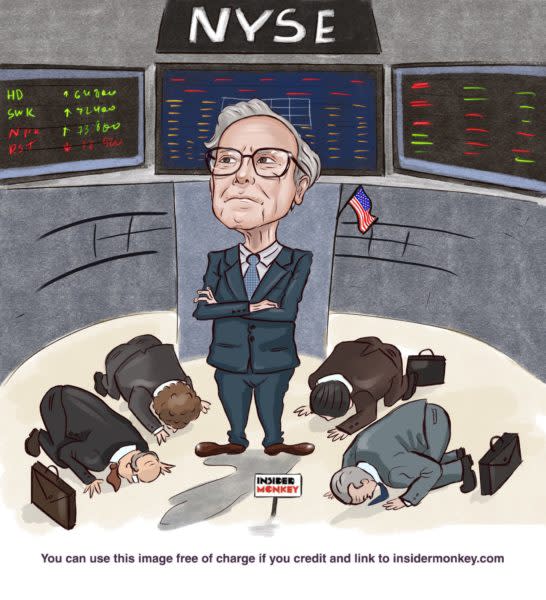

15 Best Warren Buffett Stocks to Buy Now

In this article, we discuss the 15 best stock picks of Warren Buffett. If you want to skip our detailed analysis of these stocks, go directly to the 5 Best Warren Buffett Stocks To Buy Now.

Warren Buffett’s investment strategy is an open secret now: invest in solid companies and hold their stocks forever. But it’s easier said than done. The stock market bloodbath this year has not spared anyone. In this environment, it’s difficult for investors to keep a long-range view. But it’s not difficult for Warren Buffett, who remains a net buyer in this difficult market. Data as of the end of the second quarter showed that Buffett’s hedge made $3.8 billion worth of purchases in the period.

In this article we will take a look at some of the best Warren Buffett stocks. We picked the top 15 names from Buffett’s portfolio for the second quarter of this year. You will notice that most of these stocks are stable, blue-chip companies that pay dividends.

Best Warren Buffett Stocks To Buy Now

15. The Kroger Co. (NYSE:KR)

The Kroger Co. (NYSE:KR) has been featuring in Warren Buffett’s portfolio for the last several quarters. The Oracle of Omaha, as of the end of the second quarter of this year, owns 52.4 million shares of the company, worth about $2.5 billion. The Kroger Co. (NYSE:KR)’s planned acquisition of Albertsons is currently a topic of debate in the Wall Street as the deal is expected to go through a lot of scrutiny from regulators. In October, Kroger confirmed its offer of $34.10 per share to buy Albertsons. The offer implies a total enterprise value of about $26.4 billion.

The Kroger Co. (NYSE:KR) is a strong defensive play in the current market situation. The retailer has raised its dividend for 16 consecutive years. The Kroger Co. (NYSE:KR) is also one of the most favorite retail stocks among the elite hedge funds tracked by Insider Monkey. As of the end of June, 49 funds reported having stakes in the company, compared to 45 in the previous quarter.

14. Citigroup Inc. (NYSE:C)

Citigroup Inc. (NYSE:C) is gaining the market's attention as investors flock to bank stocks amid rising interest rates. Warren Buffett’s hedge fund built a stake in the bank in the first quarter of this year and at the end of June, it reported having a stake worth $2.5 billion in the company. Recently, the bank posted strong third-quarter results. Adjusted EPS in the period came in at $1.50, as compared to the Wall Street consensus of $1.45. Citigroup also declared a quarterly dividend of $0.51/share quarterly dividend.

Of the 895 funds tracked by Insider Monkey, 82 had stakes in Citigroup Inc. (NYSE:C) as of the end of the second quarter, compared to 88 in the previous quarter. Harris Associates was the second-biggest shareholder of the bank after Berkshire, with a $1.2 billion stake.

Here is what Diamond Hill Long-Short Fund has to say about Citigroup Inc. (NYSE:C) in its Q1 2022 investor letter:

“Shares of Citigroup declined in the quarter as investors became increasingly negative on capital markets activity. The company is also continuing to divest certain consumer banking geographies which may be dilutive to earnings in the near term.”

13. DaVita Inc. (NYSE:DVA)

Warren Buffett’s hedge fund has been holding a stake in healthcare company DaVita (NYSE:DVA) for over 10 years now. At the end of June, the fund had owned 36 million shares of the company, worth $2.9 billion. DaVita (NYSE:DVA) is trading at an attractive PE ratio of 11 as of October 20. In August, investment firm UBS upgraded DaVita (NYSE:DVA) to Buy from Neutral, citing strong EPS growth prospects in the coming years. The investment firm also upped its price target for the company to $117 from $106. UBS analyst Andrew Mok said that he believes the company can deliver $200M-300M of OI growth in 2023.

A total of 28 hedge funds tracked by Insider Monkey had stakes in DaVita (NYSE:DVA) as of the end of the June quarter.

12. The Bank of New York Mellon Corporation (NYSE:BK)

Another strong financial services player in Buffett’s portfolio, Bank of New York Mellon (NYSE:BK) is currently trading in oversold territory, having lost 31% year to date. The bank has increased its dividend consistently for the last 11 years. It has a strong dividend yield of over 3%. Bank of New York Mellon (NYSE:BK) is already benefitting from rising interest rates. It crushed analysts’ estimates for the third quarter despite a decline in assets under custody and management. The bank’s CEO Robin Vince said the company’s performance “benefitted” from higher interest rates and continued strength in client volumes. Bank of New York Mellon (NYSE:BK)'s adjusted EPS in the third quarter came in at $1.21, versus the consensus estimate of $1.08.

In October, JPMorgan upgraded Bank of New York Mellon (NYSE:BK) to Buy from Neutral due to limited credit risk and strong return capacity.

Here is what Ariel Investments has to say about The Bank of New York Mellon Corporation (NYSE:BK) in its Q4 2021 investor letter:

“Rising interest rates, after a surprisingly long period of low absolute rates and negative “real” rates, will create a headwind. While there has been much debate about the cause of these low rates, we believe the most important factor has been the $120 billion in monthly federal reserve open market bond purchases and the accumulation of an $8 trillion balance sheet. The former will end, and the latter will shrink. It is not just the Fed that has aggressively purchased bonds, bidding up prices and lowering yields. Bond traders and hedge fund managers have added to positions, confident that being on the same side as the Fed was the wise place to be. Now as the Fed is about to become a seller of bonds rather than a buyer, Wall Street’s “smart money” is likely to follow suit. Against this backdrop, fixed income securities and bond substitutes such as high dividend paying utilities and absolute return hedge funds are substantially overpriced and are not likely to produce attractive returns going forward.

This expectation of a reversion to the mean for interest rates helped 2021 performance, though not as much as we had hoped. The yield on the U.S. 10-year Treasury did indeed increase from +0.92% at the beginning of the year to +1.52% at year-end. An underreported story was the poor performance of bonds last year. The Barclays Aggregate Index declined -1.67% for the year ending December compared to a return of +28.71% for equities as measured by the S&P 500. Interest rates have continued to climb in 2022 with the 10-year Treasury at +1.79% as we go to print. This move higher in rates has contributed to our good, early start to 2022. Smaller positions in The Bank of New York Mellon Corporation (BK) also benefited from higher rates, principally with their ability to invest customer cash.”

11. HP Inc. (NYSE:HPQ)

HP Inc. (NYSE:HPQ) is one of the best Warren Buffett stocks to buy because of its stability and strong growth prospects. Berkshire Hathaway owns 104.5 million shares of HP Inc. These shares were worth $3.4 billion at the end of June. In September, UBS added HP Inc. (NYSE:HPQ) to its top tech picks list and said that the company is “well-positioned in the still-nascent 3D printing market." Not only does HP have strong chances of share price growth, its dividend also makes it an attractive tech stock. Since 2016, its dividend has more than doubled. Currently it has a dividend yield of over 3%. Its PE ratio is just 4.67 which indicates that it’s overvalued and can rebound when the market begins to turn the corner.

As of the end of the second quarter, 35 hedge funds tracked by Insider Monkey had stakes in HP Inc. (NYSE:HPQ), which indicates no change in hedge fund sentiment when compared to the previous quarter.

10. Activision Blizzard, Inc. (NASDAQ:ATVI)

Warren Buffett’s hedge fund upped its stake in Activision Blizzard, Inc. (NASDAQ:ATVI) by 7% in the second quarter. The fund ended the period with 68.4 million shares of the company, worth $5.33 billion. Investors are holding their breath as regulators in Europe and US continue to scrutinize Microsoft’s $68.7 billion takeover of Activision Blizzard, Inc. (NASDAQ:ATVI). Reports suggest that the FTC is expected to reach a decision in this regard in November, and authorities in the UK have set March as a deadline for a decision. Nevertheless, in October, Wells Fargo added Activision Blizzard, Inc. (NASDAQ:ATVI) to its high-momentum portfolio. The firm said that long-term momentum “typically outperforms in stressful times by keeping investors away from adverse stock situations.”

Despite the MSFT deal uncertainty, hedge fund sentiment around Activision Blizzard, Inc. (NASDAQ:ATVI) remains strong. Of the 895 funds tracked by Insider Monkey, 84 reported having stakes in the company at the end of June, up from 80 funds in the quarter earlier.

Here is what Cooper Investors specifically said about Activision Blizzard, Inc. (NASDAQ:ATVI) in its Q2 2022 investor letter:

“Activision Blizzard, Inc. (NASDAQ:ATVI) – our investment preceded news that the company was under investigation for workplace bullying. When it became clear management had misled the market on the extent of the problem we sold, led by our principles of Responsible Investing. We did not benefit from the subsequent M&A premium paid by Microsoft.”

9. U.S. Bancorp (NYSE:USB)

U.S. Bancorp (NYSE:USB) is another strong dividend-paying stock in Warren Buffett’s portfolio. The company has been increasing its dividend consistently for the last 10 years. It has a dividend yield of over 4%. US Bancorp recently posted strong third quarter results, driven by growth in interest income, loan and deposit growth. Like other major banks, US Bancorp numbers were buoyed by rising interest rates. Adjusted EPS in the third quarter totaled $1.18, compared to the Wall Street estimate of $1.16. Revenue in the quarter came in at $6.33 billion, surpassing estimates of $6.20 billion.

A total of 43 hedge funds tracked by Insider Monkey had stakes in the bank at the end of June, compared to 40 funds in the previous quarter.

Here is what ClearBridge Investments Dividend Strategy has to say about U.S. Bancorp (NYSE:USB) in its Q4 2021 investor letter:

“Over the last year, we have repositioned our portfolio to navigate the course we see ahead. We have increased our exposure to interest-rate sensitive banks by adding to existing positions in U.S. Bancorp.”

8. Moody's Corporation (NYSE:MCO)

Warren Buffett owns about 25 million shares of Moody's (NYSE:MCO), worth $6.7 billion, as of the end of the second quarter. Berkshire has been holding stakes in the ratings company for over a decade now. Warren Buffett has been enjoying healthy dividends from Moody's (NYSE:MCO) over these past years. The company has increased its payout for 13 consecutive years. Its payout ratio is just one-fifth of earnings. Famous investors like Chuck Akre, Chris Hohn and Nicolai Tangen have major stakes in the company as of the end of the second quarter.

In August, Deutsche Bank analyst Faiza Alwy slashed Moody's (NYSE:MCO) shares to Neutral from Buy, adding that the stock could have a limited upside when compared to its valuation.

Here is what Smead Value Fund has to say about Occidental Petroleum Corporation in its Q3 2022 investor letter:

“Our top-performing stocks in the quarter includes Occidental Petroleum (NYSE:OXY). Oil and gas have been the best game in the stock market town this year and it was a pleasant surprise to see home builders pick up even with dour news on interest rates and the economy. For the first three quarters of the year, we should change the name of our fund to the Jed Clampett Fund. Occidental Petroleum (NYSE:OXY), was one of the standouts. Up through the bear market came a “bubblin’ crude!”

7. Occidental Petroleum Corporation (NYSE:OXY)

Warren Buffett increased his hold in Occidental Petroleum Corporation (NYSE:OXY) by 17% in the second quarter of 2022. His hedge fund now owns 159 million shares of the energy company. These shares have a total worth of $9.3 billion. The fund now owns 21% of the energy company. In light of this, Truist said in a report that Buffett now has a “clear path” towards acquiring Occidental Petroleum Corporation (NYSE:OXY).

Truist analyst Neal Dingmann said in a note to investors that the “total” purchase of Occidental Petroleum Corporation (NYSE:OXY) would make “logical sense” for Berkshire, given the oil company has a strong FCF forecast, declining debt and is showing strong progress on low carbon ventures.

Despite the bloodbath in the stock market in 2022, Occidental has gained 129% year to date.

6. The Kraft Heinz Company (NASDAQ:KHC)

The Kraft Heinz Company (NASDAQ:KHC) is an important defensive stock that is gaining investors’ attention in 2022 amid recession fears. But Berkshire has been a long-time shareholder of the stock. At the end of the second quarter, Buffett’s fund owned 325 million shares of The Kraft Heinz Company (NASDAQ:KHC), worth $12.42 billion. Earlier this month, Goldman Sachs upgraded the stock to Buy from Neutral. Goldman’s analyst Jason English cited attractive valuation and favorable conditions for the upgrade. Analysts see The Kraft Heinz Company (NASDAQ:KHC) favorably in this high-inflation environment as it’s relatively easier for food companies to pass on the price increases to consumers. The Kraft Heinz Company (NASDAQ:KHC) is a high-dividend stock, with a yield of 4.5% as of October 21.

Hedge fund sentiment for The Kraft Heinz Company (NASDAQ:KHC) is increasing. Of the 895 hedge funds tracked by Insider Monkey, 41 reported owning stakes in the company at the end of June, compared to 35 in the previous quarter.

Click to continue reading and see 5 Best Warren Buffett Stocks to Buy Now. Suggested articles:

Disclosure: None. 15 Best Warren Buffett Stocks To Buy Now is originally published on Insider Monkey.

Yahoo Home

Yahoo Home