New Report Highlights States With Most Staggering Childcare Costs

A new report released on Thursday by the Democratic members of the U.S. Congress Joint Economic Committee (JEC) on the state of childcare in America finds that access to high-quality early learning childcare is more critical than ever for American families — and even more difficult to find.

The report found that access to affordable high-quality childcare will increase employment opportunities: For every 10 percent decrease in childcare costs, mothers are anywhere from 0.5 percent to 4 percent more likely to work. And that’s not the only benefit seen by mothers with access to affordable childcare. Mothers whose children participate in childcare programs are more likely to seek post-secondary education and, for low-income mothers, the availability of childcare can increase earnings by $90,000 over the course of their careers.

Of course, kids benefit too.

Children who receive high-quality early education perform better on math and reading tests through the age of 21, and are more likely to graduate from college. And strikingly, the impact is generational: The children of those who, as children, received high-quality child care are also more likely to attend college. Children who have access to high-quality early childhood programs also have higher rates of employment, higher lifetime earnings, and better long-term health.

The States With the Highest Childcare Costs

But the costs of high-quality early childhood care are staggering — and is unattainable for many American families. A typical family will spend more than 15 percent of its total income on infant child care alone.

The JEC reports that the top ten states with the highest average annual infant-care costs are the District of Columbia ($22,658), Massachusetts ($17,082), Colorado ($14,950), Minnesota, ($14,826), Maryland ($14,726), New York ($14,144), Connecticut ($14,079), Hawaii ($13,584), California ($13,343), and Illinois ($13,176).

And the top ten states with the highest average child care costs for a 4-year old are the District of Columbia ($17,863), Massachusetts ($12,796), New York ($11,700), Connecticut ($11,669), Minnesota ($11,420), Hawaii ($11,232), Colorado ($11,089), Alaska ($10,764), Vermont ($10,440), and New Hampshire ($10,259).

When it comes to where families spend the largest share of their income on infant care relative to median household income, things are the worst in the District of Columbia (28.4 percent), New York (20.8 percent), California (20.1 percent), Colorado (19.5 percent), Oregon (19.2 percent), Illinois (18.7 percent), Massachusetts (18.6 percent), Minnesota (18.5 percent), Nevada (18.4 percent), and Rhode Island (18.4 percent).

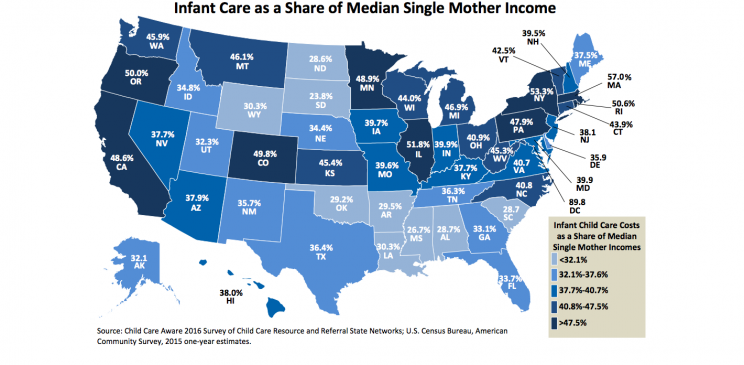

The Worst States for Single Moms

Single mothers are up against particularly staggering economic challenges when it comes to accessing high-quality care for their young children because they have to put huge parts of their annual income towards childcare. In the District of Columbia, single mothers on average spend 89.8 percent of their annual income on infant child care. The other worst states for single mothers? Illinois (51.8 percent), Colorado (49.8 percent), Minnesota (48.9 percent), California (48.6 percent), Pennsylvania (47.9 percent), Michigan (46.9 percent), Montana (46.1 percent), Washington State (45.9 percent), and Kansas (45.4 percent).

How Does Trump’s Proposed Child Care Plan Stack Up?

Unfortunately, President Trump’s plan to help make childcare more affordable does very little for those who need it most. In fact, those who stand to gain the most from this tax cut plan are those families earning between $200,000 and $500,000 a year.

The tax plan proposed by Trump while on the campaign trail called for a deduction for childcare expenses for families earning up to $500,000, as well as a smaller refundable tax credit that would cover only a fraction of the child care expenses remaining after other child care tax provisions. Those earning less than $30,000 annually stand to gain just $10 a year from such a plan, and the national median income of single mothers is just $25,274.

Those earning $40,000 to $50,000 a year would see about $25 annually to help with childcare costs. The median household income for a family with children in the U.S. is $68,260 — and would qualify for a $150 tax cut with the Trump plan.

The JEC report also points out that tax-preferred dependent savings accounts proposed by Trump on the campaign trail “disproportionately benefit wealthier families” becauselower-income families are less likely to have extra income to save and would receive smaller tax benefits should they be able to save.

It is estimated that only 53 percent of all American families and just 32 percent of low-income families would be able to use such a savings account.

Here’s What Would Really Help:

The Democratic members of the JEC have outlined the following principles for policymakers working toward childcare policy plans both inside and outside of the Trump White House:

Affordability for low- and middle-income families to ensure that these families are not forced to put the majority of their take-home pay towards quality childcare.

High-quality preparation for kindergarten and beyond — complete with a well-compensated early learning and care workforce who can guarantee this kind of readiness.

Affordable childcare that meets the needs of today’s working families — from single parents to households with two parents who work outside the home to those households where one or more parents work nontraditional hours.

As the report states, “without government programs that guarantee affordability, provide high-quality preparation for future education, and meet the needs of working families, American families will continue to struggle.”

Read more from Yahoo Style + Beauty:

‘Vanity Bonded Me to My Elegant Mother When I Was Young. But Then She Fell From Grace’

Perez Hilton’s Mom Is the Best Thing on His Instagram Account