Tequila Prices Are Surging. Is a Shortage Looming?

For tequila enthusiasts, the last few years have brought an unending cycle of sticker shock with every trip to the liquor store. And the steady rise of two to three dollars every couple of months has been hitting all brands of tequila, high-end and low.

An obvious reaction is to blame inflation. Or maybe it's something sinister: Greedy agave bastards are taking advantage of the recent popularity of tequila and using inflation as an excuse.

Related: The Best Sipping Tequilas of 2023 to Enjoy Neat

It's true that more than inflation is behind the price hikes across the tequila landscape. Though it's fun to get mad and shake your fist at Big Liquor, the shockingly high prices of tequila are mainly driven by four frustratingly logical reasons.

1. The Tequila Boom

Last year, tequila overtook American whiskey to become the second most valuable spirit category in the U.S., and it’s expected to overtake vodka in terms of dollar value within the next two years, according to the alcohol market analysis firm IWSR. And things may only be getting started.

Back in 2016, tequila commanded a 1.8 percent volume share of the global spirits market, by 2021 it was up to 2.5 percent. Overall, tequila rose by more than 30 percent between 2015 and 2020, according to IWSR data.

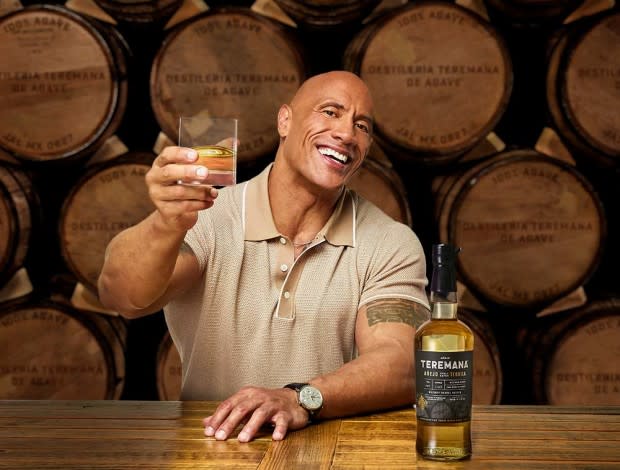

Courtesy Image

The category, by volume, is expected to grow at seven percent globally from 2021 through 2026, which is significantly faster than global spirits volumes, which is set to grow at two percent over the same period. And that growth rate is even higher in the U.S.—tequila’s No. 1 market—where the 2021–26 volume growth for tequila is expected to be at a nine percent.

While the agave boom is well underway in the U.S., it’s only getting started in other parts of the world. Export volumes to Spain jumped by 90 percent last year, to France by 73 percent, Britain by 68 percent, and Germany by 60 percent, according to Mexico's Tequila Regulatory Council, compared to global growth of 23 percent.

In less numerically littered terms, tequila is growing fast with no look of slowing down in the near future.

2. Agave Shortages

The skyrocketing demand for tequila is causing agave shortages. It takes about seven years to grow a Blue Weber agave to the point it’s ready to harvest for tequila. Mature agave (7-plus years) allows makers to get a higher yield because mature agaves contain more sugar that can be converted into alcohol, which can increase yields by around 30 percent. However, agaves aged 5 and 6 years are all that most distilleries currently have access to.

Getty

This, among other factors, has caused agave prices to remain close to record levels for around three years, according to Jose Luis Hermoso, IWSR’s research director. He expects, “prices will only start moderating when there are signs that tequila is cooling down in the key U.S. market.” So no time in the near future.

Related: 50 Best Whiskeys in the World 2023

3. Copper and Glass Costs

It’s not just agave prices that are raising the price of tequila. Higher production costs that include everything from shipping prices to the cost of glass bottles and copper—essential for making artisanal pot stills—are boosting prices as well.

The German Federal Statistical Office (Destatis) reported that the producer prices of glass and glass products were up 26.9 percent in January 2023 year on year, while price increases were particularly large for glass bottles, which saw non-colored glass rise 40.2 percent year on year, while prices of bottles of colored glass rose 37 percent year on year.

The price of copper, meanwhile, has doubled since 2016, and is only expected to go up in the coming years. Currently the third most-used metal in the world, analysts believe that copper will be crucial as the world moves away from fossil fuels to greener sources of energy.

Labor shortages are also a cause of concern within the tequila industry. A growth in construction in part due to the tequila boom in Jalisco has been one of the causes of a shortage of distillery workers.

4. The Premiumization Of Tequila

When it comes to looking inside the tequila category, premium tequilas are proliferating at the fastest rate, despite the cost of agave. “Over the years, tequila has evolved from being a low-price shot to a more premium option used in cocktails and high-end sipping,” says Hermoso. “The category has grown alongside consumer awareness to offer experimentation across blanco, reposado, a?ejo, and cristalino.”

According to Liz Paquette, Drizly’s head of consumer insights, the average unit price of tequila sold on Drizly over the past five years has grown 29 percent. During the same period, “mezcal is up four percent and whiskey is up five percent.” The company also notes that 27 percent of all tequilas sold on Drizly carry a price tag of $100 and up, and that every tequila subcategory has seen an increase in average unit price on Drizly, but some categories have made gains faster than others. The silver/blanco subcategory, for example, has seen less of a price increase (22 percent over five years, sitting at $39.79 in 2022) than reposado (57 percent, sitting at $60.88 in 2022) or a?ejo (25 percent, sitting at $101.39 in 2022).

As recently as 2016, standard tequila products accounted for more than half of global tequila volumes, and almost half of global value–compared to super-premium-and-above’s 13 percent volume and 33 percent value shares. By 2026, however, super-premium-plus products are expected to own 55 percent of tequila’s global value, and to account for almost 40 percent of category volumes.

“Within the agave category we continue to see consumers trading up, choosing more premium-and-above spirits on the whole, and thus furthering growth and demand within the category,” says Julka Villa, global head of marketing at Campari Group.

Current IWSR analysis of the tequila category shows that the premium tequila segment is set to drive the category forward, especially in the U.S. market, where it is expected to add more than $15 billion in additional value to the overall category by 2026. Outside the U.S., growth is expected as well though maybe not at the same rate.

Related: 20 Cocktail Recipes Every Man Should Know How to Make

Is a Tequila Shortage Coming Up?

Despite the additional agave planted over the last few years, premiumization and the rising popularity of aged tequila is leaving some concerned about a possible tequila shortage.

Debra Crew, CEO of Diageo—one of the world’s largest drinks companies and owner of Don Julio and Casamigos—recently told Yahoo! Finance: “On the aged kind of variants, the anejos, the reposados—things for us like 1942 Don Julio—we have faced some constraints on it just simply because the demand's so high… It is based on agave and really high-quality agave, so for us, it does take some time in the ground. And so we have had capped volumes. So, you know, if you see that 1942 out there, go and grab it.”

On the smaller, boutique brand end, Antonio Salles, master distiller at El Tequile?o says that “there's always a chance that demand is greater than supply, especially with certain tequila expressions. I think [it] depends on your go-to brand. The tequila category has over 1,800 different brands, but only 184 registered tequila distilleries, and merely a portion of those are actively producing.”

Though, as the steady march of higher prices has shown, there is certainly a constraint on supply due to increased demand and material availability being tightened, it's not quite at the point where you need to freak out and storm the liquor store for your favorite agave tipple quite yet. Yet...but there are some that think we might be nearing the peak of tequila frenzy.

When Will Prices Go Back Down?

No one is sure when or if tequila prices will head back down, but some remain positive. Fernando Felix, head of the U.S. and Canadian operations at Proximo Spirits, the subsidiary of Mexican distiller Becle that manages Jose Cuervo distribution, expects the price of agave to go down in about two years, when the agave planted a few years back becomes ready to harvest and supply begins to outpace demand.

In the meantime, the pressures on tequila pricing raise the prospect of category-adjacent products emerging, including mezcal and other agave spirits from countries outside Mexico such as Australia and South Africa. It's worth noting that the Southwestern United States and Northern Mexico also offer a intriguing alternative to tequila called sotol, which is made from an agave-like plant. The also-ancient spirit may just be what tequila lovers need in this time as it imparts a similar flavor and kick, and is generally cheaper (though a bit tougher to find) than tequila or mezcal.

Salud!