Shaq, Allen Iverson Join Reebok Management Team

Reebok is serious about reestablishing a foothold in the sports arena and is bringing some high-powered names on board to make it happen.

On Thursday, the company revealed that Shaquille O’Neal would be officially joining Reebok in the newly created role of president of basketball. In addition, Allen Iverson has joined the brand as vice president of basketball.

More from WWD

Both of the former athletes have long-standing relationships with Reebok as well as its parent company, Authentic Brands Group. Authentic bought Reebok for 2.1 billion euros from Adidas in August 2022.

“Looking back on my career with Reebok and in basketball, this appointment means everything to me,” O’Neal told WWD. “It’s a reminder of where I’ve come from and what I’ve built. I’m just motivated to make an impact and bring the brand back to the place it belongs in basketball.”

He added that he is also eager to be working closely with Iverson to build the business. “AI [Allen Iverson] is a founding father of Reebok Basketball and has left a lasting impact on the game and its surrounding culture. There is no one I’d rather work with to bring in a new generation of ballers to Reebok than him. Shaq and AI back at it — feels good.”

O’Neal teased his new role on Instagram over the weekend when he posted a photo of himself wearing a 2024 Shaq for President T-shirt. The shirt is being sold by Reebok with Reebok Basketball on the back.

The goal for Reebok as a whole, according to the brand’s top executives, is to hit $10 billion in sales by 2027. At the time of the acquisition, Reebok had global retail sales of $3.7 billion and Authentic had projected it would hit $5 billion a year after the completion of the sale. But Reebok has already exceeded that estimate, according to Nick Woodhouse, president and chief marketing officer of Authentic.

“We’re going to be very close to $6 billion in ’23,” he said, pointing to strength in apparel as well as “better global distribution, and just bringing more heat to the brand.”

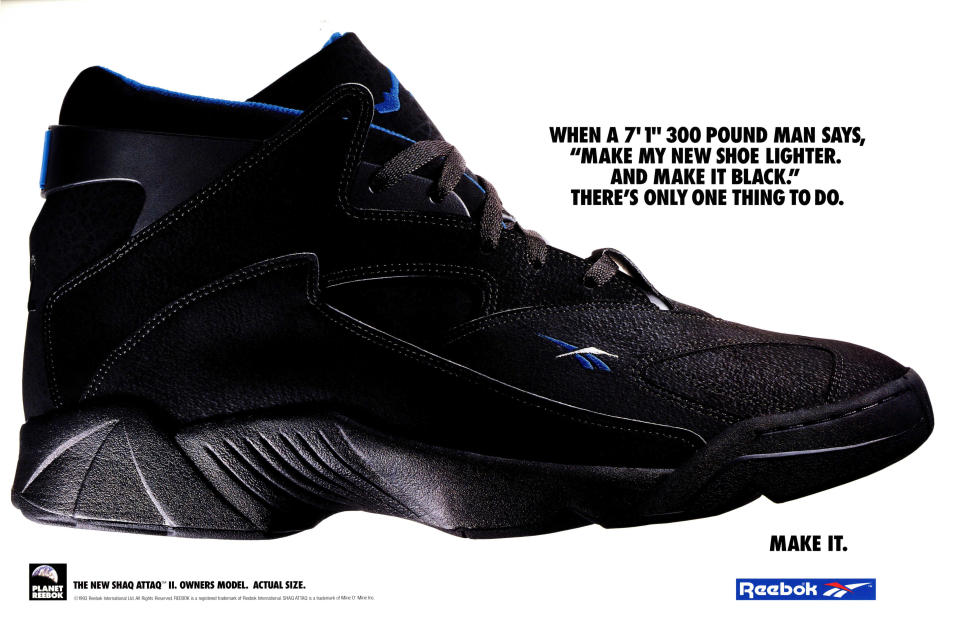

A big spark will be lit by adding O’Neal to the management team, he believes. The former NBA star signed his initial endorsement deal with Reebok — the brand’s largest ever at that time — prior to his rookie season in 1992. That relationship included the introduction of O’Neal’s first signature shoe, the “Shaq Attaq,” followed by a host of irreverent and disruptive ad campaigns and products that helped establish Reebok as a leader in the basketball space.

Iverson signed with Reebok in 1996, ahead of his rookie season.

But during the years it was owned by Adidas, Reebok lost its position in basketball as well as other sports as the German parent focused most of its attention on its flagship brand.

When word got out in 2019 that Adidas was open to selling Reebok, O’Neal was among the most vocal proponents that Authentic, the brand management firm in which he is a partner, should acquire the business.

“Authentic has had a partnership with Shaquille for a while and he was so instrumental in buying Reebok,” Woodhouse said. Since the deal was finalized, O’Neal was constantly offering suggestions to the team on what could be done with the brand. “He said we have to get back in sport,” Woodhouse said.

The team agreed.

“We love the retro business and some of the other stuff we’re doing in fashion, but we’re a sport brand, that’s what we were founded in,” he added.

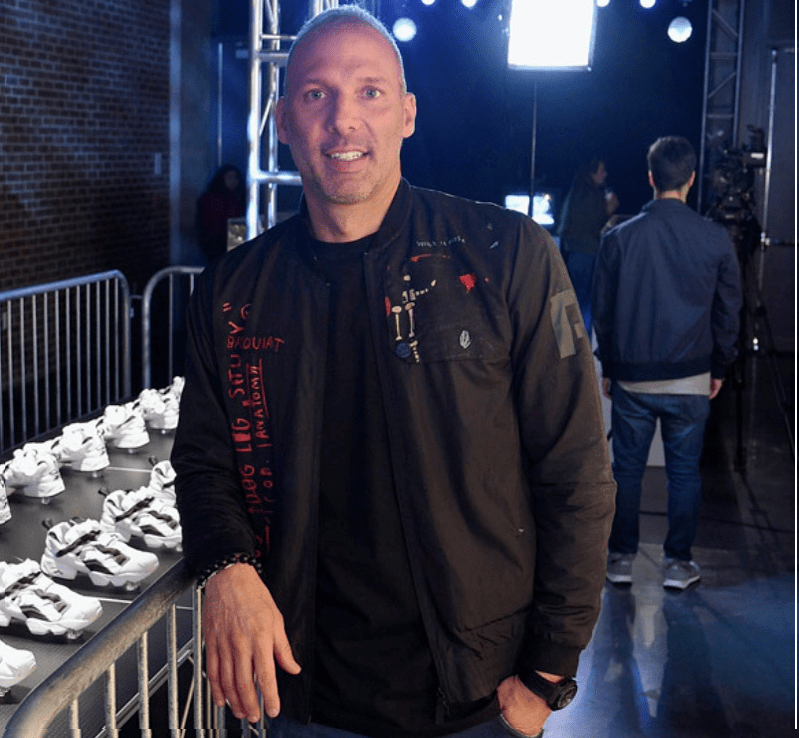

So together with Todd Krinsky, chief executive officer of Reebok, they decided to make O’Neal an unprecedented offer. “There are a lot of lifetime deals with athletes for shoes or whatnot,” Woodhouse said. “But Todd’s idea was, instead of just giving them a lifetime deal, let’s bring him into the boardroom. This is a true executive role of immense added value, not just a consulting role.”

Krinsky added of O’Neal: “He’s got a tremendous passion for Reebok — it’s where he signed when he was 19. And now it comes full circle. It didn’t take long for us to to say, after a few conversations, ‘You’ve got all of the skills to lead this for us.’”

In this newly created role, O’Neal will oversee the brand’s basketball category and work to cultivate partnerships with athletes and organizations. Krinsky said he will work on product creation, marketing, will participate in events, oversee player recruitment and help negotiate deals on behalf of the brand.

“He’ll be involved in every area,” Krinsky said. “I clearly have a team running the business here in Boston, but we’ll be taking the direction from Shaquille. This is not a figurehead role. He has a lot of ideas and some things he has strong conviction on. But on other things, he really just wants to listen and learn, and ideate with us on how we should do things. This is a major opportunity for a brand that has rich, rich heritage [in basketball] to get back into one of the biggest global sports in the world.”

Currently, Krinsky said, basketball represents under 10 percent of Reebok’s total sales, and it’s all centered around retro styles. “We have no performance basketball business now.” But with O’Neal taking over the reins, Reebok expects that number to jump to between 20 percent and 25 percent over the next few years.

“When we were in basketball, we had very big market share,” he continued. “So there’s no reason we can’t get back to that. I think we did it in a very disruptive way back then with some very irreverent personalities and some very unique products. And we’re looking to take that same path but modernize it with a new playbook. This is a move to get into performance basketball in a significant way.”

Right out of the gate, they said, O’Neal will concentrate on player recruitment. He has already identified some potential partnerships and is making calls to athletes. “It happens at great speed when he’s involved,” Krinsky said, “because you can imagine if a family gets a call from Shaquille O’Neal, they’re answering it pretty quickly.”

His initial focus will range from professional athletes to collegiate and high school prospects, both male and female, Woodhouse said, but the primary thrust will be on “up-and-comers. Someone changing from another brand to our brand doesn’t really excite us. We’re looking for someone who can grow up with our brand. Today, it’s almost more important what kids are wearing in the tunnel as opposed to on the court and that’s also very important to us. Can they also be brand ambassadors?”

In his new role, Iverson also will help drive player recruitment, and work on grassroots and community-based initiatives and athlete activations such as the Iverson Classic, the company said.

Beyond basketball, Krinsky said Reebok sees opportunities in other areas as well.

“We’ve got a very big classics/heritage business — this is the cornerstone of our brand — it does really well in every market around the world. And it’s continuing to grow,” he said. “And then our second biggest category is training. We’ve always had great history, trading back even to the Eighties, to today.”

But beyond throwback product, the brand plans to double down on other sports such as running, Krinsky said. “We’re getting ready to launch a big running innovation next year. And then tennis and global soccer are coming as well. But we’re doing it methodically, we’re not jumping into every sport right away.”

He characterized it as “a renaissance period for Reebok,” which had exited many of these sports over the past few years and is poised to reenter them.

Woodhouse also pointed to the opportunities in the comfort arena. “With a rapidly aging population, there’s a movement to comfort,” he said, pointing to popular brands such as Hoka. Reebok’s recently introduced Walk DMX shoe is “blowing out,” and the brand will continue to expand on that success with other comfortable shoes for active people.

“If you’re going to do a tough workout, we’ve got a shoe for you; if you’re going to be a top basketball player, we have a shoe. And if you’re going to run a fast marathon or 10k, we have a shoe for you as well,” he said. “But if you want to walk two miles in the morning and you don’t want to wear a $190 performance shoe, we’ve got a great shoe for under $100.”

Apparel, which represents around one-third of sales, is seen as another growth area. “One of the unlocks for us with apparel, was getting back into the field of play and having more athletes on Saturdays and Sundays wearing our product, because we haven’t had a lot of exposure to our apparel outside of just the fitness enthusiast or instructors,” Krinsky said. “So now I think you’re going to start seeing more athletes and influencers wearing our apparel. We’ve kind of gone through a little bit of a branding change over the last few years — a bigger, bolder expression of Reebok.”

He pointed to Justin Fields, quarterback for the Chicago Bears, who has been wearing a lot of Reebok product in and out of the stadium as an example. “So the U.S. consumer is going to start seeing the apparel more on athletes. That’s a key move for us as well.”

But juggling sport and lifestyle product is not an easy task. Under Armour is pivoting away from a strict focus on sport to shine more of a light on fashion while Puma is looking to increase its penetration in sport while also introducing product from Rihanna and other celebrities.

Woodhouse admitted that doing both can be tricky, but he believes Reebok can succeed.

“I think maybe only Nike would be ahead of us as far as permission to combine sport, fashion and lifestyle because of our history,” Woodhouse said.

At Reebok, the brand has a deal with New Guards Group, the Milan-based division of Farfetch Ltd., that is its core operator in Europe and with which it is collaborating on luxury products. “We just launched our first product with them, a $200 luxury version of our Club C shoe, and it sold out in minutes on Farfetch,” Krinsky said. “We’re working on a bunch of new collaborations we’re about to announce and we’re working with them on a running innovation that will launch maybe on a runway, but it will be for runners. So we don’t really see separating sport from fashion completely. We think it’s all one expression for the brand.”

Blending sport and lifestyle will also fuel Reebok’s ability to hit its $10 billion sales goal. Woodhouse said the brand will continue to work with its wholesale partners internationally to build the business. The brand has signed deals with Foot Locker and Macy’s in the U.S. as well as JD Group, a global multichannel retailer that also owns Finish Line, DTLR and others.

“We’ve always been a fan of wholesale and retail. We love direct-to-consumer too but we feel all methods of distribution are the right way to go for our brands and our consumer,” Woodhouse said. “And our wholesale partners are helping us win in a big way globally.”

Best of WWD