Student loan forgiveness panel gives Biden’s latest plan stamp of approval

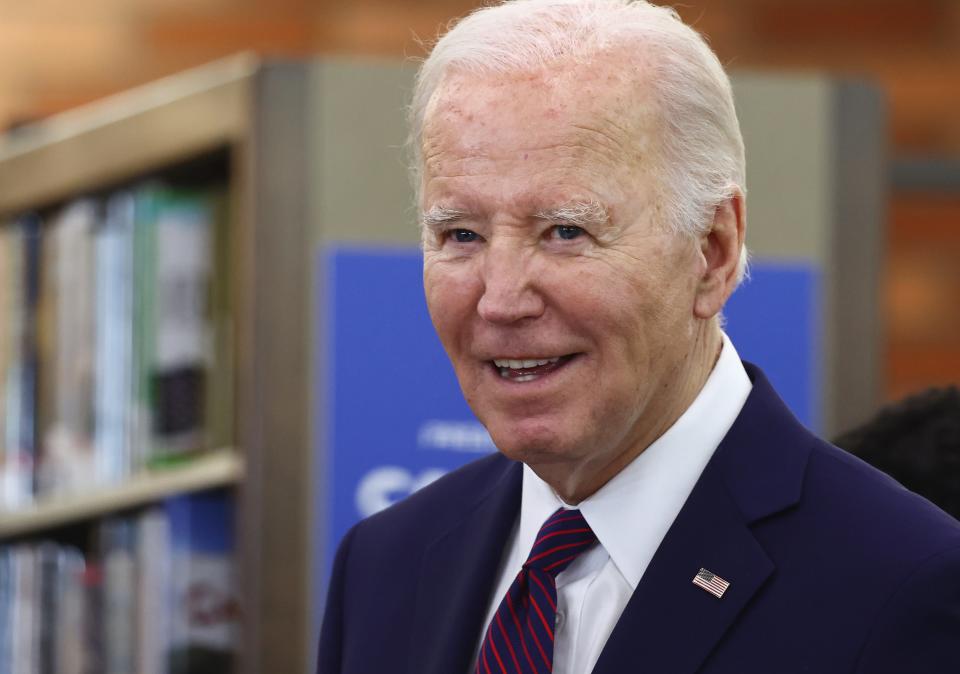

President Joe Biden’s Plan B for broad student debt relief just got one step closer to becoming reality.

After hours of talks Thursday and Friday, a group of former students, advocates and experts greenlit an Education Department proposal that could forgive student loans for a broad range of struggling borrowers.

The decision comes the same week that Biden forgave more than $1 billion in loans for a separate batch of borrowers, drawing the ire of conservatives in Washington who accused him of trying to “buy votes.” The president says he’s pursuing debt cancellation in every venue he can.

Read more: Biden's student loan forgiveness talks are nearing an end. Here are a few takeaways.

“We are hopeful that you can see that our best effort has been put forth,” said Tamy Abernathy, a policy coordinator for the Education Department, during this week’s talks.

The specific plan approved on Friday would ensure automatic relief for borrowers experiencing economic hardship. It would give the U.S. education secretary significant authority in determining who would count under the new regulation. The secretary would be allowed to consider multiple factors in those decisions – including income, age and the likelihood a person would default on their loans.

Read more: Biden proposes student loan debt relief for borrowers ‘highly likely’ to default

The regulation follows the Supreme Court’s rebuke last year of the Biden administration’s original plan for mass student loan forgiveness. After that ruling, the president vowed to try a different path, instead wading through government red tape in hopes of accomplishing something similar.

For months, the administration has been pursuing relief through a bureaucratic process involving changes to federal higher education law. Talks have been ongoing since July.

But the last meeting in December left a swath of the panel’s members miffed. Many of them felt the Biden administration wasn’t thinking broadly enough. Its previous ideas, they argued, excluded large swaths of borrowers with unmanageable levels of debt and little means to pay it off.

Amid pressure from Democratic lawmakers and loan relief advocates, the agency extended the talks in January. Two weeks later, officials proposed the new student debt relief formula.

Critics derided it as a “magical model” that would give the federal government too much power.

What comes next?

There's still a long way to go before the plan sees the light of day.

The Education Department has to submit a finalized version of what they've just hammered out by November. Before that can happen, there will be a 30-day period for public comment. The earliest the rule could take effect is July 2025.

And there will likely be more hurdles. Court challenges could hamstring that timeline. Since the Supreme Court ruling, federal officials have been especially careful to wrap their new proposals in carefully crafted legalese.

In the months to come, borrowers will get a better sense of how airtight the new plan is. Within days of the government releasing the plan last week, critics began to chip away at it. In a statement to USA TODAY, Sheng Li, an attorney for the New Civil Liberties Alliance, a group representing conservative law firms, was already raising questions about its legal merits.

This article originally appeared on USA TODAY: Biden's student loan forgiveness plan gets one step closer to reality