Credit card late fees capped at $8 under Biden crackdown on 'junk fees'

WASHINGTON ― Most credit card late fees will be capped at $8 under the Biden administration's latest move targeting so-called "junk fees."

The Consumer Financial Protection Bureau finalized a rule ? opposed by the banking industry ? Tuesday that will close a loophole to slash late fees charged by credit card companies from an average of $32 to $8, which the agency projects will save $220 annually for 45 million Americans.

Credit card interest margins are at an all-time high, according to the CFPB, with credit card companies charging $105 billion in interest in 2022, costing the average card-holder about $250 a year.

More: CFPB caps credit card late fees under new Biden admin rule. How low will they go?

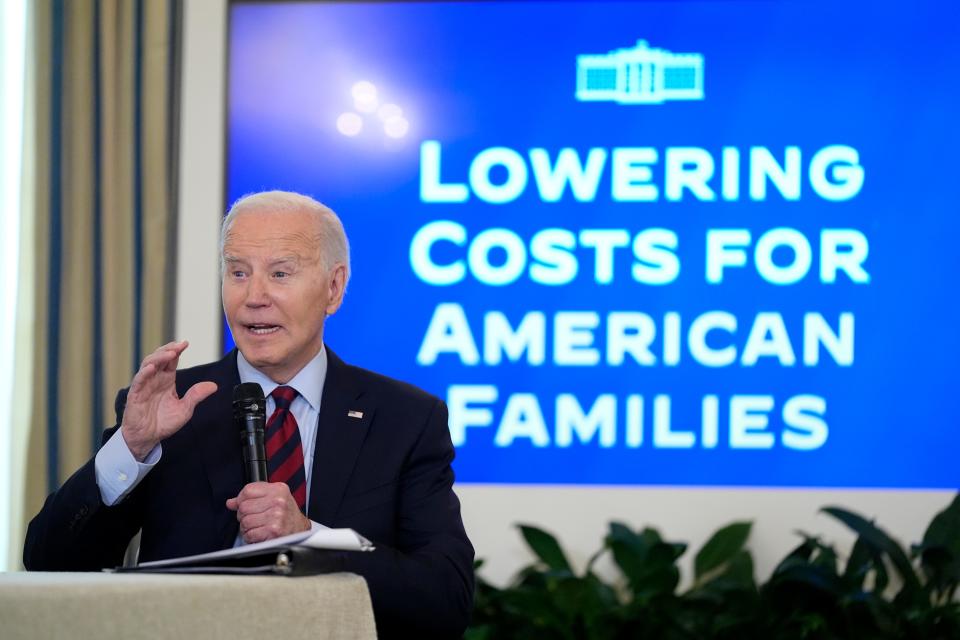

President Joe Biden announced the rule at a meeting with his Competition Council, saying his administration estimates credit card companies are generating five times more in late fees than it costs to recoup the late payment. He said the practice violates federal law preventing credit card companies from charging late fees that exceed the cost to collect the payment.

"They're padding their profit margins and charging hard-working Americans," Biden said. "This action will collectively save families $10 billion in credit card late fees ever year."

The move follows action by the CFPB in January to reduce overdraft fees charged by banks by closing a regulatory loophole that had exempted overdraft lending services from provisions in the federal Truth in Lending Act of 1968.

Even though banks will still be able to charge limited overdraft fees, it won't be able to exceed the banks' losses under the rule. The CFPB has not finalized an amount but is exploring overdraft fees capped at $3, $6, $7, or $14, plus $.50 per transaction. The overdraft rule is currently under review.

The banking industry opposes caps on overdraft and credit card late fees.

"Today’s flawed final rule will not only reduce competition and increase the cost of credit, but will also result in more late payments, higher debt, lower credit scores and reduced credit access for those who need it most," Rob Nichols, president and CEO of the American Bankers Association, said in a statement.

Nichols said capping credit late fees will force credit card issuers to reduce credit lines, tighten standards for new accounts and raise rates for all customers including those who pay on time. He accused the CFPB of "choosing to put politics over sound public policy," noting the timing of the rule ahead of Biden's State of the Union address to Congress set for Thursday.

The U.S. Chamber of Commerce said it would be filing a lawsuit against the CFPB "to prevent this misguided and harmful rule from going into effect.”

"Once again, the Consumer Financial Protection Bureau has exceeded its authority," said Neil Bradley, the chamber's executive vice president and chief policy officer. "The agency’s final credit card late fee rule punishes Americans who pay their credit card bills on time by forcing them to pay for those who don’t."

Biden has made cutting hidden "junk fees" charged by companies and bank on consumers a key piece of his economic agenda. The Council of Economic Advisers estimates the administration's actions ? which have targeted the banking, ticketing, airline and several other industries ? will reduce more than $20 billion in junk fees annually.

Biden on Tuesday also announced a new federal "strike force" on unfair and illegal pricing that will seek to "root out and stop illegal corporate behavior" that hikes prices on American families through anti-competitive, unfair, deceptive or fraudulent business practices. The task will be co-chaired by the Justice Department and the Federal Trade Commission.

"The American people are tired of being played for suckers," Biden said.

In another move aimed at "junk fees," the Federal Communications Commission proposed a new rule that would ban "bulk billing" arrangements in which landlords or providers charge everyone living or working in a building for internet, cable or satellite services even if they haven't opted in.

Reach Joey Garrison on X, formerly Twitter, @joeygarrison.

This article originally appeared on USA TODAY: Credit card late fees capped by Biden's CFPB crackdown on 'junk fees'