Glossier Talks Sales, Sephora and Beyond

Glossier’s buzz was always bigger than its actual business.

Now, with new chief executive officer Kyle Leahy and an all-female, diverse C-suite at its helm, the onetime direct-to-consumer darling appears to be closer than ever to aligning those two factors.

More from WWD

Providing exclusive figures to Beauty Inc, Glossier revealed that it is on track to clock in $100 million in sales in its first year at Sephora, after entering the retailer in February, marking an about-turn from its prior strategy and adopting a more traditional retail playbook. Overall retail sales for the brand, including DTC, its own stores and Sephora, are up 73 percent year-over-year, the second consecutive year of growth.

Industry sources estimate that overall sales are around $275 million.

Leahy, who joined Glossier as its first chief commercial officer in 2021 before taking the reins from founder Emily Weiss in May 2022, declined to disclose a monetary number, and it’s also not known how much Sephora accounts for as a percentage of the overall business. A spokeswoman said: “A significant majority of Glossier’s business is in owned channels.”

“What we’re most proud of is Glossier is bigger now than ever, and we’ve shown that this brand has incredible resilience,” said Leahy, a Harvard Business School graduate, who previously held senior positions at Cole Haan, in an interview over Zoom last week. “I think it is unrealistic for brands to be a straight line up to the right….If anything, we’re just getting started on an exciting multiple years of runway of growth and it just shows the power of this brand.”

Leahy believes the fact that Glossier has 51 percent brand awareness and less than 1 percent market share means the opportunities are “limitless.”

“We’re still driving significant volume through our own channels and they’re a really important customer experience. But our partnership with Sephora allows us to reach more people and connect them with the world of Glossier,” she said.

She credited much of the turnaround to its new all-female C-suite, many of whom have big tech and extensive beauty experience: chief creative officer Marie Suter, chief marketing officer Kleo Mack, chief commercial officer Chitra Balireddi who joined in March from Chanel, chief financial officer Seun Sodipo, and chief people officer Sarah Stuart. In May 2022, Weiss, who founded Glossier off of the success of her beauty blog Into the Gloss in 2014, stepped into the role of chairwoman of the board.

“Look at that leadership team. It is an incredible mosaic of women,” said Leahy. “They’re incredibly talented and smart and diverse in every sense of the word background of experience.”

Looking forward, Glossier is laser focused on international expansion and product innovation, according to Leahy.

To that end, just last week it launched international shipping to Europe, New Zealand, Australia, Mexico, India and Brazil, with Leahy hinting at more international expansion that is planned for 2024 and beyond. Its partnership with Sephora is currently just in the U.S., Canada and the U.K.

“The rest of the global opportunity remains ahead of us and we’re actively and rapidly looking at how do we bring the brand and more people around the world in a really differentiated and unique way,” said Leahy.

Glossier’s vision of its target audience is also evolving. During a recent quick stop in London en route to a friend’s wedding, Weiss stood in line at Glossier’s Covent Garden store, studying the crowd at the brand’s best-performing location.

“I don’t usually [stand in line] to be honest, but I did. I wanted to have the line experience in London,” she said over Zoom from Europe, where she has been for the past few weeks with her family. “I remember the customers who were in the first pop-up when it was down in New York’s Canal Street almost 10 years ago being my age, being around 30. Now, I walk into our Covent Garden flagship and I’m waiting in line behind a group of 9- and 10-year-old girls. For me that’s very similar to if you look at something like Clinique. My mom used Clinique, and then I used Clinique.”

Leahy pointed to social media to demonstrate how Glossier is resonating across generations. “For instance on TikTok, we’ve just passed 2.2 billion views of hashtag Glossier. We’re seeing growth on Instagram, a platform that many brands are seeing contract, but we’re seeing 2,000 percent growth in our average monthly followers. So both our core consumer demographic, our Millennial consumer as well as Gen Z, is engaging with Glossier.”

According to CreatorIQ, Glossier’s earned media value grew 52 percent year-over-year between January and September. EMV assigns a unique value to a piece of content based on engagement that this content receives from users (likes, comments, shares, views), as well as the platform that this content was published on (Instagram, YouTube, TikTok, etc.), and attributes that value to brands mentioned in this content.

“While Instagram was responsible for 60 percent of Glossier’s EMV, and TikTok drove 24 percent, TikTok’s haul represented 138 percent year-over-year growth, indicating that TikTok was key to the brand’s growth,” said Conor Begley of CreatorIQ.

On new products, of which it plans to debut every four to six weeks, Glossier’s biggest launch this year has been Stretch Fluid Foundation, $34, building off of the popularity of its Stretch Balm Concealer, released in 2016. The foundation is available in 32 shades across seven shade categories and five undertone groups. The brand has previously faced criticism for its very limited shade offering for some products. At the same time, Stretch Balm Concealer, $22, expanded its range to 32 foundation-matching shades.

“This is a long term opportunity for the brand,” said Leahy. “It shows how we can build upon existing franchises like our concealer and then add newness to it in a way that keeps the brand growing and relevant in a really meaningful way.”

The foundation is reportedly performing well at Sephora, where Glossier is said to be a top 10 color brand. A banking source told Beauty Inc that color cosmetics, Glossier’s mainstay and a category hit hard during the pandemic as consumers were stuck at home, is performing well across the board at the retailer, with Rare Beauty, Charlotte Tilbury and Makeup by Mario continuing to attract customers as they head out to events once again.

Additionally, Glossier You, $68, has become the top-selling fragrance at Sephora both in stores and online. “We have top products in makeup, skin care and fragrance,” noted Leahy.

“We could not be more thrilled with Glossier’s record breaking debut at Sephora in the U.S., Canada and U.K.,” said Artemis Patrick, Sephora North America’s newly minted president.

“We exceeded our launch forecast by more than 100 percent and as a result have been looking at a new level of inventory to meet both in-store and online client demand,” added Carolyn Bojanowski, executive vice president of merchandising. “At just a few months in, this is only the start with Glossier and we’re so excited about the future growth potential together.”

Elsewhere, there is an 18,000-strong wait list for its deodorant on its own website, said Weiss.

Such figures mark a revival of sorts for the brand. Prior to the partnership with Sephora, sources had told WWD and Beauty Inc that sales — and buzz — had slowed. Glossier laid off nearly 200 retail employees during the pandemic and eliminated another two dozen roles last year. Around the same time, savvy shoppers took to social media to report they found some of the brand’s sought-after products like Generation G matte lip colors and Cloud Paint liquid blush discounted at TJ Maxx and Marshalls. Then there’s the tell-all book authored by journalist Marisa Meltzer.

Culture at the company, including in corporate and retail, was also repeatedly brought into question. During the racial reckoning of 2020 in the aftermath of the police killings of George Floyd and Breonna Taylor, an anonymous Instagram account of former Glossier employees detailed “an ongoing insidious culture of anti-Blackness, transphobia, ableism and retaliation” at Glossier’s retail locations. Weiss issued a public apology and vowed to do better.

In a bid to improve culture, Stuart has overseen a new employee and customer code of conduct, while in 2020 Glossier launched a grant program for Black-owned beauty businesses in which it has invested more than $1.4 million thus far.

As for Weiss’ role in the company, Leahy stated she is first and foremost the founder and will continue to play an important role through that lens. Then, as chairwoman, she works with Leahy to drive long-term strategic direction.

“She still has her thumb prints on things like long-term product innovation, and our retail customer experience and how the brand comes to life from a creative standpoint,” said Leahy. “But at the same time, we’re showing that Glossier is beyond any one individual, and this incredible team is showing that we can really drive the success of Glossier decades into the future.”

When asked how big of an adjustment the role change has been, Weiss responded that it was the smart thing to do, pointing to brands she admired. “It doesn’t even have to be in the beauty space. It could be a brand like Nike. The founder was not the CEO for 50 years. The founder might have been exactly the right CEO for the first three years or five years or 10 years.”

The transition has been much talked about in the media, but not more so than in Meltzer’s “Glossy: Ambition, Beauty, and the Inside Story of Emily Weiss’s Glossier” (Atria/One Signal, $28.99). The book follows the brand pre-conception, when Weiss was known as a super intern on the MTV scripted reality show “The Hills,” to its onetime unicorn status when it scored a $1.8 billion valuation (Glossier raised an estimated $265 million in funding with key investors including Forerunner Ventures and Sequoia Capital) to the present day. As part of the research, Meltzer stated in the book that she interviewed Weiss four times.

“It is surreal to think that Glossier and I are the entire subject of a book — the brand is less than 10 years old and there are brands that are much larger and have been around longer than ours, who haven’t received this kind of attention,” said Weiss in a statement, noting that she did the interviews on the understanding that the book was going to be a look into the beauty industry as a whole. “I have mixed feelings about it but it’s clear that what we’ve built is special and enduring, if it’s the focus of an entire book.”

Asked whether her vision for Glossier has changed at all since its conception, Weiss answered that it has not.

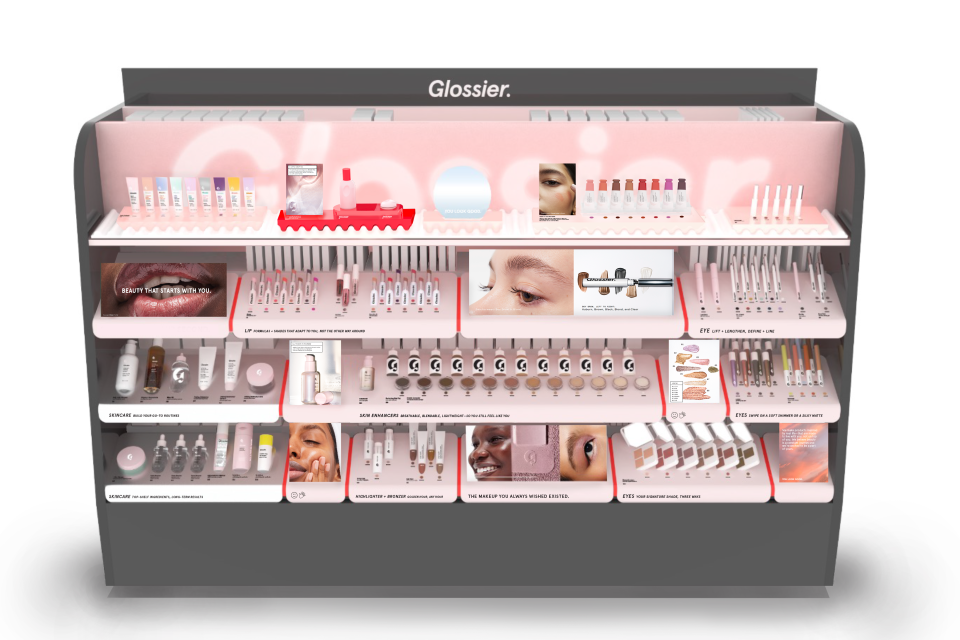

“The brand is so resilient. I think it’s very clear. You can recognize a Glossier product, a Glossier store, a Glossier gondola, a Glossier-created image or visual, and all of those things are why we believe so much that we are in year nine of a 100-year brand.”

Leahy was in agreement: “We are oriented to this being your kind of 100-year brand. The power of it in terms of the momentum the brand has today, the fact that it’s connecting across generations, the multicategory and multiple channels and markets for growth means that the potential is really significant.”

Best of WWD

Solve the daily Crossword