Road to Recovery for SMBs Marred by Inflation

In the latest quarterly “Road to Recovery Report” from Alignable’s Research Center, small- and medium-sized businesses are struggling to recover from the pandemic due to inflation. And the hardest hit in businesses looking to recover revenue to pre-pandemic levels are retailers.

Small businesses are generally defined as companies with less than $50 million in revenue, while medium-sized enterprises are those that make between $50 million and $1 billion.

More from WWD

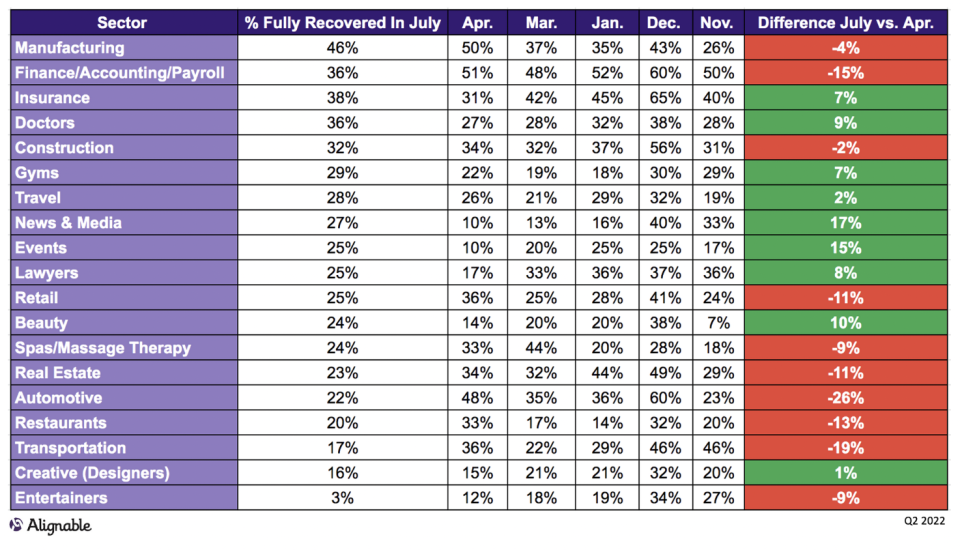

Authors of the Alignable report said 80 percent of respondents expect to be fully recovered by 2024. Just 25 percent of SMBs polled say they are fully recovered — which is 2 percent lower than the prior quarterly report. And of the retailers polled, 25 percent say they’re fully recovered versus 36 percent in the prior report.

Of all those polled, 80 percent say they have fully reopened their businesses, but many noted that inflation and the lingering effect of COVID-19 are holding back a full recovery. “The percentage of businesses feeling the financial impact of the COVID[-19] crisis remained relatively unchanged over the past quarter,” the report noted. “With 56 percent of businesses still reporting some financial impact due to the crisis — 23 percent of those still rank the impact as severe.”

“That said, the focus has significantly shifted from the fear of government re-closures and customers being too fearful of returning to inflation and having the financial resources sufficient to ride out the storm,” the report stated.

Courtesy image.

Forty-seven percent of respondents in the U.S. said they were concerned inflation could force them to close their business unless economic conditions improved. In Canada, that number was 56 percent. In the U.S., 1 percent of respondents said they had to shutter their business due to current economic conditions. In Canada, the number stood at 2 percent.

“Given this current outlook, it’s not unimaginable to see a growing movement for more financial support for specific industries later this year,” authors of the report said.

Holding back recovery is inflation on several fronts, Alignable said. This includes higher costs of rent, fuel, supplies, labor and transportation. “One of the biggest concerns with regard to inflation is the ability for business owners (struggling to get their customers to return) to increase prices in lockstep with their costs, so they’re able to maintain their margins,” the report stated.

Regarding passing costs on to the consumer, Alignable said in the report that while 91 percent of businesses report experiencing higher costs, “only 61 percent have been able to increase the prices they’re charging to their customers.”

By locale, Alignable said more small businesses in Illinois, Colorado and New York were concerned about the negative impact of inflation as compared to businesses in other states.

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.