Candidates have a plan, or a score of different ones, to change the tax code

Presidential elections are decided by many things: media exposure, financial backing, personal chemistry, timing and luck. Policy positions often are just a way of signaling where a candidate stands on the political spectrum. But 2020 is shaping up to be different, the most ideas-driven election in recent American history. On the Democratic side, a robust debate about inequality has given rise to ambitious proposals to redress the imbalance in Americans’ economic situations. Candidates are churning out positions on banking regulation, antitrust law and the future effects of artificial intelligence. The Green New Deal is spurring debate on the crucial issue of climate change, which could also play a role in a possible Republican challenge to Donald Trump.

Yahoo News will be examining these and other policy questions in “The Ideas Election” — a series of articles on how candidates are defining and addressing the most important issues facing the United States as it prepares to enter a new decade.

No one likes taxes, and about 45 percent of Americans think they pay too much in federal income taxes, according to a 2018 Gallup poll.

Income inequality has become a major issue of the 2020 election, with Democratic presidential candidates proposing various ways to address the issue. For some it starts with the tax code, whether by increasing taxes on the wealthy or cutting them for the middle class.

In 2017, President Trump and Republicans promised higher wages and lower taxes for average Americans in the Tax Cuts and Jobs Act, which reduced federal taxes by a total of $1.7 trillion over 10 years. The corporate tax rate was slashed from 35 percent to 21 percent.

The bill was widely criticized by Democrats as a major break for wealthy Americans and corporations. Now a majority of Democratic presidential candidates vow to repeal that break, and some go further by proposing increases in corporate and individual taxes on high earners.

As a result of the tax overhaul, 60 Fortune 500 companies paid no federal income tax in 2018, according to an analysis from the Institute on Taxation and Economic Policy. The CEOs of S&P 500 companies got an average pay raise of $800,000, or 7 percent in 2018. In the same fiscal year, the average worker saw 0.6 percent wage growth after inflation.

On Tax Day this year, Gallup released a poll showing that 49 percent of Americans disapprove of the 2017 tax cuts. Only 14 percent said they received tax cuts, according to Gallup, although they might have been confused owing to changes in withholding tables. H&R Block found that, of the millions of returns it prepared, taxpayers on average received a tax cut of $1,200, but refunds, which is how many wage-earning Americans measure their tax bottom line, went up by a much smaller amount.

Most of the 23 Democratic candidates have endorsed an expansion of government health care, and several have proposed plans to make college tuition-free. These and other social programs will cost billions or trillions of dollars annually. All of it, some Democrats say, will be paid for with higher taxes on the rich and corporations.

Income inequality has skyrocketed since the 1970s, with the top 1 percent of families earning 26.3 times more, on average, than the bottom 99 percent of families, according to a 2015 study by the Economic Policy Institute.

According to Gallup polling data, a majority of Americans have consistently thought that corporations and top earners don’t pay their fair share in federal taxes.

How much represents a fair share is up for debate, but the proportion of federal tax revenue from corporations has shrunk dramatically since the 1950s — from 33 percent in 1952 to 7.6 percent in fiscal year 2018, according to data from the IRS.

The 2017 Republican tax plan was the first major tax reform in three decades. The Tax Reform Act of 1986 received bipartisan support when it passed through Congress. That legislation reduced the top income tax rate from 50 percent to 33 percent and eliminated several tax deductions and tax shelters.

The 2017 bill lowered the top marginal tax rate for wealthy Americans and slashed the corporate tax rate from 35 to 21 percent.

In Bernie Sanders’s 2016 campaign, he cited the 1950s as a time when taxes on the rich were high — with a marginal personal income tax rate of 91 percent on income over $200,000 (about $2 million today) — and the economy boomed. By the definition of a marginal tax rate — the percent of taxes paid on an additional dollar of income — no one actually paid 91 percent of their income to the U.S. government, and no one pays the top marginal tax rate on their entire income now. In 2017, income over $418,400 was taxed at 39.6 percent. When the Republican tax overhaul kicked in the following year, the top bracket was changed to $500,000 and taxed at 37 percent.

Sen. Elizabeth Warren, D-Mass., has some of the most detailed policy proposals. At rallies, she often jokes, “I have a plan for that.” To pay for programs like universal health care, Warren intends to create new taxes for big businesses and wealthy Americans.

Warren’s Real Corporate Profits Tax would tax any corporation that reports more than $100 million in profits at 7 percent for the amount that exceeds $100 million. She also wants to place a 2 percent tax on people with a net worth of more than $50 million and a 3 percent tax for those with a net worth above $1 billion.

“Right now, those biggest fortunes, they are putting in less than the rest of America. Let's just level that playing field a little bit,” Warren said earlier this month on “PBS NewsHour.”

About 61 percent of Americans support Warren’s proposed tax hikes on Americans with large net worth, according to a February poll by Morning Consult and Politico. Critics have said that Warren’s new wealth tax could be easily evaded by the wealthy and may be unconstitutional.

Like Warren, Sen. Bernie Sanders wants to raise taxes on the ultra-rich. Sanders’s For the 99.8% Act would create a progressive tax on estates — inheritances — larger than $3.5 million, with a top rate of 77 percent on billion-dollar estates.

The plans from Warren and Sanders would not directly increase or change the income tax rates for the wealthiest Americans. Warren’s wealth tax instead focuses on net worth, a person’s assets minus liabilities, which could be a larger amount than just income. Sanders’s estate tax is similar to a tax on net worth because the value of an estate depends on assets like bank and investment accounts, stocks and real estate.

In 2018, the number of estates subject to the federal estate tax dropped from 5,500 to 1,700 after the passage of the Tax Cuts and Jobs Act, according to estimates from the Tax Policy Center.

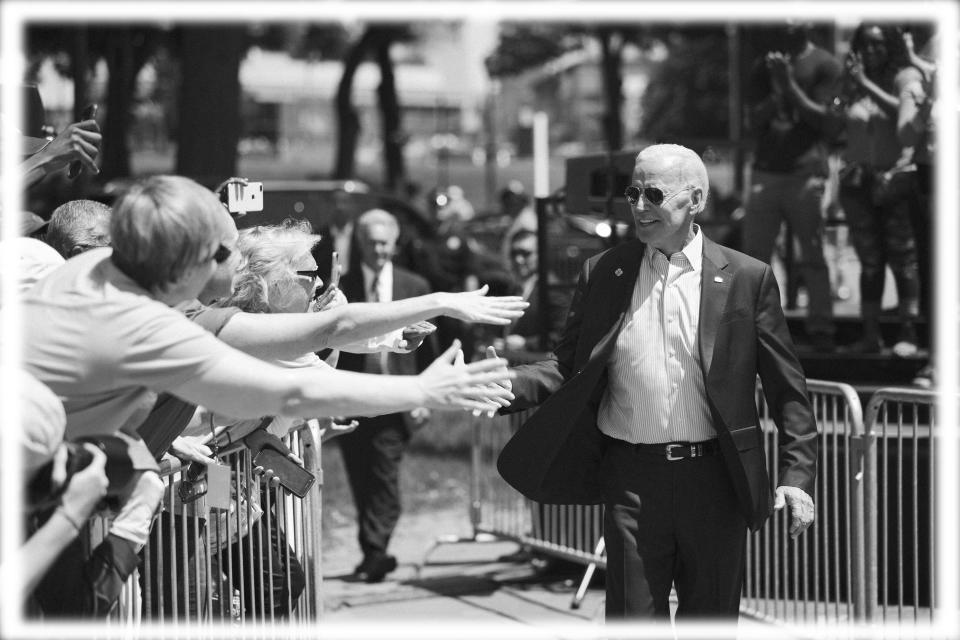

Former Vice President Joe Biden has distanced himself from Sanders, but he has also criticized tax breaks for the wealthy and corporations.

Last year, he told a crowd at the Brookings Institution, “I love Bernie, but I am not Bernie Sanders.” Biden said he didn’t blame billionaires for income inequality but that the tax code favors investors instead of workers.

When he kicked off his 2020 campaign at a Pittsburgh rally, Biden criticized tax breaks in the 2017 Republican tax plan and vowed to repeal it. He also suggested removing tax breaks and loopholes that reward millionaires.

“I'm going to change that. So millionaires and billionaires don't pay lower taxes than firefighters, teachers, and I could go on and on,” Biden said in Pittsburgh. “We need to reward work in this country, not just wealth.”

At a Fox News town hall last month, presidential candidate Pete Buttigieg briefly discussed his tax policy. He called for a higher income tax rate on top earners, a “reasonable wealth tax,” a financial transactions tax and closing corporate tax loopholes. Buttigieg hasn’t released exact details on how much taxes would increase.

Sen. Kamala Harris, D-Calif., has focused on tax cuts for low- and middle-income Americans rather than taxing the ultra-rich. Harris promises a refundable tax credit of $500 per month for families making less than $100,000. Under her tax plan, single people without children would also get a tax credit if they make $50,000 or less.

The Tax Policy Center estimated that about half of American households would receive an average tax cut of $3,200. Harris’s plan would cost the federal government an estimated $3 trillion over the next decade.

Sen. Cory Booker, D-N.J., has proposed repealing the Tax Cuts and Jobs Act to pay for “baby bonds” for every child in the U.S. that would start at $1,000. Money would be added to the account every year until the child turns 18. Thereafter the money could be used for only specified purposes, such as college, home purchases, entrepreneurship and retirement.

The end balance depends on the family’s income — ranging from about $1,700 for children in affluent households to nearly $50,000 for low-income households, according to an analysis from the Booker campaign.

Taxes have become a major selling point for Democratic candidates. With every candidate calling for the repeal of the 2017 Tax Cuts and Jobs Act, Trump will have to mount a strong defense of the plan that he signed into law.

The president’s promises of wage gains and tax cuts for the middle class will be put to the test if Americans feel the tax cuts didn’t benefit them. Democrats will likely continue to focus on how much wealthy individuals and corporations were the beneficiaries of the cuts. Trump can point to GDP growth of 3 percent in 2018 or a rise in wages to support the legislation.

Repealing the Republican tax plan won’t be easy. Tax cuts and hikes must be approved by Congress, as with promises of universal health care, free college or a Green New Deal. Democrats need to maintain the House seats they won in 2018 and gain three seats in the Senate if they want to turn their proposals into a reality.

Then there’s the deficit.

Over the next decade, programs like Medicare for All and tuition-free college would cost tens of billions of dollars — while Harris proposes tax cuts that would amount to $3 trillion. In 2017, one of the Democrats' criticisms of the tax plan was how much it increased the federal deficit, which is nearing $1 trillion.

Repealing the tax cuts from 2017 would free up about $1.9 trillion in the next decade if the bill is completely repealed. A full repeal, however, would also take away the tax cuts for middle-income families. The plans from Warren and Sanders to raise taxes on wealthy Americans or large corporations would similarly provide billions or trillions for their social programs — if the rich don’t figure out how to evade them, as they often have.

_____

Read more from Yahoo News: