Answer Man: Asheville faces highest rent in NC; How much funding for affordable housing?

ASHEVILLE - As rents rise, affordable housing remains a primary goal of city staff, city council and Asheville's community. One reader asks: what does city of Asheville spending look like for affordable housing projects?

Got a question for Answer Man or Answer Woman? Email Executive Editor Karen Chávez at [email protected] and your question could appear in an upcoming column.

Question: How much has the city actually invested in affordable housing in recent years?

Answer: Reader, thanks for asking. I'm sorry to say the answer is complex.

The "actually" in the question was also italicized when we originally received it. The best answer might be one that includes a breakdown of the processes the city uses to fund affordable housing, along with a recap of what recent affordability efforts have looked like and what the affordability crisis looks like for Asheville.

What does affordability mean for the city?

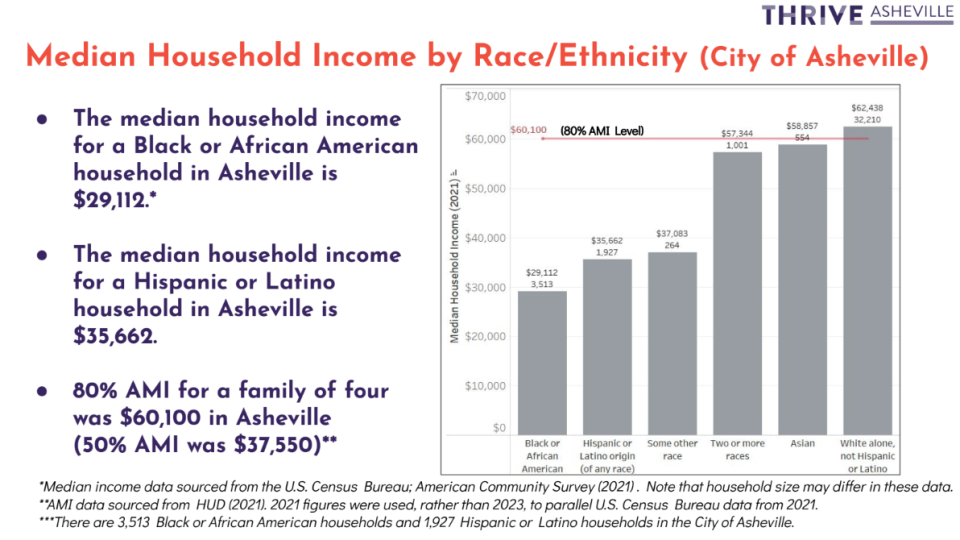

For most city and county projects, the term "affordable" has been defined by the U.S. Department of Housing and Urban Development. The city of Asheville defines affordable housing using area median income, with anywhere from 80% to 30% AMI being target income levels for affordable housing projects.

Examples of recent projects using the 80% AMI level of affordability include the 115 Fairview Road project, which will bring 57 units rented at 80% of Asheville's area median income.

As I recently reported, Asheville's HUD metro Fair Market Rents are the highest in North Carolina, with the Raleigh metro area close behind. Currently, Asheville's one-bedroom apartments are looking at a monthly Fair Market Rent of around $1,500.

After a little bit of research, I found Asheville's metro has the third highest fair market rent for a one-bedroom apartment between North Carolina, Virginia, Georgia, South Carolina and Tennessee. The high cost of living has come alongside stark increases in the living wage in Asheville, which shot up 9% this year, and now sits at $22.10 an hour.

Among communities in North Carolina and its adjacent states, Asheville's Fair Market Rent trails only Atlanta and Washington D.C.

If you want to go a little deeper, four-bedroom rentals are even more expensive here than they are in Atlanta — by about $150, according to HUD data.

Affordability 'myth busting': 80% AMI? Workforce housing?

To answer this specific question about affordable housing in Asheville, I caught up with Asheville's Affordable Housing Officer Sasha Vrtunski, who helped clarify some misunderstandings included context for some of the affordable housing funding systems.

Vrtunski also highlighted a term that might be antiquated given Asheville's high Fair Market Rent.

"There's a term that people use sometimes: 'Workforce housing,'" Vrtunski said. "They mean 80% to 120% of AMI. We're trying not to use that term anymore because people who work their butts off — all the restaurant workers or CNAs in the hospital — those folks are all below 80% and maybe below 60% AMI."

Vrtunski also helped me answer some elements of this question that I wasn't able to include, notably discussion of the Land Use Incentive Grant, or LUIG.

When affordable housing developers aren't facing market forces that compel a pivot to build Airbnb units, developers have previously sought and used a LUIG as another tool in their affordable housing belt acting as "kind-of like a rebate," though not technically one.

The fund is not a tax deduction or tax rebate, Vrtunski said. The grant only comes into play after developers show they're providing affordable housing approved by City Council and then they'll receive money back that would pay for the city portion of their taxes.

"The city will pay back the city portion, so they still have to pay the county taxes," Vrtunski said.

LUIG was paused during the Feb. 13 City Council meeting after the late 2023 Thrive Asheville study provided a clearer analysis of the fund, raising questions of whether its focus on 80% area median income perpetuates or exacerbates preexisting disparities in Asheville.

After that presentation, city staff recommended the pause to allow further discussion of what the future of the fund looks like. Vrtunski said the pause comes as the department considers how to move forward with all affordable housing projects.

"We're not just changing one thing on its own, but we're really considering how does the LUIG fit in with the Housing Trust Fund or other projects or partnerships," Vrtunski said.

Affordable housing in Asheville from 2017 to 2024

Vrtunski also provided fairly specific numbers when it came to affordable housing projects approved from 2017 to 2024.

This information does not include funding from other public sources like Buncombe County, where the county is currently working on multiple affordable housing projects, including Ferry Road and one just off of Coxe Avenue in downtown. Both are in Asheville city limits.

Between the Housing Trust Fund, Affordable Housing Bond and LUIG, estimates for affordable housing projects are totaled around $50 million for the city of Asheville since 2017. Around $6 million still remains from the Affordable Housing Bond.

Housing Trust Fund

In the 2017 Affordable Housing Bond, a decent amount has been broken out into multiple affordable housing projects. Here's a breakdown of that funding.

Simpson Street Apartments: $1.2 million

Amaranth Apartments: $1.4 million,

360 Hilliard: $860,000

Short Michigan: $1.3 million

Habitat: $240,000

However, over $8 million in Housing Trust Fund loans have been given out between 2022-2024, with the following approved for funding:

West Haywood Street Apartments: $904,000

Laurelwood Apartments: $1,500,000

Start Point Apartments: $850,000

Redwood Commons: $1,800,000

Fairhaven Summit: $875,000

Reimagining Deaverview: $1,035,000

Stewart Street Cottages: $1,052,850

Land Banking

Two land banking opportunities have been created by the city of Asheville from which the city has spent around $3 million in the development of these properties.

One of the projects was the Haywood Street Community Development, which recently broke ground and will provide 41 units targeting those earning 30-50% of the area median income.

In Asheville, according to the city's 2023 appendix, 30% AMI for one-person is $17,850, and $20,400 for two. At 50% AMI, annual income is $29,750 for one-person and $34,000 for two.

The other investment is the "Talbert Lot" at 50 Asheland Avenue, where the city closed on the property for $2.5 million in 2021. The goal is to receive funding from the Federal Transit Administration to build affordable housing next to the ART station.

You can learn more about these projects at https://www.ashevillenc.gov/projects/redevelopment-of-city-owned-land/.

City owned land

In addition to other city bond related items, city owned land or purchased property has also been set toward affordable housing. Here's a breakdown of those projects:

Oak Hill land purchase: $444,697

319 Biltmore: $7.6 million

Due diligence on various small lots, Cedar Hill and 65 Ford Street: $602,246

LUIG

Since 2016, the LUIG fund has seen the funding of over $23 million put toward developments aiming for elements of affordability, like the 115 Fairview Road project mentioned earlier. The grant has led to 571 affordable units being included in the project language since 2016.

Interested in learning more?

As the future of LUIG is considered, the city of Asheville will soon host a community feedback session for the Affordable Housing Plan, where draft recommendations for addressing affordable housing will also be presented.

The meeting is scheduled for March 27 from 6 p.m. to 7:30 p.m. in the Harrah's Cherokee Center Banquet Hall.

More: Asheville Amtrak plan seeks around 250K in funding; advocates to look for sponsors

More: Asheville and Buncombe County living wage increases 9% amid soaring housing costs

Will Hofmann is the Growth and Development Reporter for the Asheville Citizen Times, part of the USA Today Network. Got a tip? Email him at [email protected].

This article originally appeared on Asheville Citizen Times: Answer Man: How much funding toward Asheville affordable housing?