Macy’s Marketplace Play: What It Means

Macy’s has launched its digital marketplace platform, significantly expanding its offering of categories and brands available on macys.com and providing sellers with a wider audience of potential shoppers.

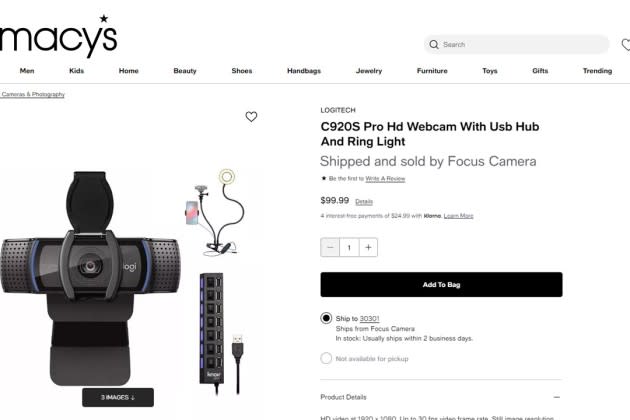

This fall, via its marketplace, macys.com will make available 400 brands not previously sold at Macy’s, across 20 categories. Of the 20, eight categories are new to Macy’s: electronics, video games, floral gifts, gift tissue/wrapping paper, vitamins, sports nutrition, computers and peripherals, and wellness.

More from WWD

The marketplace is geared to grow Macy’s volume and profitability and meet the demand for products that the retailer’s shoppers requested but couldn’t find on its website or in Macy’s stores in the past. The online offering will grow over time.

A huge chunk of Macy’s volume is generated online. Last year, of Macy’s Inc.’s $24.46 billion in total sales, digital represented 35 percent, a 9 percentage point decline from 2020, but a 10 percentage point improvement over 2019.

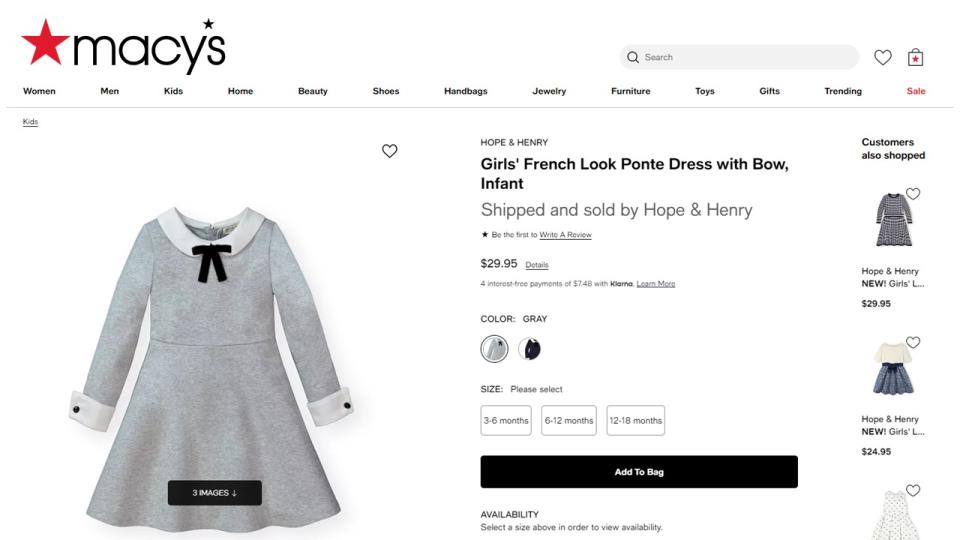

Executives from the department store retailer told WWD that the marketplace is being “seamlessly” integrated into the product assortment of the e-commerce site, meaning that customers shopping online and through Macy’s mobile app should feel minimal differences. On the product pages, marketplace items sold by a third party and shipped by it are indicated.

Brands, third-party merchants, and/or individual products sign up through the marketplace platform to sell their products on macys.com. With the marketplace format, Macy’s does not own that merchandise or manage the shipping to customers, but gets commissions on the sales. This is different than owned merchandise that is bought by Macy’s merchants, held in its warehouses and delivered to customers by the retailer. It’s also different from drop shipping where Macy’s also owns the goods that are sold on macys.com, but shipped by the supplier.

For the past couple of weeks, Macy’s has been testing its online marketplace with certain products and brands, but on Wednesday it was officially launched with more products. Many of the 400 brands are already being offered and others will be listed later this fall.

Digital marketplaces such as Amazon, eBay, Walmart, Alibaba, Farfetch and Shopify list a vast array of categories and items. Some are characterized as “generalists,” meaning they offer everything to everybody without having a sharp identity or clear image.

More recently, a fast-growing subset of smaller marketplaces has been emerging, providing additional competition for Macy’s, such as Express, Hudson’s Bay, Best Buy, Stadium Goods, Lands’ End, Crate & Barrel, Urban Outfitters and StockX. They enable retailers to present wider assortments, accelerate sales volumes, and reach more consumers, whom they hope won’t surf competitors on the internet as much to get what they want.

“While there are many very large marketplaces out there, Macy’s competitive advantage is our curation, our merchants’ lens, that we bring to all of the categories that we sell, and we want to make sure that manifests through our marketplace offering as well,” Matt Baer, Macy’s Inc.’s chief digital and customer officer, told WWD in an exclusive interview.

“For us, marketplace is a multiyear journey, and our commitment is to build a best-in-class seller experience and best-in-class customer experience,” said Baer. “I am really confident that as we open up the marketplace to additional sellers and additional brands, we will be able to maintain that really strong curation and great customer experience, and that marketplace will continue to evolve and grow and will be a critical platform for Macy’s future success.”

Baer said Macy’s has more than 44 million customers — those who have shopped the retailer at least once in the trailing 12 months. They provide “a ton of information in terms of what they are looking for when they are shopping at Macy’s and also what other products and categories and retailers they are shopping when they are not at Macy’s. We are able to use that information to determine what are the best categories for us to get into, from a marketplace assortment perspective. That list evolves over time as well as we enter new or adjacent categories with the aim of best serving the customer and meeting their demand for categories, products and brands that they expect, or are comfortable with Macy’s selling.”

With a marketplace, speed is another advantage, Baer said. “A marketplace platform allows you to get product to customers more quickly than you would otherwise be able to in a more traditional merchant channel, so we can stay ahead of style and trend. If we identify a style or trend in the market, we can find a seller that has that product available, and we can onboard that product to the marketplace and have the product available almost immediately.”

Baer also said that marketplace “enables another channel, where we can ensure that we are fulfilling the product to customers in the most profitable manner possible.”

In addition, “as we build the strategy,” Baer said, “It’s really helping us to accomplish some of our other enterprise goals, like our support for ‘Mission Everyone,’ which is Macy’s social purpose program to promote and sell women-owned, diverse-owned and sustainable brands.” This fall, 20 percent of marketplace sellers and brands will be from “underrepresented enterprises,” according to Macy’s.

Some products that wind up getting listed on macys.com through the marketplace could also wind up being displayed in Macy’s stores. As Baer said, “Another benefit of the marketplace platform is that it allows merchants to test consumer response to categories, brands, styles and products. Where we see a strong consumer response we would consider including in future store assortment plans.”

Bloomingdale’s will also be launching the marketplace format on its website. “Our goal is next year,” Baer said, without being more specific on that timing. Bloomingdale’s and Macy’s, as well as Bluemercury, are divisions of Macy’s Inc.

With any marketplace, there are risks. Brands sometimes find themselves near other brands of inferior quality, affecting perceptions. Brands also risk cannibalizing their sales on one marketplace from another. In addition, if a consumer orders from a marketplace and is disappointed by a poor shipping experience (it arrives late or the wrong product is delivered) the marketplace might be blamed and its reputation suffer, even though it could be the fault of the brand handling the shipping.

However, Baer said with the Macy’s marketplace, it’s been “a year of intense work creating an exceptional experience for customers and sellers.” He emphasized that the marketplace platform has been “seamlessly integrated into Macy’s digital shopping experience, giving our customers access to an array of expertly curated products — from apparel and beauty to home improvement, toys, pet products and more.

“What was really important for us is that we created the most seamless customer experience we could. The customer would have notification at the point of sale or on the item page, in terms of who the seller is and who would be fulfilling that product, and there are a couple of points of distinction in the post purchase experience as well,” Baer explained. “But we really made sure that as we were building the platform we were creating a best-in-class experience for marketplace transactions.”

Select Macy’s marketplace categories and new brands include:

Baby and children’s apparel: Bonsie Baby, Dabble & Dollop, Wabi Baby.

Beauty and wellness: L’Occitane, Mary Ruth’s.

Electronics: LG, Samsung, Sony, TCL.

Gifting:The Million Roses, Teaspressa, Wrappr.

Home: Ettitude, Smeg, Sunday Citizen, W&P.

Maternity: Everly Grey, Ingrid & Isabel.

Pets: Little Beast.

Toys and video games: Magna-Tiles.

“We are not focused on sku (stock keeping unit) growth, because it is so important for us that the assortment is curated,” Baer said. “So we are really focused on getting the right brands and categories on-site and making sure we are not creating any goals internally that would potentially dilute that customer experience.

With the initial 20 categories that Macy’s chose to focus on with marketplace, “a lot of those categories were really easy for us to identify based on what consumers were telling us and based on what they were expecting us to carry — things like beauty and wellness, or electronics or maternitywear, or pets,” Baer said, referring to pet accessories and other products, not the pets themselves.

“There is also some adjacency opportunities or expansion opportunities that might not be quite as obvious today, but will tomorrow as we continue to build out our Toys ‘R’ Us partnership. As we begin to enter video games through our marketplace platform, there then becomes natural extensions to other categories like sports cards and memorabilia. Even if it’s not our first choice today, it becomes a really obvious choice tomorrow, as we continue to expand our product offering.”

Macy’s marketplace is powered by Mirakl, a major marketplace technology company, and customized by Macy’s digital, merchant and technology teams.

“We made extensive research and identified what the best-in-class solutions are out there in order to provide the best seller experience,” Baer said. “We became very confident that Mirakl partnering with Macy’s was the right path forward to create the best experience and to get to market as quickly as possible.

“The Macy’s brand is very meaningful for customers. It stands for quality, curation, and we have a point of view that helps customers own their style. Our process in building the marketplace and identifying sellers and curating an assortment that we bring onto the platform is one that is highly creational and we have the best merchants in the world and they are involved in that process in terms of identifying the sellers and curating the assortment. We offer to customers an opportunity to access this assortment, that is also curated and aligned and has the right adjacencies to our existing owned and drop ship assortment,” he continued. “It also becomes a great benefit to sellers to have access to Macy’s really strong network of customers. It is a really awesome opportunity for sellers to get their products and brands exposure, and we have had a ton of success going to market and talking to prospective sellers that are so excited about the prospect.”

“Our marketplace complements our existing omnichannel strategy and is another platform we will use to find the most efficient distribution strategy for our partners. Not only will we continue to maximize brands and existing assortments, but we will use the marketplace to test and customize our assortments based on customer demand,” Josh Janos, Macy’s Inc. vice president of marketplace, said in a statement.

Last February, Macy’s Inc. chairman and chief executive officer Jeff Gennette said Macy’s has decided not to spin off its digital business, after a review of its operations. Macy’s had been under pressure from activist shareholder Jana Partners, to create separate dot-com and brick-and-mortar store businesses.

“This was a very comprehensive review…pressure-testing our strategy that we are maximizing shareholder value,” Gennette said.

The review was undertaken by the board along with management and AlixPartners, a leading retail consultancy that worked on Hudson’s Bay Co.’s separation of its dot-com and brick-and-mortar operations at the Saks Fifth Avenue, Hudson’s Bay and Saks Off 5th divisions.

“Key to the decision by Macy’s management and the board was that an integrated Macy’s delivered greater value than the separation of physical assets,” Gennette told WWD. They also concluded that spinning off the dot-com business would result in “really high” separation costs, as well as ongoing costs of operating separate companies, and execution risks, Gennette said.

Gennette added that Macy’s was heavily investing in its dot-com business and that the company’s three-year, $3 billion cap-ex budget was largely devoted to growing the digital business by launching a marketplace.