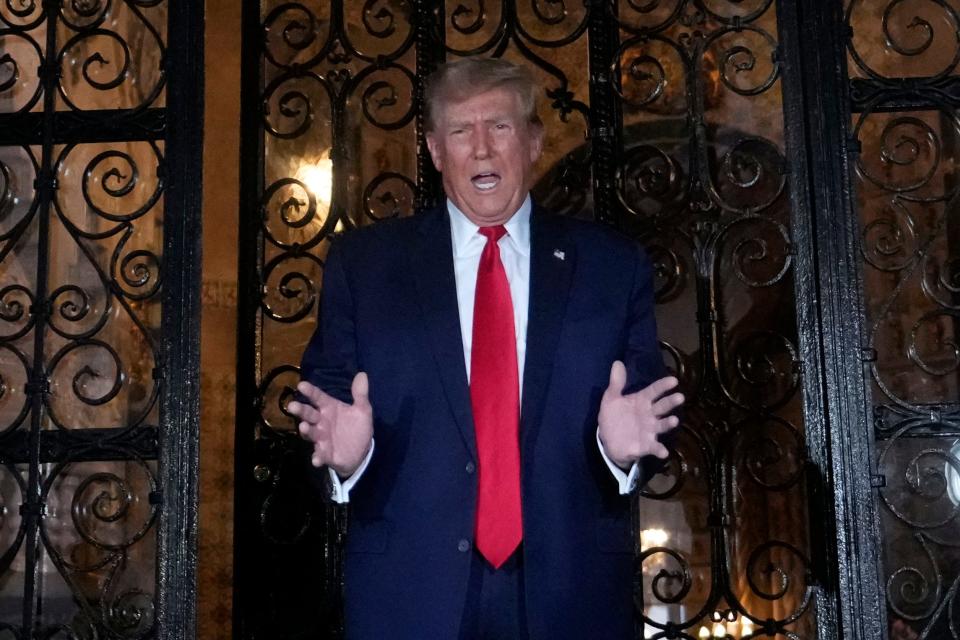

Donald Trump faces more than $500 million in legal penalties. Will he pay it? Can he appeal?

Now that former President Donald Trump has been socked with a combined $536.8 million in losses from two massive courtroom defeats, the question is: Will his opponents ever see a dime of the money?

The Republican presidential front-runner and his business trust on Friday were ordered to pay $453.5 million in penalties and interest after a New York judge ruled Trump had spent years fraudulently inflating the value of real estate holdings, including his own Trump Tower penthouse and his private club in Florida.

And last month a federal jury in Manhattan ordered Trump to pay $83.3 million to writer E. Jean Carroll in a defamation case stemming from Carroll's allegation that he sexually assaulted her in the mid-1990s.

Trump won't 'go gently'

Trump says both cases were political hit jobs aimed at stalling his steamroller campaign for the GOP nomination, and he's vowed to appeal.

"Donald Trump is going to fight this to the end and is going to try and delay and delay until the last possible moment," said George Arzt, a veteran New York political consultant.

"There is no chance that he is going to go gently."

But that won't stop New York Attorney General Letitia James, who sued Trump for real estate fraud, or Carroll and her lawyers from trying to seize their awards up front, experts say.

Defendants in Trump's position quickly become vulnerable to collection actions even during an appeal ? unless they can secure what's called an appeal bond or place a cash deposit with the court that, with interest, typically exceeds the amount of the judgment.In the real estate fraud case, that means Trump would have to produce hundreds of millions of dollars up front in cash or property — unless someone agrees to give him an appeal bond for less — to guarantee James' ability to collect later if his promised appeal fails.

Related: In Trump E. Jean Carroll verdict, former president ordered to pay $83 million

'Taking his assets'

If Trump pursues an appeal without getting a bond or placing a deposit with the courts, Carroll and James would normally be allowed to go after the money right away.

That "would mean liquidating bank accounts, taking his assets, not just in New York, but any place in the United States," Mitchell Epner, a former federal prosecutor who has practiced law in New York for about three decades, told USA TODAY.

"It's a really bad outcome, which is why most people and most companies, if they take an appeal, try to figure out a way to put up the undertaking, to stay the judgment, during the course of the appeal," Epner said.

But even getting a bond or depositing the cash can be no easy feat when facing the kind of legal judgments Trump is up against.

More: Donald Trump hit with $453.5 million penalty in New York real estate fraud lawsuit

Will Donald Trump face a cash crunch?

While the state of Trump's finances remains somewhat opaque, third-party estimates peg the real estate and reality TV titan's net worth at well above the hefty New York judgments. The Bloomberg Billionaire's Index estimated his fortune at $3.1 billion last year, while Forbes reported it at $2.6 billion.

That surplus might suggest Trump can comfortably pay. But his actual financial comfort level likely has more to do with how much cash he has on hand. And very few companies — even well-capitalized ones — have several hundreds of millions of dollars simply lying around, according to Epner.

"If you are a business, you want to have your assets at work, in real estate, in operating companies, in things that are going to be paying you more than the amount of interest you can get by putting it into a bank," Epner said.

Which means Trump will probably feel the pinch, even if he is a billionaire several times over.

"A nine-figure number, coming on top of the $83.3 million number in the E. Jean Carroll case, is going to put a very severe cashflow crunch on Donald Trump," Epner said.

Finding cash or a bond

Trump claimed in a 2023 deposition during the civil fraud case that he had "fairly substantially over $400 million in cash." The claim hasn't been independently verified but, if true, his current legal predicaments could mean he has to part with a very large share of that sum.

Assuming Trump is a multibillionaire, Ohio-based bonds adviser Mark Levinson said he expected Trump would be able to get an appeal bond, but he noted the process could be unpleasant.

A bonding company is likely to require Trump to put up collateral that matches the size of the judgment or provide an irrevocable letter of credit from a bank – a type of bank guarantee – to ensure the company can recoup the money, Levinson said.

"Even for someone that's three or four times over a billionaire," the $83.3 million Carroll judgment alone is a lot of money to part with, Levinson said. Friday's $453.5 million fraud judgment could require multiple surety companies that provide appeal bonds to team up and pool their efforts, he said.

"That's going to be pretty difficult for anybody to get that bond," Levinson said.

The judgment against Trump in the New York civil fraud case came from a state court, in which the losing party generally has to either get an appeal bond or deposit 100% of the judgment, plus interest, in order to escape collection.

100%, plus interest

Carroll's $83.3 million win against Trump came from a New York federal court that has discretion over what kind of deposit or bond to require from Trump in order to block Carroll from collecting during his appeal. That court typically also requires 100% of the judgment, plus interest. After Trump lost an earlier case against Carroll to the tune of $5 million, he left a deposit exceeding that amount with the court while he pursued an ongoing appeal.

In both cases, it's possible for a court to block the winning parties from swiftly going after the money. But if that doesn't happen and Trump can't find the cash, he could be hounded by Carroll and the state attorney general's office.

The New York judgment included more than $453.5 million, with interest, in "joint and several liability" against Trump and certain entities. "Joint and several liability is warranted when the misconduct of the company and its top controlling officers are indistinguishable," Judge Arthur Engoron wrote in his decision on Friday. That means James, the New York attorney general, can go after either Trump or the companies themselves for the full liability they share.

'We're going to get the money'

Carroll lawyer Roberta Kaplan has already pledged to go after the full verdict in the $83.3 million defamation case.

"Even if he doesn't have the cash on hand, he has plenty of assets, and he may have to sell his assets to pay us, but we're going to get the money," Kaplan said on "CBS Mornings."

It remains to be seen if a bonding company would even want to help Trump, Epner said. He noted Trump's casinos had multiple bankruptcies going back decades and that, in the case of the $5 million Carroll judgment, Trump put up the money and interest himself.

Levinson also said that Trump's imperfect history with creditors could give a bonding company pause. If there are fears Trump might file for bankruptcy, the company could insist on collateral worth 100% of the bond, or even demand an irrevocable letter of credit from an acceptable bank since that kind of guarantee — unlike collateral in the form of property or cash — can't be clawed back during the bankruptcy process.

"If he can't get an appeals bond, then he has to put up an undertaking in the court itself, and that ordinarily is cash," Epner said.

Related: Did Donald Trump rape E. Jean Carroll? Here's what a jury and judge said.

'Trump would avoid bankruptcy at all cost'

Filing for bankruptcy is still an option. That's what former New York Mayor Rudy Giuliani did in the wake of a $148 million court loss in a separate defamation suit brought by two Georgia election workers. Filing for bankruptcy triggers an automatic pause on efforts to collect from the debtor.

But filing for bankruptcy would have major downsides.

"I think Trump would avoid bankruptcy at all cost because if he were to file, the bankruptcy court allows super broad discovery into his financial affairs, with the help of subpoena power, and I think he would not want that," said Albert Togut, a lawyer with 45 years of experience in bankruptcy law.

"In the same manner that Trump didn't want to disclose his taxes when he was running for president or when he was president, I can't imagine that he would ever want a trustee with federal court powers to be looking into his affairs," Togut told USA TODAY.

Related: Rudy Giuliani ordered to pay $148 million to two Georgia election workers he defamed

Bad politics in pleading poverty

Trump's political calculus might also weigh against the bankruptcy option.

"It would seem to me to run entirely contrary to his thesis for political power for him to say, 'I am no longer a super rich real estate mogul; I'm now somebody who's in bankruptcy,'" Epner said.

Further complicating a potential Trump bankruptcy, the relief a person gets in those proceedings is also only available to an honest debtor, Togut said.

"If you have someone who engaged in all kinds of shenanigans, particularly if it was illegal, they will not be granted a discharge in bankruptcy, and all the debts will survive," he said.

Epner also noted that bankruptcy requires a debtor to be honest at the risk of criminal punishment. Reality TV couple Teresa and Giuseppe Giudice of "Real Housewives of New Jersey," for instance, both served prison time after being convicted of bankruptcy fraud.

More: Bombshell witness? A look at the man who may know all the secrets in the Fani Willis Trump drama

This article originally appeared on USA TODAY: Donald Trump faces half a billion in legal penalties. Will he pay?