Philipp Plein Outspoken on Changes in Fashion, Company Adjustments

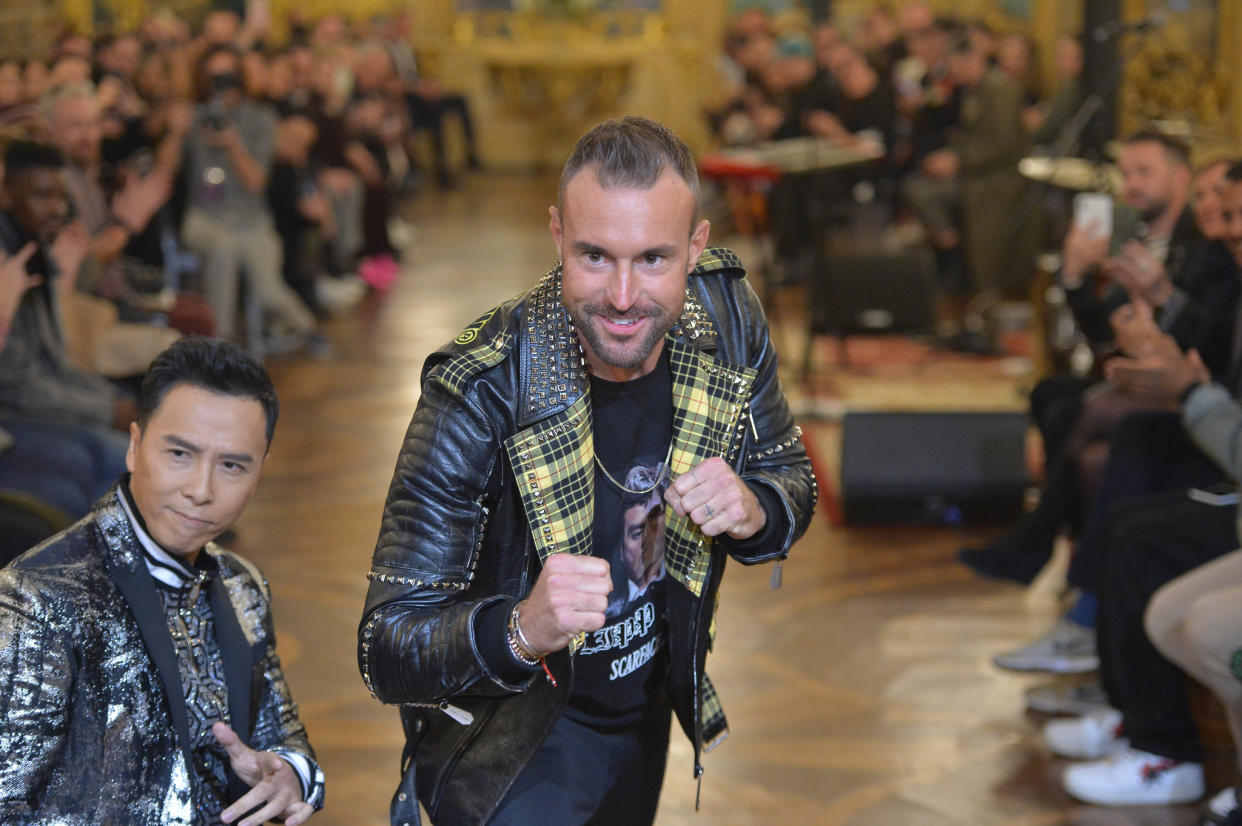

MILAN — “Welcome on board,” said an energetic Philipp Plein meeting members of the press on Thursday in the private jet-themed bar installed in his namesake brand’s flagship here.

As restrictions in Italy were eased and commercial activities restarted, the designer seized the opportunity to host an intimate IRL gathering and was said to have opted for the eccentric location to evoke the long-gone experience of traveling. The journey was intended to lead the audience through the company’s new strategic plan and challenges for 2021, but the route came with some turbulence as the outspoken designer commented on how the industry has changed this year.

“Finally fashion is changing,” he said, first addressing the evolution of communication. “The speed of it has changed. Who wants to read a fashion magazine now, to see what is coming in six months? In the past [magazines] showed the trend of next summer, but the people today want to see it now… In six months they forget it and want something different.

“The distribution of communication changed, too. Today you go directly to the client with social media, you don’t need the filter anymore… In the past the editor would decide who will be the next fashion brand, Vogue decided who were the hottest brands, but this doesn’t work anymore. This concept is dead and now the consumer decides it.”

“So the fashion editors have lost their power,” he continued. “Anna Wintour is a queen without a country. A queen is only powerful as her country… which is the readership. If nobody reads my magazine, I have a small country. I’m still the queen, I have a title, I have a crown but I don’t have the power anymore because I’m not influencing the people like I did before. I still have the history of the queen, people remember me as the queen but my power has been reduced.”

Plein also addressed Condé Nast at large. “It’s a very good example of a powerhouse and they had a monopoly…but they didn’t use it. They could have done everything, they could easily move into the online and so on, but they did not do it and today they are not relevant anymore. Why should I advertise in a magazine that sells 60,000 copies? I make an Instagram post and I have 50,000 likes in one picture… Where is this power now? If you have to decide between Anna Wintour and Chiara [Ferragni] to be front row, who is more important? Who gives you more visibility?” he asked.

Plein then turned his tirade to the role of designers in today’s fashion ecosystem. “Today most of the designers are prostitutes, because they work for everybody who pays money,” he said. “A brand for me is something with a strong DNA. There are some designers who bring the same idea to [different brands,] which creates confusion for clients…Many brands have an identity crisis and this is happening today. Then they look around, see who’s cool now and want to look like it. It’s also [a matter of] insecurity.”

Addressing the different approach investment funds have when they take over fashion labels, Plein stressed he’s proud of still being financially independent.

“Some companies are using the pandemic as an excuse but COVID-19 affects businesses and economy just like it affects people… If you’re healthy it doesn’t affect you. If you’re not healthy or have underlying problems, it could kill you,” he noted. “I have to admit that at the beginning I was a little bit nervous… now I’m more optimistic about the situation. We can’t complain about it, it was uncomfortable but it didn’t affect us as much as we thought.”

Yet he admitted that in 2018 and 2019 his group was a target and was approached by funds, which valued the business at 750 million euros. “But this company is my life. At the beginning my dream was to make money, but then you understand that money doesn’t make you happy… What I found in this company is much more than that, it’s a reason to exist,” said Plein.

His enthusiasm was further strengthened by the pandemic, as he revealed he “had more fun this year than the year before,” because of new challenges and he was able “to change direction and vision for the company, and that’s exciting.”

In particular, the restructuring of the company moved on different axes, involving a change in top management; a rethinking of the wholesale and retail channels and of the Plein Sport and Billionaire labels; the reinforcement of the online strategy, and the launch of new licenses.

“My idea was to structure the company on a high-efficiency level, but it’s important to underscore that none of the changes implemented was made because of COVID-19. The pandemic just made us slower in the development but nothing happened because of it,” he said.

During 2020, the group streamlined its structure, as a string of top executives exited the company, including Ennio Fontana — who was later named general manager of Roberto Cavalli; the worldwide retail manager Andrea Lanza Cariccio, and the global communications director Maddalena Bertoli Tedeschi.

The designer explained the infrastructure was getting too big “and there were too many people I didn’t even know the names of.” But new strategic appointments were recently made. This month Riccardo Pasero joined the group as chief financial officer, after a long experience at Kering and in consultancy roles for real estate players. At Philipp Plein, he succeeded Gilles Gaucher-Cazalis in the role.

Without sharing sales, Pasero said the group showed resilience in 2020, with earnings before interest, taxes, depreciation and amortization not reaching the earlier values of 40 million to 50 million euros but still expected to hit a double-digit figure. Yet overall turnover will be down 30 percent this year, due to the wholesale and retail channels equally impacted by the pandemic and consequent stop in tourist traffic as well as the protests in Hong Kong.

“For us, the lockdown in Italy was worse than elsewhere. Sales of stores here were down 60 percent, because usually local customers account only for 30 percent while the majority are Russians, Chinese and Americans… While in Germany the situation is different, because 85 percent of sales there are generated by local consumers,” explained Plein.

In direct retail, the company also closed five stores between Amsterdam and the U.S., whose operations were already meant to be ceased because they were not profitable. As for the wholesale channel, it was already suffering but the group supported its partners by offering to cancel orders during the pandemic. “We basically skipped a collection and a half, the one showed in February and the pre-collection in June,” said Plein.

“All the brands, including us, started to operate directly the online and in this way we killed the wholesale. We are killing the wholesale and at the same time we’re complaining about the wholesale going down,” continued the designer, who will rely on this channel and online for the relaunch of the Plein Sport and Billionaire lines in 2021.

Introduced in 2016, Plein Sport was momentarily suspended “because of its success, which cannibalized the Philipp Plein brand and interfered with the perception of the first line,” said Plein, revealing that wholesale sales of the activewear line generated 70 million euros in its first year. The company had about 30 stores dedicated to the label and half of them shut down, while the others were converted into Philipp Plein locations.

Also under the group’s umbrella, Billionaire “was losing money last year and this year” but the impact on overall sales was limited as the label accounts for only 10 percent of total revenues. “Let’s say Billionaire is an expensive hobby and we’re using the knowledge of Philipp Plein to develop it,” Plein said.

In general, the company is shifting its focus from the wholesale channel to an omnichannel approach through monobrand stores — both directly operated and franchisers — and online platforms.

In particular, this year online sales grew 20 percent, which encouraged Plein to explore new ways of doing business on digital platforms.

First the company enhanced its presence on Farfetch, where it was ranked the second men’s wear brand during Black Friday, claimed Plein. This matched the company’s own e-commerce, where the average basket stood at around 800 euros. Top markets for online sales are Russia, Germany, the U.S., Italy, the U.K and Poland.

Last month the company landed on Tmall and said it’s readying its launch on Amazon’s Luxury Stores in January. Overall, the goal is to connect with 15 different platforms to target and engage local markets. Consequentially, product assortment and designs will be expanded and adjusted to better fit each marketplace and audience.

“Even before the pandemic, I said we need to become an online company, which implies a complete change of mentality,” said Plein. To this end, the group turned all its brick-and-mortar stores to distribution points to better support online demand.

“Every day from this single store in Milan we ship something like 200 boxes… Just [orders on] Farfetch took 1 million euros from this store this year,” said Plein, who underscored the challenges that come with such a shift in strategy, including managing the warehouse and rethinking budgets and orders for each store.

“But if you want to be successful online, you need to be successful also offline. I believe in the brick-and-mortar, I need it because I need to take customers to an experience,” said Plein. “At the end the secret is that there’s no secret. We’re all using the same material, even the same suppliers… The difference is in the dream you sell.”

To better support the expansion of its physical distribution, the company promoted Elisa Lubinski to helm the omnichannel development of the direct retail and franchise businesses. Lubinski joined Philipp Plein last year after 12 years at Tod’s and, before that, starting her career at Gucci.

As part of the 2021 retail strategy, the group will open two directly operated stores in China, an addition to the two existing doors in Shanghai, an outlet and the company’s Chinese warehouse.

In the U.S., the company is scouting locations in New York’s SoHo and in Miami, planning to open two units by the end of 2021 to add to the current ones in Los Angeles and Las Vegas.

Other direct openings will include a four-story flagship in Frankfurt in February, as well as a store and outlet in the Spanish cities of Marbella and Malaga, respectively.

In terms of locations operated by third parties, the brand said it’s planning 15 to 20 openings next year. In March the first store in Delhi will kick off an expansion in India, which will be reinforced by a unit in Mumbai and a project of pop-up stores across the country. In Malta the company will open two doors next year and one in 2023 as part of the new Mercury Towers real estate complex. Other units will bow in Poland, South Africa, South Korea, the Philippines and Vietnam. The company is also scouting locations in Turkey and is in negotiations to expand in Japan and Latin America, specifically in Mexico, Colombia, Panama and Brazil.

Product-wise, after entering into the fragrance arena, the brand signed a license agreement for eyewear collections with De Rigo and said it expects to close one for watches by the end of 2020. In addition, it is eyeing licenses for porcelain homeware collections, furniture and wallpaper, which will mark a return to the beginnings of Plein’s career in the design world.

Best of WWD

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.