The Fear Factory: How Robert Mercer's hedge fund profits from Trump's hard-line immigration stance

On Aug. 18, 2016, the share price of Corrections Corporation of America, one of the main operators of private prisons and immigrant detention centers, fell by 50 percent to $13.04 after the Obama-era Justice Department directed the phaseout of federal private prisons. The company’s stock floundered for the next few months. On Nov. 7, the day before Donald Trump’s historic election — and by which point the company had rebranded as CoreCivic — it closed at $14.36.

But with Trump’s unexpected victory, CoreCivic stock rose meteorically. By Inauguration Day on Jan. 20, 2017, it had doubled, and it climbed higher when the new administration began implementing its hard-line immigration and law and order policies. On Feb. 24 — a day after Attorney General Jeff Sessions reversed the Obama ban on private prisons — CoreCivic’s share price hit $35.03. That was a potential windfall for investors, including Renaissance Technologies, a hedge fund then headed by billionaire Robert Mercer. According to filings with the Securities and Exchange Commission, between Trump’s election and inauguration, Renaissance unloaded 645,586 CoreCivic shares for a big profit.

Few people backed Donald Trump’s 2016 presidential campaign with as much cash as Mercer. He donated $15.5 million to a pro-Trump PAC called Make America Number 1, making him the group’s largest donor, according to Federal Election Commission data compiled by the Center for Responsive Politics. He and his daughter Rebekah — a conservative activist who runs the family’s foundation — had started off as Ted Cruz supporters. But they reportedly worried that the Republican establishment was too soft on immigration and shifted to Trump after the Texas senator flamed out in the primaries.

At the same time, Robert Mercer promoted a tougher national stand on immigration by funding politicians and organizations — including Breitbart News — that have fueled hysteria about immigrants by claiming that their entry into the U.S. would directly lead to crime, terrorism and job losses. And after the election, Rebekah Mercer won a spot on the executive committee of Trump’s transition team — and reportedly pushed for hiring Sessions as attorney general.

Since Trump’s election, the policies the Mercers had promoted have taken off — and paid off, according to an investigation by Yahoo News supported by the nonprofit Project on Government Oversight. With Trump ratcheting up anti-immigrant rhetoric and enforcement, Renaissance Technologies — where Mercer was co-CEO until last fall and where he continues to be active — invested in corporations directly involved in the president’s immigration crackdown and the administration’s embrace of private prisons.

These include CoreCivic and GEO Group, the two biggest Department of Homeland Security contractors operating immigrant detention centers. In the last two years, Renaissance has purchased millions of dollars worth of shares in CoreCivic and GEO Group, which have seen their stock prices soar.

Meanwhile, a number of recipients of the Mercer family’s largesse stoked the flames of the immigration Fear Factory. They included nonprofits like Secure America Now, which received $2 million from Robert Mercer and which produced videos released in the last weeks before the election, warning that Muslims were poised to take over the United States, France and Germany.

The general furor about immigration to which these ads contributed appears to have significantly increased the value of some Renaissance investments. Most recently, Trump has spread fear over Central Americans seeking asylum, deployed thousands of troops to the border, and floated a proposal to ignore birthright citizenship — a right contained in the Constitution — with a potentially unlawful executive order.

Renaissance is a so-called “quant” hedge fund and says that it makes investment decisions based on complicated mathematical algorithms. Quant investment strategies “use technology and formulas to automate the investment process,” is how Bloomberg put it in a recent story and guide to the practice, which highlighted Renaissance as one of the earliest and most successful hedge funds utilizing quant.

But that doesn’t mean that quant investing is pure math. A 2014 Senate report states that these trading algorithms are “frequently modified manually by programmers” to “direct trades” or change “portfolio size.” And a joint statement submitted to the Senate by three Renaissance executives, including Peter Brown, co-CEO and co-president, said that in making its investment decisions the fund collected all publicly available data it believed “might bear on the movement of prices of tradable instruments,” which included news stories, energy reports and regulatory findings.

Two hedge fund experts told me that quant investing is heavily influenced by political analysis and bets. “Sure, everything is a math equation, but human beings make the equations and decide what the inputs are,” said one, who still works in the hedge fund industry and is very familiar with Renaissance. “Some of the inputs are going to be related to likely policy developments and their political impact. That may get reduced to a number or numbers that are plugged into the equation, but politics is part of the algorithm.”

Renaissance and Robert Mercer declined to comment for this story. Rebekah Mercer did not respond to requests for comment sent to the press office at the Heritage Foundation, where she is a trustee, or to her email sent to Ruby et Violette, a cookie bakery in New York City she co-owned with her two sisters that recently closed.

From the outside, Renaissance’s investments in private prison and detention camp operators look to be based on more than just complicated math, but also on knowledge of Trump’s plans and the ability to influence them. And there is nothing illegal about it.

The Mercers had unique insight into and influence on the new administration’s hard-line approach to crime and immigration. The Huffington Post reported that Rebekah Mercer convinced Trump to hire Steve Bannon, then Breitbart’s executive chairman, as his campaign manager and Kellyanne Conway, who previously ran a pro-Ted Cruz Super PAC funded by the Mercers, as his pollster.

Thanks to the Supreme Court’s Citizens United decision, which greenlighted dark money, and the nation’s fractured and polarized political and news landscape, the Mercers and other well-connected billionaire donors have an easier time than ever promoting policies that serve both their ideological and financial interests.

“Unfortunately, wealthy individuals pushing candidates who promote policies that advance their financial goals is not uncommon or illegal,” said Walter Shaub, the former head of the Office of Government Ethics and now senior adviser to the D.C. watchdog group Citizens for Responsibility and Ethics in Washington. “It’s sort of legalized corruption and a general problem of our campaign finance system.”

The White House did not reply to a request for comment.

*****

Robert Mercer isn’t the only key executive at Renaissance to be associated with a political cause. Its original founder, James Simons, a former National Security Agency codebreaker and mathematics PhD, has been active in Democratic politics. Simons, who stepped down in 2009 but remains Renaissance’s nonexecutive chairman, spent around $11 million to support Hillary Clinton’s 2016 presidential campaign. (In 2016, he was paid $1.6 billion, making him the year’s highest paid hedge fund manager.)

But Simon’s political contributions and influence are dwarfed by Mercer’s role in the GOP and conservative politics. The Mercers helped launch Breitbart News with a $10 million contribution in 2011. They also created Cambridge Analytica, a political data analysis firm that worked for the Trump campaign and helped test and refine messages designed to stir up fears about immigration and build support for the border wall. Father and daughter also donated at least $35 million to right-wing think tanks between 2009 and 2014 and another $36.5 million to individual GOP races since 2010, according to the Washington Post.

For years the Mercers were major financial patrons of Steve Bannon, who served as Breitbart’s editor and sat on the board of Cambridge Analytica. He became the Trump campaign’s CEO and in 2017, at the behest of the Mercers, was named White House chief strategist. Bannon was initially a key link between the Trump campaign, the alt-right and anti-immigrant activists. The Mercers broke with him earlier this year, when Trump became infuriated with Bannon over comments he made in Michael Wolff’s book “Fire and Fury: Inside the Trump White House.”

All of these ties and connections led the New Yorker to describe Mercer in a March 2017 profile as “The Reclusive Hedge-Fund Tycoon Behind the Trump Presidency.” In the story, Bannon is quoted saying the “Mercers laid the groundwork for the Trump revolution.”

Today, Renaissance is a gigantic fund, with market holdings valued at about $91 billion at the end of June. It has delivered spectacular returns to investors, with its flagship Medallion fund registering average annual gains of more than 35 percent between 1990 and this year.

Renaissance’s holdings in private immigrant detention firms are small proportionally, but are an example of how politics can affect investments.

The hedge fund reported owning 850,200 shares of CoreCivic stock on June 30, 2016, when it was worth $35.02 per share. Renaissance didn’t own any GEO Group stock in 2016, but that would change the next year.

Stock share prices of private prison companies are highly volatile, partly because profit margins depend on keeping cells filled with inmates and detainees. That corporate imperative can in turn be heavily affected by federal and state policies, which may change dramatically depending on election outcomes and other political developments.

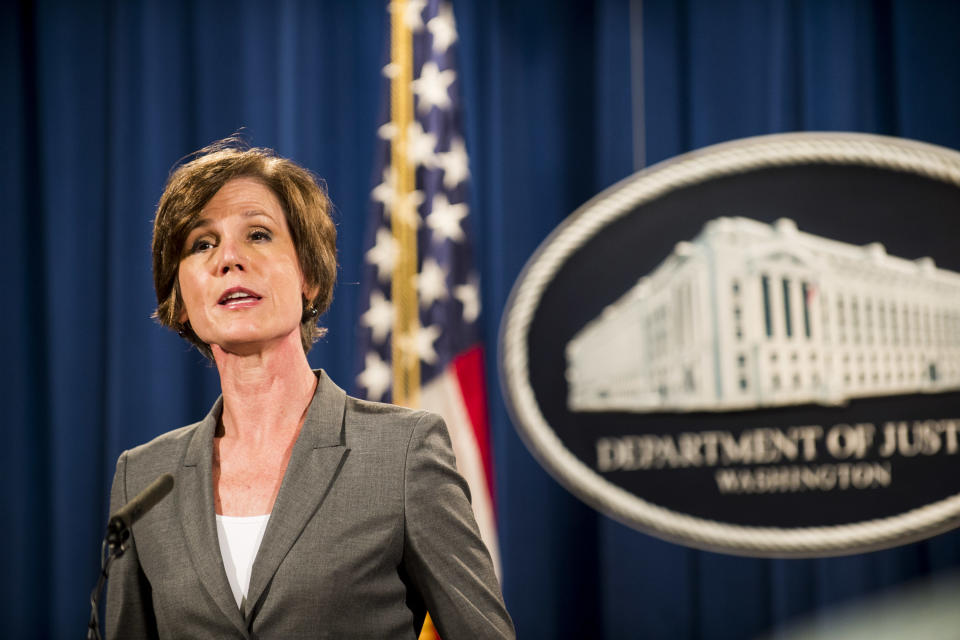

Share prices of private prison contractors plunged in mid-August 2016, when Sally Yates, then-deputy attorney general in the Obama administration, ordered the phaseout of private prisons. She said they did not significantly reduce costs and that government-run facilities were safer. This also was a time when Trump’s likelihood of winning the presidential election was deemed to be remote.

CoreCivic’s share price tanked after Yates’s announcement, and Renaissance also got hammered. But the hedge fund saw the plunge as a buying opportunity and picked up 186,289 more shares during the downturn. When it filed its quarterly disclosure report to the Securities and Exchange Commission on Sept. 30, 2016, it owned 1,036,489 total shares of CoreCivic priced at $13.87 each, worth a total of $14.37 million.

Share value popped after Trump’s election and Renaissance sold 645,586 shares of CoreCivic during the last quarter of the year, according to its Dec. 31, 2016, 13F filing with the SEC. That netted the hedge fund millions of dollars, and it still held 390,903 shares.

GEO and CoreCivic stocks soared even higher just a month after Trump’s inauguration when newly confirmed Attorney General Sessions scrapped Yates’s decision to phase out privately run facilities, one of his first major policy changes.

*****

Since January 2017, when Trump took office, Renaissance has bought back in with a vengeance. By June 30 of this year it owned 1,867,590 shares of CoreCivic — about 1.5 percent of all the company’s stock and currently worth about $44 million — according to its second quarter filing with the SEC, the fund’s most recent.

Renaissance bought 87,491 shares of GEO in December 2017 at $23.60 per share. It added 298,900 shares in March 2018, at $20.47 per share. That gave it 386,391 total shares, which is what it still holds, according to its most recent SEC filing.

On March 30, Sessions attacked judges for slowing the pace of deportations and promised the Trump administration would speed the process up. A week later, he notified all U.S. Attorney’s Offices along the southwest border of a new “zero-tolerance policy” for people trying to enter the U.S. illegally.

This was all terrible news for undocumented immigrants, but great for GEO Group and CoreCivic shareholders. During the two months following Sessions’s actions, GEO Group’s share price rose by roughly 35 percent while CoreCivic climbed by about 22 percent. The two companies’ stock prices have had ups and downs since Trump took office, but the general trend has been markedly upward.

It’s hard to calculate how well Renaissance has done on all of its CoreCivic trades because precise purchase and sale dates are not known — and the fund specifically declined to reveal those numbers — but it certainly has actively sought to cash in on the stock. In the case of GEO Group, Renaissance purchased its shares for a combined $8.2 million. At the end of trading on Oct. 23, its shares in GEO Group were worth $24.73 each, making the hedge fund’s stake worth about $9.5 million. That’s a profit of $1.3 million and a rate of return of 16 percent over just 10 months.

In August, the American Federation of Teachers released a report showing that Renaissance was one of 26 hedge funds that held a combined $4 billion in stock in CoreCivic, GEO Group and General Dynamics. (The latter’s primary business is defense related, not operating private prisons and detention camps, but it was included in the study because it has contracts with migrant shelter operators to provide “casework support services” for child detainees. Renaissance had nearly $100 million invested in General Dynamics, the Federation of Teachers reported.)

Renaissance had more invested in CoreCivic than any single hedge fund. The Federation of Teachers has been pushing pension trustees to divest from hedge funds that invest in private prison firms. Those firms and the hedge funds are “profiting off a broken justice system and abetting the administration’s policies of family separation,” Randi Weingarten, the group’s president, said when the report was released.

A 2018 investigation by an advocacy group called Enlace also pointed to the high concentration of stock ownership in the industry. It identified Mercer’s hedge fund as one of only 42 investors that held more than 1 million combined shares of CoreCivic and GEO Group and said that collectively those investors owned over two-thirds of both companies.

Detention centers aren’t the only Renaissance-held business profiting from Trump’s anti-immigration policies. Partnership for Working Families, a watchdog group, issued a report in November 2017, “Wall Street’s Border Wall,” showing that Renaissance is a major investor in Sterling Construction, one of four firms that received a contract to build a prototype of Trump’s proposed border wall and the only of the four that is publicly traded.

In a letter to investors and staff last November, Mercer, who became co-CEO of Renaissance in 2010, announced that he would step down from his position and from the hedge fund’s board on Jan. 1. He and the fund did not publicly provide a reason. But his resignation came amid protests over his close links to Trump and right-wing causes. Nonetheless, Mercer remains active in Renaissance’s research work.

Since then, the Mercers have been keeping a low profile, but they continue to spend millions of dollars in campaign contributions to bolster congressional Republicans before the upcoming midterm elections. “I would not confuse silence with them being out,” Dan Eberhart, a Colorado energy executive and GOP donor and activist, told the New York Times in April. “I think they’re very strategic.”

The same appears to be true of their investments.

The hedge fund expert said that the Mercers and other wealthy donors know “how to fan the political flames” in ways that benefit their investments. “Every hedge fund is looking for inside information, but the really big dogs also [use that information to] advocate for policies that put money in their pockets,” he said. “That’s basically the business model with the biggest funds and investors.”

This article was reported in partnership with the nonprofit Project on Government Oversight, an independent, nonpartisan government watchdog.

Ken Silverstein is a Washington-based investigative journalist.