Infrastructure work holds greatest promise for U.S. economy

Who was the U.S. president responsible for creating the greatest economic boom in the nation's history? And for what was he better known?

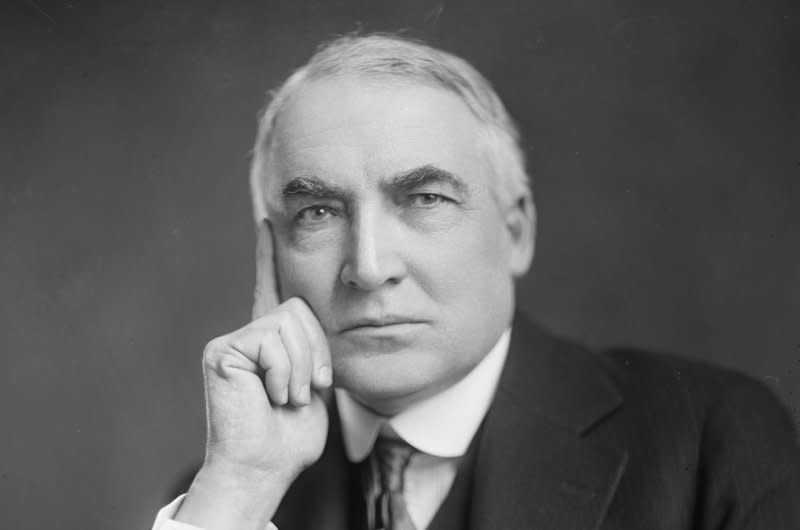

One hundred years and one month ago, President Warren Harding died of a heart attack in San Francisco after only 18 months in office on March 4, 1921.

The Harding administration was awash in scandals. Teapot dome was the most outrageous in the illegal sale of oil licenses. The head of the Veterans Bureau Charles Forbes was guilty of embezzling nearly $2 billion in current dollars. And there were other cases of massive corruption.

In addition to having one of the most scandal-laden presidencies, Harding was a known womanizer. Despite Prohibition that began in 1919, Harding still consumed alcohol in the White House. But, almost invisibly to most observers, he also set in motion this extraordinary economic growth.

Other than Andrew Johnson, no president arrived in office at a worse time. World War I ended in November 1918. The Spanish flu killed nearly 700,000 Americans. Twenty-four letter bombs terrorized the country, probably more than Sept. 11 did.

Hundreds of thousands were detained under the Espionage and Sedition Acts on the vague charge of criticizing the government. Tens of thousands were deported without due process. Massive labor riots and protests shook the country, compounded by the "red scare" that made Joe McCarthy's obsession with communism seem trivial. And Woodrow Wilson had been incapacitated for much of his second term.

The 1920-21 recession was winding down. So what did Harding do in these circumstances? First, he signed the Federal Aid Highway Act and the Budget and Accounting Act in 1921 that created the Bureau of the Budget. Second, he moved to cut government spending and taxes from 70%, eventually to 25% in 1925. Third, in his touting of "returning to normalcy," he allowed the private sector to take charge.

The 19th Amendment, giving women the vote, empowered half the population with newly found "freedoms." The end of the war unleashed new demand and technology exploited that. Automobile sales skyrocketed.

Cars required new roads made possible by the Highway Act that, in turn, depended on concrete and other materials, as well as a surfeit of workers. Cars needed steel, rubber, gas stations, meaning gasoline was in great demand and hospitality facilities for dining and sleeping that supercharged the economy.

Radio and aviation were just entering service. Marketing and radio commercials spurred consumerism. Budget and tax cuts put more money into people's pockets that could be spent. That the period became known as the "roaring '20s" mirrored this economic success.

Of course, cutting the budget was much easier then. Social Security and Medicare/Medicaid had not been invented. Defense after the war was slashed. And less government spending meant less government.

The problem was that the good times led to great excesses, particularly in the stock market, where share values were soaring. Credit flowed freely and buying on the margin only required a small cash payment. In October 1929, all that came crashing down. In fact, it would take World War II for the nation to recover fully from the Great Depression as America became the industrialized arsenal of democracy.

Fortunately, no administration has been as scandal-ridden as Harding's. And no administration has created such an economic miracle either. What can be learned from this experience?

While the refrain of cutting budgets and taxes is often and loudly heard, those are not viable solutions. Perhaps new super technologies will emerge that will have the same economic transformational qualities as the automobile did. But if not, what then?

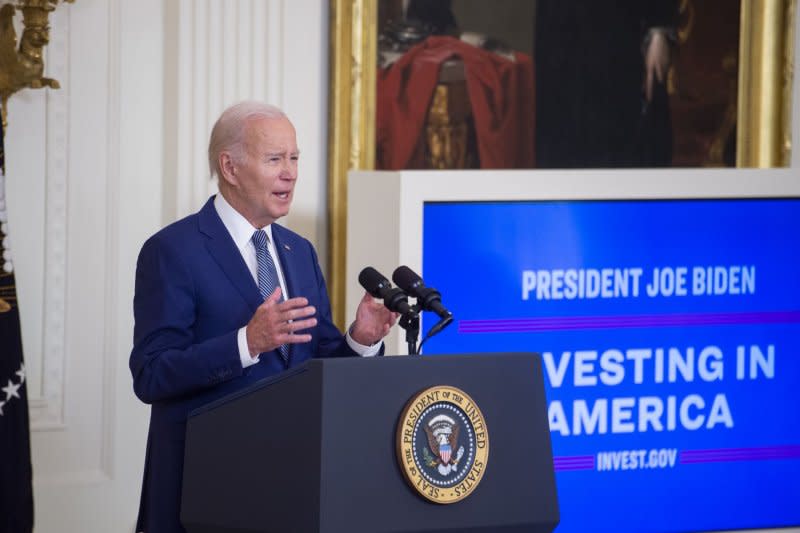

The single greatest potential for an economic renaissance, however, is infrastructure improvement. Given the American Recovery; Chips and Science; and the Inflation Recovery Acts, many trillions of dollars are in place for a massive rejuvenation of infrastructure. If properly managed, the increases in productivity will stimulate unprecedented rates of GDP growth.

The key is properly managed. So far, the administration has not developed a national infrastructure strategy or plan. Nor has it put any single individual in charge. Hence, coordination is suspect. And the risk of waste, fraud and abuse is real.

President Joe Biden should establish a committee to take charge of infrastructure oversight writ large. That body must include members of Congress. Commerce Secretary Gina Raimondo would be ideal to chair this group. And it should be supported by an array of experts in areas of business, finance, technology, construction and science as advisers.

This can work. But will it? Where is Warren Harding?

Harlan Ullman is UPI's Arnaud de Borchgrave Distinguished Columnist, a senior adviser at Washington's Atlantic Council, the prime author of "shock and awe" and author of "The Fifth Horseman and the New MAD: How Massive Attacks of Disruption Became the Looming Existential Danger to a Divided Nation and the World at Large." Follow him @harlankullman. The views and opinions expressed in this commentary are solely those of the author.