rudes, CEO of Los Angeles-based L’Agence, said when women emerged from the pandemic, they wanted to dress up, and that has continued. “She started wearing blazers and tweeds and charmeuse silk and spaghetti straps. We saw her wanting to get dressed. It went from lounge and sweat to ‘let’s look hot and go out. I’m so over it,'” he said.

L’Agence is offering very understandable silhouettes in bold colors. “The most important thing we’ve done since January is color, complete color. The bright colors. We’re known for our earth tones, the khakis, the ivories, the ecru, the cocoa browns to espresso. These brights oversold them three to one. They’re on the line because we believed in them, but we were surprised at how strong they sold,” Rudes said.

“We’re doing a lot of dresses. Even at home she wants to put on a sexy slipdress. Everything has sex appeal,” he said. Prices have stayed relatively the same.

L’Agence has two stores, on Madison Avenue in Manhattan and Melrose Place in L.A., and plans to open on Beverly Drive in Beverly Hills in summer 2023. The brand is looking for three more locations. “L.A. is our second biggest territory next to New York,” Rudes said. The store business is growing 40 percent a year in the L.A. area, with freestanding store and wholesale accounts such as Neiman Marcus, Saks and Nordstrom. The Melrose Place store is up more than 40 percent.

Rudes said the company is heavily relying on its website, which makes up 30 percent of its business and is growing.

When a customer comes into the brand, she usually buys a pair a jeans. “We know within one year, she’s buying silk blouses. Over 40 percent of our daily business on the site is new customers. That’s why we’re growing exponentially. We’re helping her get to those eight items in 12 months,” he said. “We’re marketing from within and we’re heavily marketing for new acquisitions.”

As for fourth-quarter business, he said the wholesale business is running 27 percent higher in the fourth quarter than a year ago, though freight costs tripled at one point, and are hovering at around double. Rudes said the brand is looking at adding categories, including swimsuits and intimate apparel, potentially through a license or joint venture. Eventually, the brand will do coats and outerwear and other things that fall into ready-to-wear. After that, they’d like to do cosmetics and fragrances, Rudes said.

Veronica Beard

“The largest shift has been our penetration for direct-to-consumer. That is now 50 percent of our business, and had been 32 percent direct-to-consumer and 68 percent wholesale,” Unwin said. “That was an intentional shift, and it wasn’t really a pandemic shift. We were in the process of opening stores and we were opportunistic. The world reemerged and that served us well. What we’ve seen is people are excited to get into stores again,” she said.

Overall, Veronica Beard has 19 stores, including one that opened in London in June. “We have 10 in the works over the next 12 months,” she said. She said the brand is looking all over the U.S., and at one location in Toronto.

Veronica Beard is opening in Suburban Square outside of Philadelphia, and Bal Harbour, Fla., and the brand is looking in Colorado and at more Florida locations. “We’re having incredible success in Georgetown, Boston, Greenwich, Connecticut. We’re really trying to diversify across both urban and suburban locations,” Unwin said.

She said her specialty store business is strong. “The stalwarts are still good. They have really strong relationships with their customers. We all partnered during a very difficult time, whether it was payment terms, taking returns, swapping or canceling orders. We all helped each other out.”

She said things look very good for the fourth quarter. “We’re significantly up for the year. While we have been growing our direct-to-consumer business, it’s not at the expense of our wholesale business.…Our wholesale business overall has been growing significantly over the last couple of years. Right now, we’re very high-double-digit comps in all our stores, and our e-comm and d-to-c is high-digit growth. In wholesale, we’re mid-double-digit growth. We’re in good shape.”

She said supply chain issues are the company’s “greatest challenge.”

“We have a strong team, and it is still an issue for us. Of course, it was COVID-19 for a long time and factories opening and closing and there would be waves of it that go through the world. We produce a lot in the U.S. still, and produce in China, India, Vietnam and Peru. We would have weeks where factories would be closed. It’s more raw materials right now. Raw materials and, of course, freight, there’s a real shortage around the world, and then workers in the factory,” Unwin said.

“We’re trying to stay ahead. We’ve moved our production cycle so we’re booking fabrics earlier, and taking that inventory risk on certain raw materials. So we’re in a position not only to deliver on time, but to react if there’s good business. We want to be able for our customers to deliver reorders in the same season,” she said.

In the fourth quarter, Veronica Beard is launching a tabletop collaboration with Juliska exclusively with Neiman Marcus and in Veronica Beard stores and online. It includes plates, place mats, glassware and table top accessories.

Unwin said the company can “flex” across different categories. As attire has changed the last few years, as things were more casual, the brand leaned into jeans, and called it “Off Duty.” Unwin said the brand is a top three resource for denim with all their major partners.

Now that the trend has become more wear to work, the brand has tailored options. “We are building a dream wardrobe for a layered life. We understand our women,” she said.

“Recently [what she needed] was occasionwear, and now for summer, it’s relaxed, punctuated with special pieces. Now we’re starting to gear up again for fall. We’re a top one, two, three partner for ready-to-wear,” she said.

Prices have gone up in certain places, at most 5 to 7 percent. “The greatest pressure are freight prices more so than materials,” she said. At one time, they were $3 a garment, now they are around $12. “Freight is the main contributor to raising prices,” she said.

Ramy Brook

Ramy Sharp, president and creative director of Ramy Brook, said, “Since the pandemic, what we found is people are really celebrating life. Everything that was postponed in 2020 and a little bit in 2021, has really kicked in 2021 and 2022. What we’re finding is people are more interested in buying a lot of occasionwear because they have places to go, and they’re also traveling. We feel that swim cover-up business has also kicked in. It’s been interesting to see quite a few destination parties, and people buy for a few different events over a small period of time.”

The boutique business is doing better than ever. “It’s really exciting, at least for us. Our wholesale partners still do the majority of their sales online, but they’re finding more people coming into brick-and-mortar. We do a lot of business with stores such as Bloomingdale’s online.”

Sharp said she does 40 percent of their business on the Ramy Brook website, up from 20 percent before the pandemic. The company also has a flagship store on Madison Avenue, a pop-up shop in Southampton and continues to look for new locations.

In terms of supply chain, it’s looking much better than it has in the past, she said. “That’s a good sign. In terms of getting stuff shipped, it’s had its challenges in the third quarter and we see that getting better in fourth quarter,” Sharp said. She said the brand makes merchandise in China, India, Morocco and Peru and its denim is made in L.A. “The costs and freight have risen.”

She said the line is performing really well in stores. “The boutiques are killing it. We actually just relaunched the website. Digital has been a big part of the growth of our business.”

One of the challenges, though, has been finding people to work in the store.

While the brand doesn’t participate in the New York trade shows anymore, it does participate in the Swim Show in Miami, as well as Atlanta and Dallas.

Ramy Brook is working on a jewelry collaboration with Ben-Amun, followed by another with Kenneth Jay Lane. The Ben-Amun collaboration will be launched in November and will include earrings, belts and necklaces, and the Kenneth Jane Lane collaboration will have necklaces, rings and earrings and will come out in December/January.

Vince

Asked in what ways his business has changed most profoundly since the pandemic, Jack Schwefel, CEO of Vince, said, “Probably the easier question is what hasn’t changed? Do you want to talk about supply chain, do we want to talk about a very skittish consumer, and a more skittish wholesale base?

“When I look at my relationships with Neiman’s and Nordstrom, specifically, they’ve been incredible partners,” he said, adding that Vince is celebrating its 20th anniversary.

Vince is seeing traffic return to stores. “She definitely wants to shop. We’ve seen that omnichannel customer trade coming into stores, where a year ago she was buying exclusively online. Our traffic really shows it. We’re a little soft online, but we’ve made up for that with what we’ve seen happening at the retail door, so that’s exciting,” he said. “In talking to our wholesale partners, they’re experiencing many of the same things.”

Because there was such compounded growth online from 2020 to 2021, Vince invested heavily and is re-platforming the website, which will be faster and mobile optimized. “It will be a new toy for us come the fourth quarter. It’s really a tech play more than anything else,” he said, and the company’s mobile shoppers have doubled over the last three years.

In the longer term, the tech revamp allows Vince to set up a platform in foreign countries and foreign languages.

Vince opened its second store in downtown Boston at the Seaport and is moving a few stores and re-positioning them, and remodeling a few others. The Fifth Avenue store near Rockefeller Center in Manhattan was closed throughout the pandemic, until three months ago. “We had a fortuitous lease that allowed us to wait until the traffic around Rockefeller Center really improved,” Schwefel said. “We’re back and we’re doing better than we’ve ever done,” he added.

Vince has 50 full-price stores and 17 outlets. The brand also sells through Bloomingdale’s and Saks, and would consider opening freestanding stores in Nashville, Tenn., and Portland, Ore.

The supply chain remains “unpredictable,” he said. “We move products around the world in a multitude of ways, we ship on airplanes, on fast boats that didn’t exist a couple of years ago. Getting product in place on time has been such a challenge and will continue to be such a challenge for the back half of the year,” he said.

Collections-wise, Schwefel said the company is in “the right place” and that the men’s business continues to grow. The company has dabbled in women’s scarves through a license with Amicale, and Schwefel said there are opportunities in small leather goods, men’s accessories, fragrance and home.

“Our aesthetic is dead on to where the customer has migrated to,” he said, noting that weekends are now four days for people.

Vince continues to see the department stores buying less up front and wanting to chase product, Schwefel said. They can chase with technology and drop ship. “We’re very well positioned to maximize that business,” he said.

Schwefel is looking at Vince’s rental business as an acquisition tool. “We’re very excited about it for fall. As the consumer gets as little nervous for purchase, we think it’s an incredible opportunity,” he said.

He noted that international presents opportunities and a Vince store in London continues to perform. “The U.K. was a little slower coming out of the pandemic than we were, so we’re seeing it rev as we saw our stores rev last fall,” Schwefel said. Vince is also doing well in South Korea, launched shops-in-shop in Australia with David Jones that continue to perform, and plan to open a new shop-in-shop at Harrods and relocate to a bigger location in Selfridges.

“We’ll see the consumer earlier this year than last year [for holiday]. End of October, beginning of November will be very important. I don’t think the consumer will wait until Black Friday because what they saw [last year] with the product not being available. I don’t think Black Friday weekend will be as important as it had been historically,” Shwefel said.

For the 20th anniversary, Vince is taking bestsellers and updating them for a capsule collection.

Frame

For Frame, the pandemic was a time to “reflect and focus,” said cofounder Erik Torstensson. “As bad as it was, it was also good to slow down a bit, set new strategy, implement it, and come out of it very strong.

“Our wholesale partners are doing an incredible job and the numbers are fantastic. The consumer wants to go to stores again, feel the clothes and it pays off for us, as we have elevated all our categories,” he said.

“Supply chain has been challenging for us, like for everyone else, but our team really rallied and have succeeded in this area, so we have suffered less than many. In the absence of a more industry-wide infrastructure for sustainability, charting our path to lower-impact and better practices has been a huge and passionate undertaking during this period but we have come a long way,” Tortensson said.

For the fourth quarter, things are looking “very positive,” he said, noting that fall and winter are traditionally the brand’s strongest quarters. “On top of it we have big marketing efforts around our next collaboration launching at NYFW and the celebration of Frame’s 10th anniversary that will come in many ways and forms,” he said.

“Retail is actually a big focus for us and our next store will open in London whilst we are scouting new locations in the U.S.,” he said.

Frame is avoiding chasing trends, Tortensson said. “Trends come and go but you have to keep your identity and innovate within it. One example, travel is back in a big way. We have launched the Jet Set jeans. It’s one of our new bestsellers within our brand DNA but speaks to what the consumers’ mindset is right now.”

In September, Frame will have the second chapter of a successful collaboration they launched last year — a capsule to celebrate their 10-year anniversary with their most coveted pieces from the past decade. Close to the holidays, they are dropping “an amazing knitwear capsule with one of the original supermodels,” Tortensson said, declining to reveal more details.

LoveShackFancy

LoveShackFancy has opened about a dozen freestanding stores since the beginning of the pandemic, said president Stacy Lilien. “Overall, the traffic in our stores has been really strong,” she said, and customers have appreciated the immersive brand experience.

Rebecca Hessel Cohen, founder and creative director, said the brand had three stores (New York’s Sag Harbor and Bleecker Street and Palm Beach, Fla.) before the pandemic, “and we just kept moving forward throughout the pandemic and had leases signed like Melrose Place in L.A. and Newport Beach, and then we continued to sign new leases in Dallas, Austin [Texas], Charleston [S.C.], Madison Avenue, Greenwich, Connecticut — the momentum that picked up for us was obviously the biggest change.” Another store is planned in Scottsdale, Ariz., in October.

She said her customer is multigenerational and wants to try on clothes that feel French-inspired or English countryside-inspired, and shop in stores that transport them.

Hessel Cohen said the website grew quickly during the pandemic, but “stores are growing even faster than online now.” Currently, the business is one-third wholesale; one-third retail, and one-third e-commerce.

Lilien said they’re still seeing significant growth in their wholesale business, but “retailers are definitely being cautious for fourth quarter of this year.”

LoveShackFancy is increasing its international business, and has launched beaded and ’80s-inspired mini dresses. The brand sells with Harrods, Liberty London and other retailers, and will open its first overseas store in London in December.

Asked what she sees as the biggest challenges and opportunities in the fourth quarter, Lilien said, “We’re lucky that we can control our own inventory. We’re of the mind-set that our customer knows if she doesn’t get it now, it’s going to sell out. We’re just being really strategic with our purchases for fourth quarter and really taking that approach to really sell out.”

She said as far as the supply chain, they’re in pretty good shape. “We’re definitely paying attention to boating versus airing. We’ve definitely seen some delays with our boat shipments. We’re just making sure our holiday product will deliver with enough time, and in some cases we’ve had to change our method of delivery,” Lilien said.

Hessel Cohen said in the next year, the brand is working on building their outerwear, separates, tops, and a blazer collection, and adding pants for the first time. An activewear project is in the works, as are collaborations with Bogner, Superga for sneakers, and Larroude for footwear in the fall.

Cinq a Sept

“The pandemic shifted everything about our business — from the way we plan, market and sell our collections, to the way we design for our customer’s needs. While our business continues to be strong, we have seen that anything is possible since the pandemic, and now have our eyes wide open and are planning as close to the vest as we can,” said Jane Siskin, cofounder and CEO of Cinq a Sept.

Collections have been rooted in occasionwear, but the brand now offers a strong assortment of separates, daytime dresses, knitwear and denim. Those pieces carried the business through to the return of events, and now it is seeing a huge demand for occasionwear. “Shoppers are much more ‘buy now, wear now’ than ever before, and at the moment the demand for wear to work options has steadily increased — namely for ‘dress’ pants and blazers as offices open up and professional dressing is coming back to the forefront.”

The brand has experienced some supply chain problems, but Siskin said the “delivery calendars are finally getting back on track.”

“While many aspects of the business have become more competitive with the return to normal, we are also seeing new retail and direct-to-consumer opportunities. At this stage, we haven’t felt a significant decline in stores to sell to, but rather we’ve been focused on expanding our distribution with our existing retail partners in key markets. Production and sales travel has certainly returned, but we have been mindful in our return to large-scale runway shows or presentations, which we plan to bring back thoughtfully in 2023,” Siskin said, noting the brand is feeling “positive” about the fourth quarter.

“We’ve seen rapid growth in our numbers — our e-comm business is double this year over last year, we have expanded distribution and product offering, and we are placing a major focus on international growth and presence.”

She noted that the fall and resort collections feature novelty fabrics and embellishments, as well as fluid silks and detailing that provide both glamour and comfort.

Customers are looking to invest in suiting and separates that offer versatility, she noted.

“There is so much uncertainty around inflation, supply chain and consumer behavior, which affects all industries,” she said. “Consumer confidence is strong, and demand for occasion-based dressing options continues to increase — providing a key opportunity as they head into the fall/holiday season.”

Eileen Fisher

Eileen Fisher, who will step down as CEO of her brand this month and remain in product design, will be succeeded by Lisa Williams, the current chief product officer at Patagonia.

The brand has focused on “simplifying, reorganizing and scaling back — centering ourselves on what matters most to us as a company and getting back to the essence of who we are,” since the pandemic, Fisher said. “While we are actually doing less business than we were pre-pandemic, we are more profitable.” The company generated $241 million in sales last year.

“Like the rest of the world, we are experiencing supply chain issues and logistics problems like never before,” Fisher said. “These issues have forced us to plan farther in advance — which can be challenging — but due to our strong, longstanding partnerships with suppliers, as well as our use of eco/organic materials, we’ve been able to make it work well. All all of it is consistent with our sustainability efforts.”

She noted that the whole company has cut back on travel and entertainment during the pandemic. “We’ve been careful and judicious around any supply chain work that that requires travel,” said Fisher, who noted prospects for the fourth quarter look excellent. “We’re on a new and better track that’s clearly working for us,” she said.

Since the start of the pandemic, Eileen Fisher closed a few freestanding stores and hasn’t opened any new ones.

“The biggest challenge for us is still the uncertainty around supply chain issues and how they will affect us. COVID-19 is less of an issue than it was before, but there is still that uncertainty. But even in the midst of uncertainty, we feel much more stable as a business,” Fisher said.

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.