TN's $1.9B franchise tax break heads to full Senate vote; Lee denies conflict of interest

A bill that would create $1.9 billion in franchise tax breaks and refunds for businesses operating in Tennessee is headed to the Senate floor – despite the Lee administration not releasing information about the source of legal threats over existing law.

Republicans have pushed through the legislation in the Senate, while Democrats have questioned whether the governor’s private business could potentially benefit from the legislation and unsuccessfully sought a revenue-neutral fix.

If approved, the Senate Bill 2103 would change the method by which the state charges franchise taxes to businesses, eliminating the property tax calculation — a move that’s expected to cost the state $400 million in revenue beginning this year.

The governor’s bill also includes $1.5 million for franchise tax refunds for businesses who have recently paid based on property tax, which could include the Lee Company, which the governor helped lead for decades and still owns in a blind trust.

Members of the Senate Finance, Ways, and Means Committee approved the bill in a 9-1 party-line vote on Tuesday. It now moves to the full Senate for a vote. The bill has not yet moved in the House, but is scheduled in the House Finance Subcommittee next week, according to a House Republican Caucus spokesperson.

While presenting the bill Tuesday, Sen. Ken Yager, R-Kingston, said the bill solves a pressing threat of legal action over the state’s existing franchise tax law that was “raised by a national law firm” and “serious enough to cause departments to confer” on the legislation.

“We have come up with a solution to a serious constitutional challenge,” Yager said. “We have come up with a logical plan to address a serious challenge. There’s a front-end cost to this, of course, but as somebody once told me a long time ago, Mr. Chairman, the hardest thing to know what to do is to cut your losses and move on.”

Despite requests by The Tennessean, the Lee administration has yet to release any record of communication by a national law firm expressing constitutional concerns or threatening legal action. The governor's office did not respond to an additional request for information late Tuesday afternoon.

Yager said the bill “does away with the uncertainty of litigation” which could “result in an adverse decision that would include millions of dollars in attorney’s fees, court expenses, among other things.” He also argued the bill aligns Tennessee’s franchise tax structure with neighboring states and provides “equitable tax relief to companies that have invested in Tennessee.”

While the retroactive tax refunds were initially projected to cost the state $1.2 billion, fiscal analysts have since determined that if every one of the 100,000 businesses expected to be eligible for the refunds took advantage of them, it could cost up to $1.5 billion.

The Lee administration has sent a letter to the Senate Finance Committee pledging to include funding for the roughly $300 million difference in the governor’s budget amendment, funding the difference with interest earning growth that occurred since the budget was developed in November.

“I consider that a funding letter that says it’s funded,” Senate Finance Committee Chair Bo Watson, R-Hixson, said.

“The problem is, Mr. Chairman, that the funding letter is pretty deficient,” said Sen. Jeff Yarbro, D-Nashville, noting that the number was estimated two months ago. “I don’t know why would think that the fiscal year ‘24 interest is going to increase by $300 million dollars.”

During the same meeting, Watson said that according to the Department of Revenue, the state has collected $437.6 million less than anticipated during the first seven months into the fiscal year, resulting in nearly a -1% growth rate. Watson warned that if things don’t change, the state will have to cover the funding gap, if it continues, when the legislature returns next January.

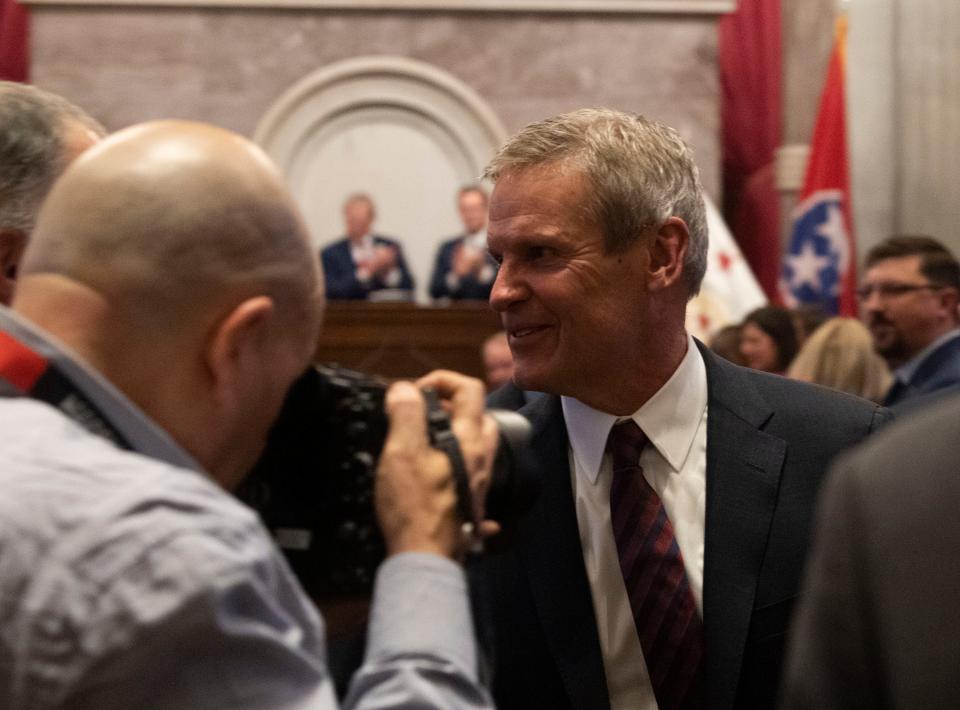

Lee denies conflict of interest

Lee told reporters Friday that he does not know whether his family’s business, the Lee Company, will financially benefit from the franchise tax break.

“I do not know whether they would or whether they would not,” Lee said Friday. “That's not available to me and it won’t be.”

After nearly four decades leading the company, Lee placed it in a blind trust before taking office in 2019.

“The reason the company is in a blind trust is because that's how you ensure integrity,” Lee said. “That's how you make sure that someone – a public official in a position like mine that is involved in a company – that there is no conflict of interest.”

Democrats have called on Lee to disclose Lee Company tax filings from the last several years to demonstrate how much the governor’s company stands to benefit from the governor’s proposal. In response, Lee cited the blind trust, saying he does not have access to company records.

“It would be illegal for me to access those records. It'd be illegal for me to know anything about the financial records or tax records of that company,” Lee said Friday. “And I won't be providing that information because I'd have to break the law to do it.”

When asked if he recalled whether the company paid franchise taxes based on the state’s property calculation when he was chair and CEO, Lee did not answer.

“The Lee Company pays taxes depending on what their outcomes are for the years that those taxes are due. I have no insight into outcome over the past five years for that company, so I have no information,” Lee said. “I have no access to that information.”

No revenue-neutral resolution

Administration officials did not answer directly whether a revenue-neutral solution to constitutional concerns was considered.

“The Department evaluated a variety of possible solutions to resolve the franchise tax legal challenge,” Courtney Swim, chief of staff at the Department of Revenue, told The Tennessean in an email. “We believe the proposed solution is the best way to address this challenge. It will minimize the state’s legal risks and financial exposure, while also more closely aligning the franchise tax with neighboring states and providing equitable tax relief to companies that have invested in Tennessee.”

Lee spokesperson Elizabeth Johnson agreed.

“As we’ve said previously, we considered many other courses, but ultimately those alternatives are less likely to achieve our forward-looking goals of improving the competitiveness of Tennessee’s tax structure while resolving our legal issues promptly and predictably,” Johnson said.

Vivian Jones covers state government and politics for The Tennessean. Reach her at [email protected].

This article originally appeared on Nashville Tennessean: Tennessee's $1.9B franchise tax break heads to full Senate vote