People Are Sharing Famous Companies That Went Bankrupt Over Dumb Decisions, And Now I Finally Know What Happened To Sears

You ever think about those big companies from years ago that seemed to make horrible business decisions and be on the decline? Well, inspired by OnlyFans' reversal of its sexual content ban, u/WolfgangCaesar asked people to list companies that (nearly) bankrupted themselves through poorly thought-out or unnecessary decisions. They did not hold back, and I decided to look into each one to find out what actually happened, Frankly, their choices are just impressive, so here are 33 of 'em below:

1.Let's start with the company that inspired the question, OnlyFans, which "[took] back its ban on sexual content" within days of announcing it.

Here's What Went Down: Founded in 2016, OnlyFans is a subscription-based social media platform that enables content creators — particularly in the adult entertainment industry — to monetize their work by offering exclusive content to subscribers. In exchange, OnlyFans gets a percentage of their revenue.

The platform experienced rapid growth, especially after gaining significant attention during the pandemic, and attracted a diverse range of creators beyond adult entertainment, including musicians, fitness trainers, chefs, and more.

However, in August 2021, OnlyFans made headlines when it announced plans to ban sexually explicit content. Many argued that it stigmatized and marginalized sex workers, reinforcing societal taboos around sexuality and adult content. Moreover, it raised concerns about censorship and the control exerted by payment processors and financial institutions over online platforms.

Due to the intense backlash from creators and users, as well as the potential negative impact on the platform's revenue, OnlyFans reversed its decision within days, stating it had secured assurances from banking partners to support its adult content. Now, OnlyFans continues to be a prominent platform for content creators to monetize their work, navigating the constantly evolving and challenging landscape due to regulatory issues and ongoing debates surrounding adult content online.

2."RadioShack. Those guys just couldn't make their niche happen and never attempted to evolve."

Here's What Went Down: Back in the 1970s, RadioShack was opening new stores left and right, riding the wave of popularity of CB radios. It even introduced the TRS-80, one of the first personal computers, which was a big hit and initially outsold Apple. But as the '80s rolled around, bigger players like Dell and IBM came onto the computer scene, causing RadioShack to switch gears and jump into the booming cell phone market.

RadioShack went all-in on selling not just phones, but also service plans and accessories. It worked, and cell-related sales made up over half of its $4.4 billion in sales by 2011. But things began to go downhill. As carriers started opening their own stores, RadioShack struggled to find its focus. It went through multiple CEOs and different slogans that didn't quite click with customers. Meanwhile, big stores like Best Buy and Walmart were offering cheaper prices and online shopping, pushing RadioShack out of its niche.

By 2014, RadioShack had thousands of stores, but many of them were too close to each other, causing all sorts of problems. The company was bleeding money, and in February 2015, it filed for bankruptcy. It was later acquired by General Wireless but ended up filing for bankruptcy again in 2017. And just like that, RadioShack's once-thriving empire crumbled.

3."One time, Red Lobster offered an unlimited [snow] crab leg deal. They brought the servings out slowly and were like, 'Nobody is going to sit there for six hours and just eat crab legs.' Actually, lots of people did — so many, they lost millions."

Here's What Went Down: In 2003, Red Lobster offered a pretty awesome deal: Enjoy unlimited snow crab legs for just $22.99 per person.

Unfortunately, at the time, snow crab prices were on the rise in the US due to farming quotas. On top of that, Red Lobster seemingly didn't account for the fact the customers would eat, on average, 3–4 servings of snow crab legs in one sitting.

As a result, the restaurant chain took a massive hit. According to the New York Post, it suffered a staggering loss of $405.9 million in stock during a single trading session and saw a drop in profits by $3.3 million.

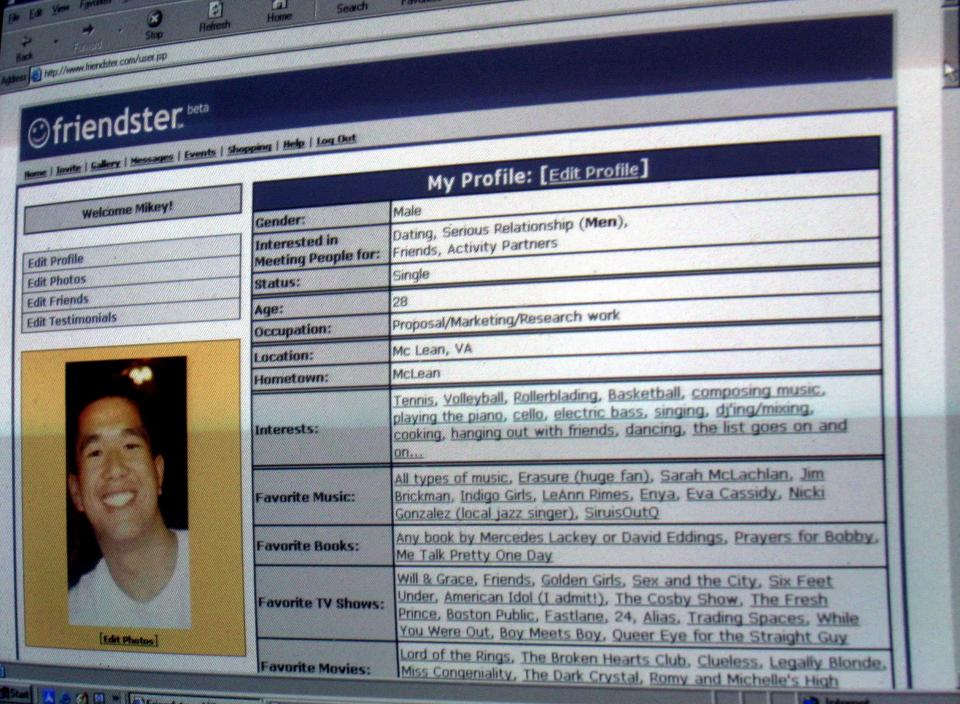

4."Friendster shot themselves in the foot with a ton of bad decisions that led to stuff like long login times for basically no reason. It is weird to think that for a short time, Friendster was big and hip enough that I actually had it on one of my business cards around 2000."

Here's What Went Down: If you don't remember Friendster, it was one of the early social networking sites that came before MySpace and Facebook. Founded in 2002, it quickly gained popularity, attracting 3 million users in its first few months and getting media coverage from big names like Time Magazine, Esquire, Vanity Fair, and Entertainment Weekly. Its founder and CEO, Jonathan Abrams, even made an appearance on Jimmy Kimmel Live! In 2003, Google offered a whopping $30 million to buy Friendster, but Abrams turned them down.

However, Friendster faced its fair share of challenges. The site became slow and sluggish as it struggled to handle its growing user base (at one point, it took 40 seconds to load a page). While competitors like MySpace were adding cool features like blogs and other interactive tools, Friendster was falling behind. The company also faced internal issues, with frequent CEO changes (Abrams was frequently spotted out partying) and financial troubles.

In 2007, Friendster managed to fix most of its technical problems and regain user trust. But by then, it had lost its momentum. In 2009, the company was acquired by a Malaysian FinTech company, which eventually sold its patents to Facebook and turned Friendster into a gaming site. Despite having millions of users, the network didn't feel connected enough, and the new interface wasn't appealing. Eventually, in 2015, Friendster shut down for good.

5."Myspace. All it had to do was not change, so people could come back to it after checking out Facebook. Instead, they got rid of everything people liked about the site and didn't make any beneficial changes. When people popped back in looking for a Facebook alternative, they found a weird, new music-focused version."

Here's What Went Down: Ok, we already established that Friendster had its fair share of technical issues, and that's when Myspace swooped in. Myspace gave users the freedom to customize their pages and added new features that people actually wanted. It became the biggest social networking site from 2005 to 2009 and was eventually bought by News Corporation for a whopping $580 million.

But once Myspace was acquired, things took a turn. Instead of focusing on the user experience, Myspace went all-in on making money. The company bombarded users with intrusive ads, some of which practically begged people to sign up for credit cards and other services. It also spent loads of cash on new sections that were meant to rake in even more revenue.

Unfortunately, these moves backfired. The product quality suffered, with glitches and sketchy ads plaguing the site. The company overspent on ventures like Myspace Music, shelled out for legal battles that damaged its reputation — including cases involving child abuse — and faced stiff competition from Facebook, Bebo, Twitter, and SoundCloud.

Despite attempts to rebrand, Myspace couldn't recapture its former glory. In 2008, Facebook surpassed them as the top social networking site. Three years later, Time Inc. bought Myspace for a mere $35 million, and now, it's primarily focused on music and operates on a smaller scale.

6."Can we get an honorable mention for Staples and its multiple attempts to merge with Office Depot, despite the fact that they're both on track to die within the decade?"

Here's What Went Down: Staples, founded in 1986, became a Fortune 500 company in just 10 years. At this point, the company tried to acquire Office Depot for $3.36 billion, but the Federal Trade Commission blocked the deal. Undeterred, Staples opened new stores and continued to grow despite the Dot-com bubble and the 2001 recession. By 2002, it had $11.6 billion in sales, 1,300 store locations, and an online business that was also making waves in North American commercial delivery.

However, Staples changed its strategy in 2002, focusing more on profitability than growth. It shifted from being an everyday low-price retailer to a promotional pricing strategy. During the 2008 recession, Staples remained the top office-supply retailer, earning $19.4 billion in sales, but expanding into international markets and acquiring companies during a weakening US economy led to significant losses and increased debt. Between 2008 and 2011, Staples' stock dropped by 37% as it faced challenges in its international business.

To overcome these losses, Staples implemented cost-cutting measures, reduced store count, and diversified its product offerings beyond office supplies. Unfortunately, these efforts couldn't reverse the declining trend, and revenues fell by $2 billion between 2012 and 2014.

In 2015, Staples announced its plan to acquire Office Depot for $6.3 billion. But just like in 1996, the FTC blocked the deal. Staples canceled the sale, laid off hundreds of employees, and had to pay Office Depot a $250 million breakup fee. Later, in 2017, Sycamore Partners acquired Staples for $6.9 billion, positioning it as a business solutions partner rather than a retail-focused company.

In 2021, Staples made another attempt to acquire Office Depot, offering $2.1 billion, but the offer was rejected. By June, it offered $1 billion for Office Depot's consumer business and sought antitrust approval in November. However, Office Depot ultimately rejected all acquisition bids in 2022.

7."Blockbuster had the chance to buy Netflix, but they were extremely stupid and turned them down. Now, they're gone and just a fond memory of the '90s. They were on their way out even before Netflix with services like Redbox and Game Fly, which mailed movies to you. Man, they were stupid. The writing was on the wall for years."

Here's What Went Down: As this redditor points out, Blockbuster's decline began before Netflix's rise. Founded in 1985, the once-dominant home movie and video game rental company experienced growth until 2004. At its peak, the company had over 9,000 stores and around 58,500 employees in the US. But by the early '90s, Blockbuster co-owner Wayne Huizenga expressed concerns about new technologies — like video on demand and cable TV — and a decrease in VCR ownership rates affecting business.

In 1997 (the same year Netflix was founded), Blockbuster rejected an exclusive deal from Warner Bros. to rent DVDs before public release. However, Walmart and other retailers took advantage of this opportunity and sold DVDs below wholesale prices. Blockbuster couldn't compete and suffered a major hit to its business model.

In 2000, Netflix offered to sell itself to Blockbuster for $50 million, but Blockbuster declined as it considered Netflix to be a niche business. This decision, coupled with poor leadership, the recession, and competition from wholesale retailers and new technologies (like Redbox kiosks), caused significant revenue losses for Blockbuster in the late 2000s. By 2010, the company filed for bankruptcy protection.

A year later, Dish Network acquired Blockbuster for $320 million. By 2018, only nine franchise-owned stores remained, and eight closed that year. The last Blockbuster location, in Bend, Oregon, made headlines when it was listed as an Airbnb rental for 1990s-themed sleepovers in 2020.

8."Netflix almost bankrupted themselves as they made the transition from DVDs. They had a period where they dropped to dangerously low subscribers."

Here's What Went Down: While Netflix is still a streaming giant today, the company lost 800,000 members back in 2011 after splitting its rental service into two separate subscription plans: one for streaming movies online, and another for getting DVDs delivered by mail.

This change meant that instead of paying $10 for a single plan, customers now had to pay $8 for each plan. (That's a 60% increase in price!) The impact was significant not just on Netflix's customer base but also on its stock value, which plummeted over 25% in after-hours trading.

9."Quiznos. The corporate office decided to buy the vendors and then contract all of the franchises to only buy materials from corporate with a price hike. The margins got way too high, and all of the stores went out of business. They shot themselves straight in the foot."

Here's What Went Down: In 2007, Quiznos reached a peak of $1.9 billion in systemwide sales. But by 2021, the fast-food franchise generated less than $100 million a year in sales across all of its stores. According to experts, Quiznos' aggressive expansion came at the expense of its franchisees, and this was especially harmful given that a significant portion of its revenue came from franchise fees.

From the beginning, the company brought on inexperienced franchisees and imposed tough financial requirements that prevented them from making a profit. On top of that, it sold food and supplies to them through a subsidiary called American Food Distributors, forcing franchisees to purchase these items at inflated prices — well above the industry average — while pocketing the extra profit.

As competitors began offering similar products at more affordable prices, Quiznos' market share in the fast-food industry declined. Between a flawed expansion strategy, unfair supply pricing, and intense competition, Quiznos experienced substantial financial losses and a decline in systemwide sales.

10."JCPenney tried to stop bullshitting customers, and it backfired. They said no more sales. They were just going to price everything low because pretty much all sales at department stores are lies, anyway. You’re not really getting 70% off — the retail price was deliberately set stupid high to convince you it was a great deal, but the discount price is the actual value of it. JCPenney’s heart was in the right place, but ultimately, it failed because customers are really that dumb and would rather be lied to."

Here's What Went Down: Back in 2012, JCPenney made a bold move by saying goodbye to "fake prices" and lowered its original prices by at least 40%. The idea was to stop the reliance on bogus sales and coupons, offering customers better deals right from the start.

Unfortunately, when the company released its first-quarter results, it reported a net loss of $163 million. Why? Well, one woman summed it up in an interview with the Associated Press, saying, "The closest JCPenney is about a half-hour away from me. If I don't get a special discount, it's not worth the trip."

In the end, the ordeal reinforced that sales is more about tapping into the psychology of customers and their emotions rather than focusing solely on pricing or objective costs.

11."The Hoover UK free airline ticket disaster. The vacuum company devised a plan to offer free roundtrip airline tickets if customers bought at least £100 in Hoover products. They underestimated how focused people would be to get free stuff — so, they then made it as difficult as possible to actually claim the tickets. People would buy the cheapest thing they could to qualify, send all the forms off perfectly, then try to take legal action when the free flights didn't happen."

Here's What Went Down: In August 1992, the British division of Hoover, the vacuum company, had a wild idea to boost sales during a global recession. It partnered with a small travel agency called JSI Travel to offer free flights to the US or Europe for customers who bought £100 worth of Hoover products from qualifying stores. Sounds like a sweet deal, right? Wrong. Turns out, Hoover made the process intentionally complicated to discourage people from claiming the flights.

Here's the basic gist of it: Customers had to mail in their receipts and application, wait for a registration form, choose three flight combinations, and hope Hoover didn't reject their choices. The company thought people wouldn't bother, but it was wrong. Though Hoover sold about £30 million worth of products, it ended up on the hook for over £100 million in flights.

To get out of honoring the flights, Hoover started playing dirty. It claimed forms were filled out wrong, sent out forms on Christmas Eve to mess with the deadlines, and even said applications were lost. Customers were furious. Some formed a coalition, and one person even held a Hoover delivery van hostage until he got his flights.

Hoover tried blaming everyone else for the disaster and even fired some of its top executives, but the damage was done. The company lost £23.6 million in sales, and its American parent company, Maytag, got hit with a $72 million bill for the flights. Hoover's market share tanked from more than 50% to less than 10%. In the end, the company had to sell off its European division for a loss of $81 million.

12."WeWork was going great right up until the IPO prospectus, and everyone realized that CEO Adam Neumann was a crazy person. Neumann himself managed to personally walk away with $1B in exchange for lighting tens of billions of dollars of investment on fire. Truly epic."

Here's What Went Down: Started in 2010 by Adam Neumann and Miguel McKelvey, WeWork became a unicorn company valued at $10 billion within its first six years. SoftBank reportedly invested $18.5 billion into the company in 2019, but things took a turn when WeWork filed for an IPO that same year. Concerns about WeWork's unsustainable business model had been raised since 2015 after BuzzFeed News leaked documents the company used to woo investors. The Wall Street Journal even called it a "$20 billion startup fueled by Silicon Valley pixie dust."

WeWork also had a reputation for a fun "office culture" with perks like cold brew, unlimited beer on tap, and community events. But those ended up hurting it. In 2018, the company faced a lawsuit over sexual harassment and excessive drinking culture. In order to promote "personal accountability," McKelvey then introduced a vegetarian policy, and the company stopped reimbursing employees who ordered burgers during meetings.

Neumann's behavior didn't help the situation, either. There were stories of him smoking so much weed on a private jet that the crew found an actual chunk of marijuana, leading to a recall of the plane. His wife also reportedly demanded the immediate firing of employees she disliked. Once, the company even ended a meeting about firing staff with tequila shots and a performance by Run-DMC.

In January 2019, WeWork was valued at $47 billion, but it dropped to $10 billion during the IPO filing in October. Neumann's reckless behavior played a part in the decline, and within six weeks of the filing, Neumann was forced to step down as CEO. WeWork's prospects plummeted. SoftBank then paid Neumann a staggering $1.7 billion to leave the company but backed out of a later $3 billion stock deal due to government investigations. Legal battles ensued, and Neumann eventually settled with SoftBank, receiving $480 million for his shares. As of now, SoftBank owns the majority of WeWork shares.

13."Xerox. They had a research lab — the Palo Alto Research Center (PARC) — that invented the personal computer and a working prototype in 1973. This was a time when the concept of a personal computer didn't exist; everything was mainframes. They also invented laser printers, computer graphical interfaces, WYSIWYG text editor (a precursor to Word, etc.), Ethernet (which much of the internet runs on), and much more. Steve Jobs got a tour of PARC in 1979 after Xerox sat on its invention doing nothing (they made copiers, goshdarnit), and the rest is history. Xerox then almost went bankrupt in 2000 as the world transitioned to email, powered mostly by personal computers and the internet."

Here's What Went Down: In 1959, Xerox introduced the world's first automatic plain-paper copier: The Xerox 914. The company had a clever ad campaign featuring a monkey making copies to show how easy it was to use. The 914 became a huge success, making Xerox the top manufacturer of office copiers in the 1960s.

In 1970, Xerox opened the Xerox Palo Alto Research Center (PARC), where the company invented groundbreaking computing technologies like graphical user interface (GUI), laser printing, WYSIWYG text editors, Ethernet, and the mouse. As part of a deal with Xerox, Steve Jobs visited PARC in 1979. Inspired by its technology, Jobs brought some of PARC's ideas to Apple and incorporated them into its computers. This is where the myth of Xerox's downfall — centering on the company's failure to capitalize on its own revolutionary inventions — began.

In the 1980s, Xerox faced challenges and dropped out of the mainframe and personal computer markets. The company released the Star in 1981, the first commercial system with PC-like technologies, but it didn't sell well. It was expensive compared to the IBM PC and Apple Macintosh, which offered similar features at lower prices. By 1985, Xerox's share of the copier market had dropped significantly. It made a comeback in the 1990s with new products and rebranding efforts. However, it still struggled, leading to a major restructuring in 1998 and job cuts.

By 2001, Xerox was on the brink of bankruptcy due to massive debt. Xerox's management played a role in its inability to capitalize on its innovations, and PARC scientists even mockingly called executives "toner heads" for their narrow focus on copiers. In 2002, PARC became an independent subsidiary and separated from Xerox. Despite these challenges, Xerox managed to turn things around and generated $7 billion in revenue globally in 2020.

14."Teledesic. Their goal was to have a global network of low-Earth-orbiting satellites that provided broadband access to pretty much everyone on the planet. They were financed by tech titans in the wireless communications space, and it all seemed like a great idea. The only problem was that the technology wasn't there yet. They went bankrupt in 2002. The Teledesic Case Study is taught at Harvard Business School and other MBA programs as a cautionary tale."

Here's What Went Down: Teledesic was created in 1990 to build a global broadband satellite network and landed investments from Craig McCaw and Bill Gates. The ambitious plan aimed to provide wireless internet access worldwide for various applications, like connecting field hospitals to consulting doctors in cities, and the military to its remote forces. The project was estimated to cost $9 billion.

Expecting to begin operations by 2001, Teledesic raised about $900 million in cash. It even convinced the United Nations and the US to set aside a portion of airwaves to carry Teledesic network signals. However, changes in satellite contractors (from Boeing to Motorola and later Alenia Spazio) caused delays. The satellite industry's decline, marked by the bankruptcies of Iridium and ICO, further pushed back the start date.

McCaw's involvement in other projects also led to frustrations among employees, and the company saw multiple CEO changes. Eventually, Teledesic downsized drastically to only 50 employees, and the project was suspended in 2002. Eventually, Teledesic laid off most of its staff and kept only 10 employees.

15."Photobucket changed its terms of service back in 2017. It then required a yearly fee for all those images you previously posted on it for free."

Here's What Went Down: In June 2017, Photobucket surprised its users by introducing a $399 annual fee to embed images on third-party websites without any warning. Suddenly, millions of listings across the internet displayed broken images and were replaced by a request to update accounts for third-party hosting. This affected around 60 million images on sites like Amazon and eBay, where Photobucket had 20 million users hosting images.

Users were understandably angry and accused Photobucket of extortion by forcing everyone into a single, expensive plan. Many decided to switch to alternative platforms that offered free or more affordable embedding services.

After almost a year, Photobucket finally restored the images, replaced its entire executive team, and began offering different plans with better prices — including a free plan that allows users to store up to 250 images. While it's not as generous as the unlimited storage offered by giants like Google Photos, Photobucket believed its users valued the simplicity of its platform.

Within nine months of implementing the new pricing options, Photobucket's paid subscriber base grew by 50%. Interestingly, 90% of these new subscribers were long-time Photobucket users who had previously been on the free plan for an average of eight years.

16."The UK jewelers, Ratners, nearly went under as a result of a cringeworthy speech from their CEO in 1991."

Here's What Went Down: In 1965, 15-year-old Gerald Ratner started working for his dad's small jewelry business, Ratners Group — or Ratners for short. By 1984, he took over the company, which was struggling with 120 old-school stores and losing £350k a year.

While jewelry back then was all about exclusivity, Gerald took a different approach to improve business. He noticed that street vendors in London who made a lot of noise and had flashy displays were actually making the most sales, so he decided to give it a try. He used eye-catching posters, put price tags on everything, and showcased affordable items in the front windows. Some thought it was tacky, but it worked. Ratners grew to over 2,500 stores, raking in £1.2 billion in sales and dominating 50% of the UK jewelry market by 1990.

Then came Gerald's big mistake. In 1991, he was asked to speak at a convention and decided to crack some jokes during his speech. One of the jokes he made was about his own products being "total crap," something the media had a field day with. Headlines about Ratners calling his own stuff crap spread like wildfire, and within days, share prices plummeted by £500 million. By the end of the year, Ratners' stock had crashed by 80%.

Consequently, Gerald had to step down as chairman and eventually got fired as CEO in 1992. People started using the phrase "doing a Ratner" to describe a major blunder that could have easily been avoided. Nevertheless, Ratners Group rebranded as Signet in 1993 and went on to become the world's biggest retailer of diamond jewelry.

17."In 1998, Yahoo refused to buy Google for $1 million. In 2002, Yahoo [was in talks] to buy Google, but Google wanted more money. Yahoo refused the offer. In 2006, Yahoo wanted to buy Facebook for $1 billion, but Facebook backed out. In 2008, Microsoft offered to buy Yahoo for $44.6 billion, but Yahoo refused. In 2016, Verizon bought Yahoo for $4.8 billion."

Here's What Went Down: It's true — Yahoo had not one but two chances to buy Google. In 1998, Larry Page and Sergey Brin offered their startup, which included the groundbreaking PageRank system, to Yahoo for just $1 million. Yahoo declined because it wanted users to stay on its platform rather than be directed to other sites.

Four years later, Yahoo entered negotiations to buy Google for $1 billion, but as talks progressed, Google increased its valuation to $3 billion. Since search accounted for only 6% of its revenue, Yahoo rejected the purchase.

In 2006, Yahoo made an offer to buy Facebook for $1 billion, but Mark Zuckerberg turned it down as Facebook had more plans in the pipeline, including the upcoming launch of its News Feed feature. However, reports suggest that Facebook's board would have accepted an increased offer of $1.1 billion, but Yahoo executives refused.

In 2008, Microsoft proposed acquiring Yahoo for a hefty $44.6 billion, but Yahoo demanded a higher price per share. Unfortunately, the company's value dropped over the years, and Verizon acquired Yahoo for $4.83 billion in 2016. Five years later, Verizon sold Yahoo (and AOL) for $5 billion.

18."On paper, Sears had everything to be the e-commerce retailer that dominated the globe. In 1984, it partnered with IBM to create 'Prodigy,' one of the first proto-ISPs that offered all sorts of online services (except buying stuff from Sears) years before the World Wide Web existed. By 1985, Sears offered its own credit card, Discover, to rival MasterCard and Visa. It even had its own insurance company in Allstate. In theory, Sears was posed to make e-commerce a thing back in the late '80s and sweep the world in the '90s with no chance for outsiders like Amazon — who had to build their stuff from the ground up — to catch on."

Here's What Went Down: Back in 1985, Sears made a huge move by launching the Discover card nationwide. This was unique because it had no annual fee, offered a higher credit limit than other credit cards back then, and even introduced the innovative "Cashback Bonus" feature. As the largest retailer in the US at the time, Sears had high hopes for Discover.

However, things didn't go as planned, and by the end of 1986, Sears lost $22 million in its credit card operations. It eventually sold its financial business in 1993 and started accepting MasterCard and Visa, alongside Discover.

Around the same time as its Discover launch, Sears teamed up with IBM to create Prodigy, an online server that eventually became an internet service provider. By 1990, Prodigy was the second-largest server of its kind and offered users the ability to shop, email, participate in online forums, and read news online. Despite its popularity, Prodigy faced challenges such as low pricing, heavily moderated forums, privacy concerns, and the removal of its unlimited chat feature. In 1996, Sears and IBM made the decision to sell Prodigy.

Outside of credit cards and ISPs, Sears had a (good) hand in creating Allstate Insurance (get it?). In fact, Allstate's actually named after a car tire sold in Sears' catalog. In 1993, Sears decided to take nearly 20% of the company public before taking it fully public in 1995.

To continue the Sears story: "Sears ended their catalog/mail-order business in 1993. For over 100 years, they had sold everything from hubcaps to houses via mail order and shipped them all over the country. Amazon was founded in 1994."

Here's What Went Down: Like we already established, Sears was a retail powerhouse. To give you an even better idea: Sears' sales accounted for 1% of the entire US economy in 1969. Throughout the '80s, its catalog division alone raked in an annual $4 billion. But eventually, the high cost of mailing catalogs for products that didn't bring in much profit hurt its bottom line, so Sears shut down its catalog division in 1993.

Four years later, Sears made an attempt to bounce back by launching an e-commerce site. It was actually ahead of the game by offering in-store pickup for online purchases even before Macy's or Target. But because the company failed to maintain updated customer lists from its previous catalog division, it had to rebuild its customer base. Even after three years, its merchandise still failed to attract new customers.

When Eddie Lampert came on board as CEO after the 2005 Kmart merger, he decided to prioritize Sears' e-commerce over department stores. This decision resulted in neglecting Sears' physical stores, and many of them ended up closing down. By 2019, Sears filed for bankruptcy.

19."Kodak completely went under when they chose not to adopt digital photography. They eventually came back several years later, somehow."

Here's What Went Down: Most cite Kodak's missed opportunities in digital photography — a technology it actually invented — as one of its biggest corporate blunders. As digital photography completely disrupted film-based business models, these missed opportunities directly led to Kodak's decline over the course of several decades.

Despite having invented the first digital camera in 1975, Kodak misunderstood the resulting digital shift. While some believe Kodak was reluctant to invest in digital technology or mismanaged its investment (like Ofoto), Harvard Business Review argues that Kodak's mistake was approaching online photo sharing as a means to expand its printing business rather than as a new business entirely.

While companies like Canon, Sony, Nikon, and Fuji branched out to keep up with the digital revolution, Kodak stagnated. Its revenue significantly declined over the years, and the company struggled to stay profitable. In 2012, Kodak filed for bankruptcy, marking a significant downfall for the once-dominant photography giant.

20."A&W created the third-pounder. It was the same price as McDonald's quarter-pounder but bombed massively. When they tried to find out why, it was discovered that Americans thought they were being cheated because three is a smaller number than four. Realizing they can't explain grade school fractions to fully grown adults without coming across as condescending assholes, A&W quietly took the burger off the menu."

Here's What Went Down: That's basically the story. In an effort to boost sales and compete with another fast-food restaurant's quarter-pound burger, A&W launched the third-pound burger in the 1980s. The company promoted its new menu item through the 'Third is the Word' campaign, but despite aggressive marketing efforts, the third-pound burgers were not selling.

To understand why, A&W hired a market research firm that conducted a focus group. The firm learned that consumers were concerned about the price of the burger because they didn't understand why they should pay the same amount for one-third of a pound of meat and one-fourth of a pound of meat.

Yes, you read that right: Most customers didn't understand that one-third is bigger than one-fourth and thought they were getting ripped off. Then-A&W owner A. Alfred Taubman said of the situation, "Sometimes the messages we send to our customers through marketing and sales information are not as clear and compelling as we think they are." (TBH, JCPenney would probably agree.)

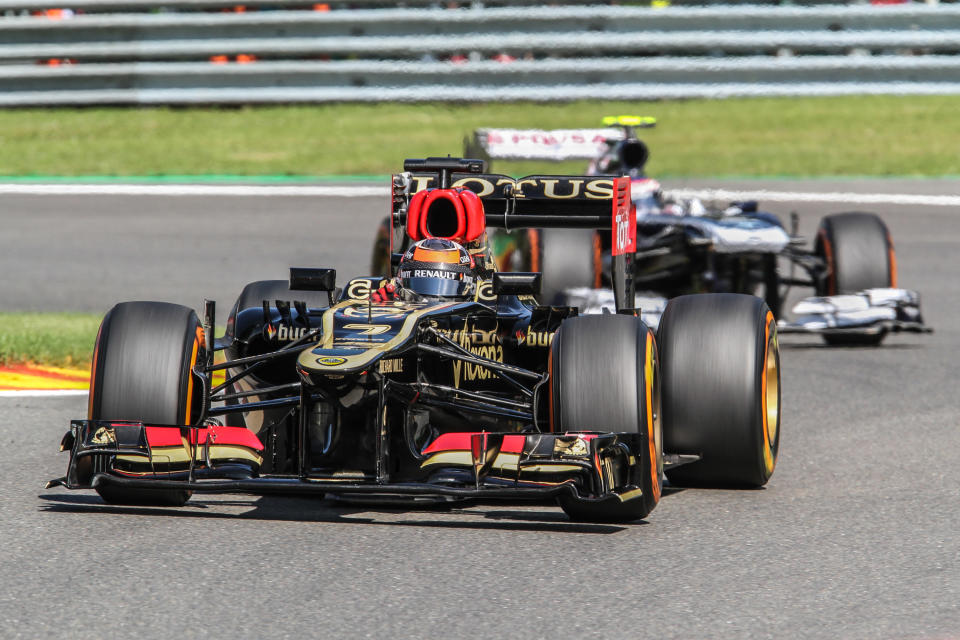

21."In 2012, after a three-year hiatus in the sport, the Lotus F1 team signed driver Kimi Raikkonen. His contract included a clause that stated Raikkonen would earn €50,000 for every point he scored in the two seasons of his contract. Raikkonen went on to finish third in the 2012 championship and fifth in the 2013 season — which was exceptionally impressive for Lotus. In doing so, he scored 390 points in two seasons and earned €19.5 million off of that bonus alone. This led to Lotus almost filing for bankruptcy."

Here's What Went Down: Like this redditor pointed out, Raikkonen had a successful run with Lotus in the 2012 and 2013 seasons, earning a total of 390 points and thus €19.5 million. However, Lotus couldn't afford to pay him in full.

During the 2013 season — Raikkonen's second season as per his contract — the Lotus team faced financial difficulties. As a result, there was a possibility that Raikkonen wouldn't participate in the 2013 Abu Dhabi Grand Prix. However, after some hesitation, he decided to compete. When asked why he arrived late to the prix, he candidly responded, "When you haven't been paid anything for a whole year, it's hard to stay positive."

Eventually, the team's financial troubles led Raikkonen to quit before the end of the 2013 season. Lotus finally paid him in full in 2014, when its financial situation improved. Lotus executive Matthew Carter explained, "The situation with the creditors is much better compared to last year. [Raikkonen's salary] was a big part of our debt, but it has been paid in full by now."

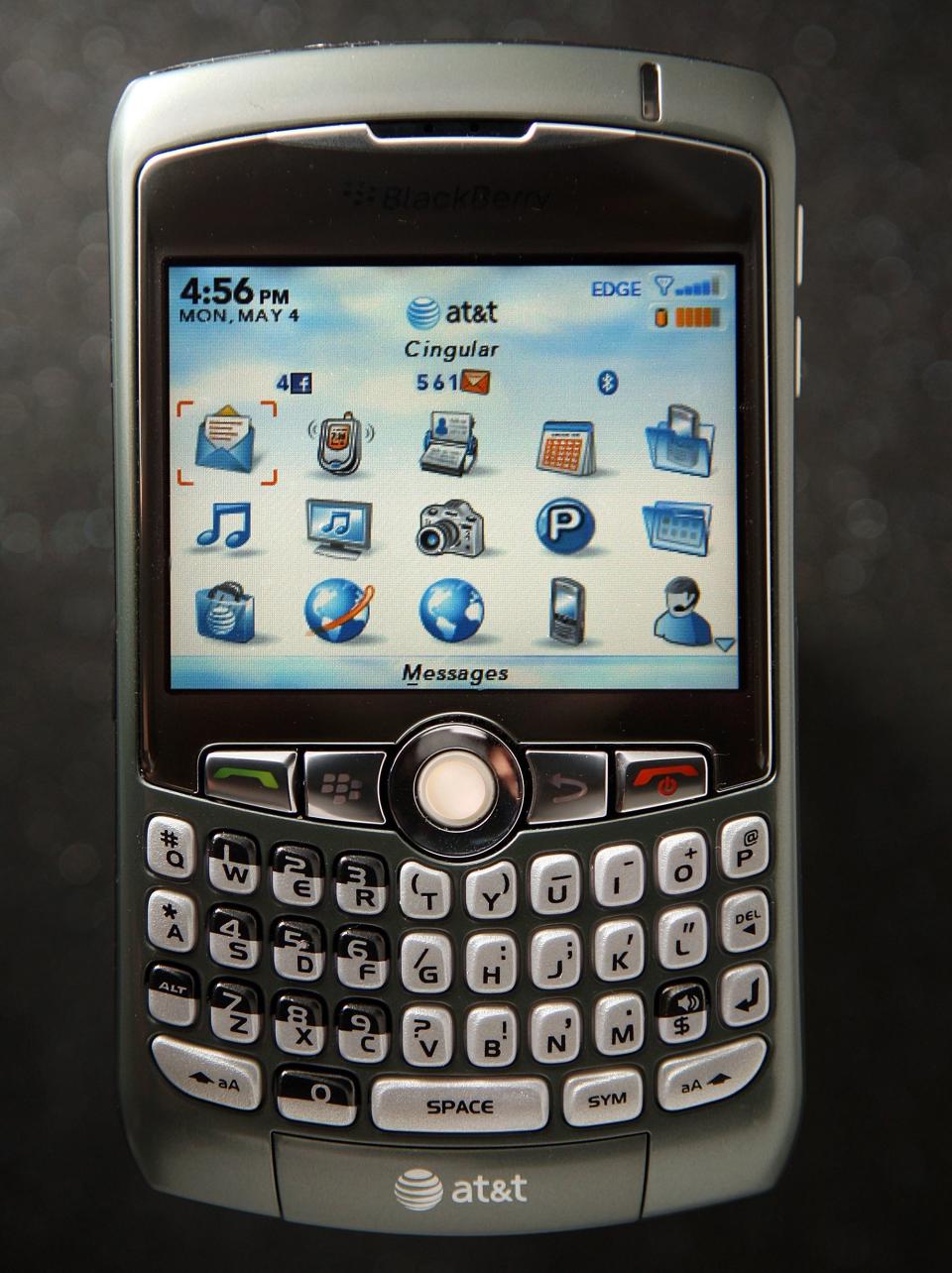

22."BlackBerry. Most popular smartphone in the world — then, they were less than 1% of the market share, and their stock value dropped. A couple of years ago, they announced that they would focus more on software and essentially gave up making phones. Lots of BlackBerry executives took advantage of their market share and thought a flat, touchscreen phone wouldn't take off the way it did. How the mighty have fallen."

Here's What Went Down: In 2009, BlackBerry was hailed as the fastest-growing company in the world by Fortune magazine. However, by 2013, its stock price plummeted by a whopping 90%. One of the main reasons for BlackBerry's downfall was its insistence on producing phones with full keyboards, despite the rising popularity of touchscreen devices like Apple's iPhones and Google's Androids.

Despite once dominating 50% of the smartphone market in the US and 20% globally, BlackBerry saw its market share shrink to 0% by 2016. In an effort to salvage its business, the company made the decision to stop manufacturing its own phones and handed over most of its branding rights to Chinese manufacturer TCL.

The partnership with TCL came to an end in 2020. The following year, a Texas start-up called Onward Mobility acquired a license from BlackBerry to produce 5G devices, including one that runs on Android and features a physical QWERTY keyboard. However, by 2022, Onward Mobility shut down, abandoning its BlackBerry plans once and for all.

23."Circuit City. It was a major retail chain in the 1980s that collapsed under mismanagement. Its arguably biggest blunder was firing all of its experienced, better-paid workers for cheaper, inexperienced ones. Apparently, selling merchandise and keeping customers happy are important in the retail business. Who knew?"

Here's What Went Down: If you were around and paying attention to Circuit City's decline at the time, you'd probably agree that its biggest problem seemed to be its suddenly shoddy customer service. That's because, back in 2007, the company decided to cut costs by laying off its highest-paid hourly employees and replacing them with lesser-paid employees. (Of course, this didn't stop then-CEO Philip Schoonover from taking $7 million in compensation that same year.)

Naturally, the company's highest-paid employees were also its most experienced employees, in part because they earned higher wages due to their years of service. To add insult to injury, Circuit City outsources its IT department and mass-fired more than 3,000 employees. At the time, WSWS commented, "The firings are the most abrupt and brazen manifestation of a trend by corporate America to push out older and better-compensated workers and replace them with a smaller, younger, uninsured, and underpaid workforce."

Ironically, Blockbuster actually announced a $1 billion bid to purchase Circuit City in April 2008 but withdrew its offer by July due to market conditions. By the end of the year, Circuit City suffered mass layoffs and store closures before filing for bankruptcy. In 2009, the company announced it planned to liquidate.

However, in 2009, Systemax purchased Circuit City's brand name, trademarks, and e-commerce website for $14 million before consolidating Circuit City under a previous acquisition in 2012. Four years later, retail veteran Ronny Shmoel acquired Circuit City and relaunched the brand in 2018.

24."Borders Books. A conversation happened between Amazon and the giant Borders Books. This internet thing was starting to look like it would harm retail sales, so Borders agreed to sell books online through Amazon. By 2007, Borders ended its marketing alliance with Amazon."

Here's What Went Down: Founded in 1971, Borders joined forces with Amazon to sell books online in 2001. Though the book retailer launched Borders.com in 1998, this deal meant that Amazon would take care of Borders' inventory, site content, and customer service, while Borders used its well-known brand to boost sales. However, in 2007, Borders decided to terminate its partnership with Amazon and sell off subsidiaries, causing its stock to drop.

In 2008, Border accepted a $42.5 million loan and relaunched its own online business. Unfortunately, as more people started buying books online, Borders struggled to keep up with Amazon. Even Barnes & Noble, which had already started selling books directly online in 1997, posed a challenging competition. To make matters worse, Amazon introduced its e-reader, the Kindle, in 2007, and Barnes & Noble followed with the Nook in 2009.

In an attempt to survive the global financial crisis, Borders replaced its CEO, secured an extension on its loan, and closed more than 200 stores. However, after more layoffs, changes in executive leadership, and losses, Borders filed for Chapter 11 bankruptcy protection in 2011 and, within months, announced plans to liquidate.

25."Quibi — when it decided that 10-minute clips watched in portrait on a commuter train is the future of home entertainment."

Here's What Went Down: Quibi, a streaming service launched in April 2020, faced failure and shut down after just six months. Co-founders Jeffrey Katzenberg and Meg Whitman blamed the challenging circumstances created by the pandemic for the company's demise.

However, despite raising $1.75 billion in funding and targeting users on the go with less-than-10-minute episodes, Quibi struggled for reasons beyond the pandemic. Between lackluster original content that failed to capture viewers' interest and weak marketing efforts, the service struggled to attract paying customers. By December, Quibi shut down.

In May 2021, Roku bought Quibi's content library. It then debuted "Roku Originals," a free collection of 30 shows originally produced for Quibi. Popular titles included Kevin Hart's Die Hart, the Emmy-winning drama #FreeRayshawn, and the revived Comedy Central series Reno 911!

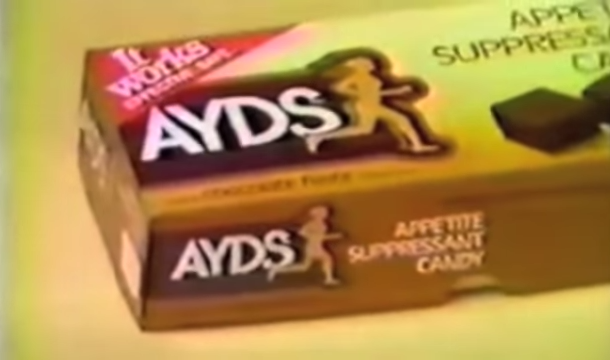

26."Ayds Diet Candy. They didn’t change their name after the emergence of the AIDS virus."

Here's What Went Down: Introduced around the 1940s (and even advertised by Hedy Lamarr), the appetite-suppressant candy Ayds came to enjoy strong sales in the '70s and '80s until the global AIDS epidemic.

Initially, the company claimed that media attention from the epidemic boosted sales. In 1986, COO Frank DiPrima went so far as to say, "Consumers are smart enough to tell the difference between a disease and a diet product. The product has been around for 45 years. Let the disease change its name."

However, as the epidemic continued to spread and gain more public awareness, the association between the candy's name and the disease became increasingly problematic. By 1988, Ayds' sales were reported to have dropped by as much as 50%. To mitigate the impact, Ayds rebranded itself as Aydslim in the UK and Diet Ayds in the US. Eventually, the product was discontinued.

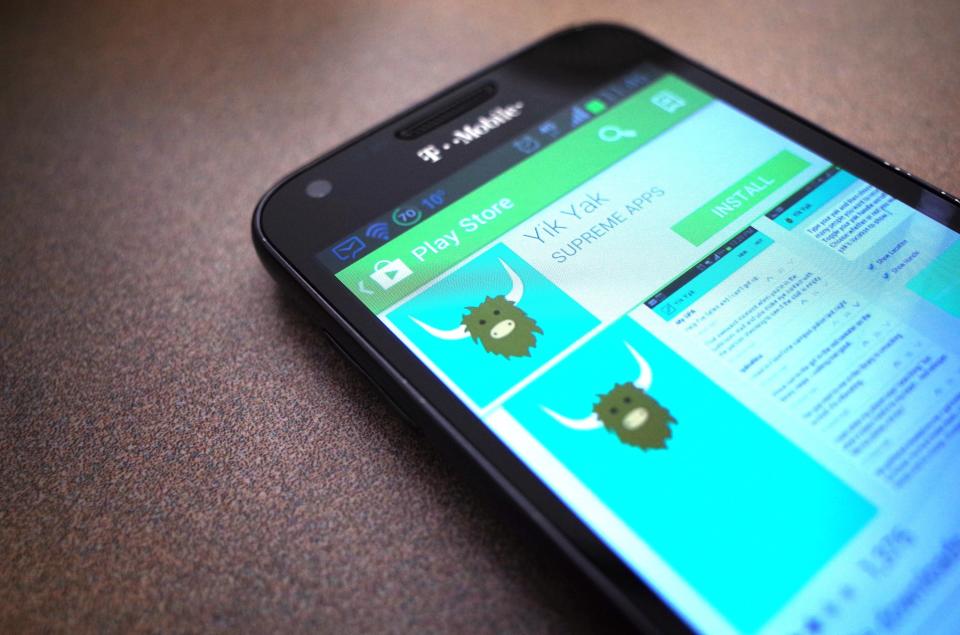

27."Yik Yak. It was a completely anonymous message-posting app at first. They then started to make it less anonymous by introducing usernames which — while they can still be throwaway usernames — certainly made people lose the favor of the app. They eventually shut down."

Here's What Went Down: Founded in 2013, Yik Yak was once valued at $400 million. The app gained popularity among high school and college students because it allowed anonymous posting. However, this anonymity became a breeding ground for cyberbullying, harassment, and hate speech. In 2014, the situation escalated as bomb threats and violence-related threats were made on the app, resulting in school evacuations and lockdowns.

The negative impact of Yik Yak was further highlighted when a university student wrote an open letter about being targeted for her weight on the app. In 2017, feminist groups and former students filed a federal complaint against the University of Mary Washington and its former president for failing to address cyber-harassment and threats of violence originating from Yik Yak.

The inability to control the rampant hate speech and the app's unresponsiveness to these issues ultimately led to its downfall. By the end of 2016, Yik Yak laid off 60% of its employees, ceased its operations, and sold its intellectual property and employee contracts to Square Inc., a mobile payment company, for $1 million.

28."Vine. It seemed like the best thing at the time."

Here's What Went Down: In 2012, Twitter acquired Vine for around $30 million. The video-sharing platform was seen as a great match for Twitter's short-text posts. However, by 2016, Twitter announced that it would be shutting down the Vine mobile app.

According to former executives, the introduction of Instagram's 15-second video feature marked the start of Vine's decline. The company failed to keep up and distinguish itself from the competition, leading marketers to invest their money elsewhere. Eventually, Snapchat emerged as the popular app for casual, everyday life updates that Vine's founders had initially envisioned for Twitter.

29."Schlitz. Throughout the '60s, it was one of America's biggest national beers. In 1974, Schlitz president and chairman Robert Uihlein, Jr. believed beer drinkers couldn't distinguish their favorite beer from other brands. He oversaw the introduction of a slimmer brewing process, replacing barley with corn syrup and using silica gel as a preservative during the brewing process that was then filtered out (so didn't have to be listed as an ingredient). Instead, the beer spoiled faster, grew cloudy on racks, didn't produce a frothy head when poured, and was flavorless. This resulted in a 100-million bottle recall. Schlitz also didn't realize light beer was becoming a thing, so it got its clock cleaned by Bud and Miller. It then ran an ad campaign with some belligerent-sounding guy threatening to kill an off-camera guy if he took his Schlitz away. By the '80s, it went back to its original brewing process, but the damage was done."

Here's What Went Down: The infamous "Schlitz Mistake" happened in the early 1970s when the company tried to save costs by compromising on quality. It introduced a new process called "accelerated batch fermentation" that backfired, resulting in a recall of over 100 million cans and bottles of beer and a loss of more than $1.4 million.

In 1976, Schlitz attempted to compete with Miller Lite by introducing Schlitz Light, but it failed to gain traction. Desperate to revive sales, Schlitz launched a disastrous ad campaign in 1977 known as the "Drink Schlitz or I'll kill you" campaign.

The ads were such a complete failure that Schlitz pulled them off the air after just 10 weeks and fired its advertisers. By 1982, Stroh acquired the world's once-top-selling brewery.

Here's an ad from the "Drink Schlitz or I'll kill you" campaign for ya:

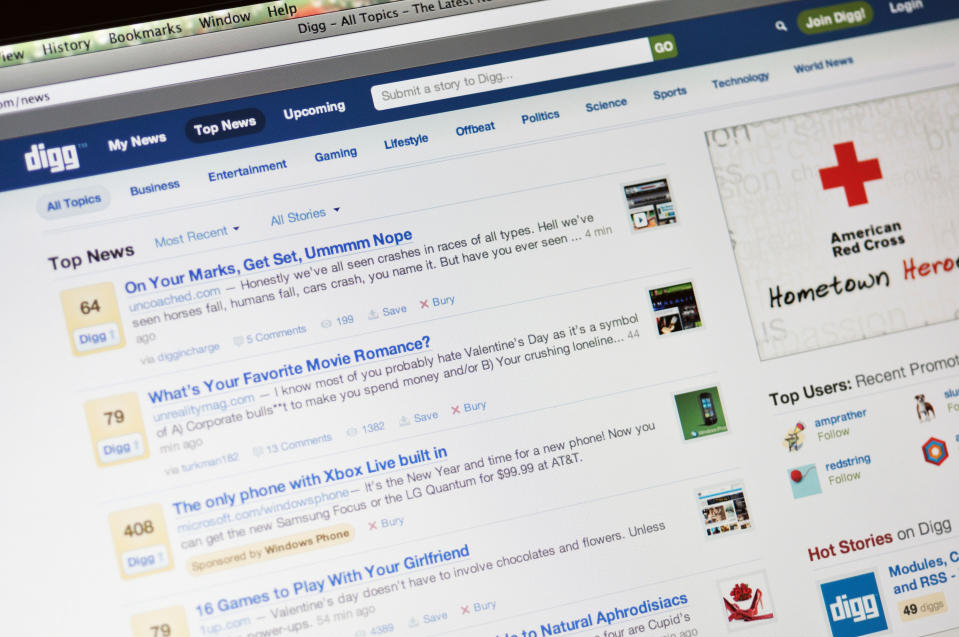

30."Digg was bigger than Reddit until they decided to force changes on the site. The changes were immensely unpopular — to the point where users began posting Reddit links as a way of rebellion. Digg stuck to their new ways and collapsed."

Here's What Went Down: Though it's now a news aggregator, Digg was founded in 2004 as a social news site in which users could upvote or downvote content (called digging and burying, respectively). It predated Reddit, and many attribute its downfall to changes in its user experience.

In particular, a redesign in August 2010 introduced modifications that upset users by altering features and launching with technical glitches. As the site continued to be burdened by more complex layouts, users began to abandon it.

Digg's inability to facilitate direct communication between users further contributed to its decline. This limitation led some users to migrate to platforms like Reddit, Facebook, and Twitter, where they could easily share links and engage in conversations.

31."Schwinn. The executives of America's most venerable bicycle maker could not be convinced that mountain bikes were anything more than a fad. They made one, called it the Klunker (yes, really), and then got an Asian company to just design a mountain bike for them. Today, Schwinn is just a brand name someone else owns."

Here's What Went Down: In the late '70s, mountain biking emerged as a new sport, but Schwinn, a well-known bicycle company, didn't see its potential. Its executives saw mountain bikes as just another cycling trend and couldn't imagine adults spending money on what they perceived to be toys. (Little did they know that mountain bikes, now priced from $500 to sky-high figures, would come to dominate the industry.)

In the following years, Schwinn faced numerous challenges. Its Chicago facility, established 80 years prior, struggled to adapt to modern bicycle production techniques like TIG welding. As a result, Schwinn began importing bikes from countries like Japan, Taiwan, and China. Gradually, Schwinn shifted from being a bike manufacturer to a bike marketer.

To avoid dealing with a unionized workforce, Schwinn decided to construct a new plant in Mississippi. Unfortunately, this location made it difficult to receive materials from its Asian suppliers. The new plant ended up operating at a loss, and in 1991, it was shut down to prevent further financial damage. The next year, Schwinn was forced to file for bankruptcy.

32."MoviePass was a weird one. Their model was too good to be true. They lost money on every subscriber who was seeing more than two movies a month — which was most of their subscribers."

Here's What Went Down: In September 2019, MoviePass, once praised as a game-changer in the movie industry, abruptly shut down. The reason was pretty straightforward: MoviePass was losing money on every subscriber.

However, MoviePass's new management was more than willing to accept losses in exchange for having a dedicated user base. In just three months, after introducing an unlimited plan for $9.95, the company gained over 1 million subscribers. To offset the high ticket costs, MoviePass planned to purchase tickets at a bulk discount and share revenue from food and drink sales with theater chains. Unfortunately, theater chains disagreed.

AMC refused to partner with MoviePass and instead launched its own subscription program called AMC Stubs A-List. On top of that, MoviePass customers faced issues with the terms of service, leading them to come together and file two lawsuits against the company. Eventually, the company succumbed to the pressure and shut down.

33.And last but not least, "There was a donut shop by my high school. It opened at 6 a.m. and closed at 5 p.m., so students would be there every day before school started at 7:30 a.m. and after school ended at 2:15 p.m. But then, they changed their hours to 8 a.m. to 3 p.m. and couldn’t make any more money. They shut down a few months after that."